Birla Sun Life Tax Relief 96: Nearly 100 times returns in the 20 years

If you had invested र 1 lac in Birla Sun Life Tax Relief 96 Fund, an ELSS Fund at its inception in 1996 the value of your investment today would be nearly र 1 crore on an adjusted NAV basis. The performance of this fund is a glowing testimony of wealth creating power of mutual fund Equity Linked Saving Scheme (ELSS). This equity linked savings scheme was launched nearly 20 years back, but is among the top 3 ELSS funds in terms of three years trailing returns even today. We have discussed a number of times in our blog that equity linked savings scheme is the best investment option for wealth creation among all Section 80C investments. ELSS also offer more flexibility and tax benefits than many other ELSS investments. Compare the returns of Birla Sun Life Tax Relief 96 with non market linked 80C investments over the last 5 years. Please note that the last 5 years included two very difficult years for the equity market (2011 and 2015) and one indifferent year (2013). Yet Birla Sun Life Tax Relief 96 Fund gave tax free 13.5% compounded annual returns over the last 5 year period. This is more than returns given by any non market linked 80C investments, which gave only single digit return and in all cases, except Pubic Provident Fund, taxable returns.

What about market linked 80C investments? Some financial (insurance) advisors argue that Unit Linked Insurance Plans (ULIPs) can give as good returns as ELSS. The best performing ULIP funds gave 15 – 17% returns in the last 5 years, but this is only theoretical. Your entire premium in ULIPs is not invested in buying units of the funds. A portion of your premium goes towards a variety of charges (please see our article, Demystifying Unit Linked Insurance Plan (ULIP) Charges and Returns) and therefore adjusting for the ULIP charges, Birla Sun Life Tax Relief 96 would have beaten most top performing ULIPs, in the last 5 years. What about National Pension Scheme? Again Birla Sun Life Tax Relief 96 would have beaten NPS, if you consider the taxation of NPS.

Fund Overview of Birla Sun Life Tax Relief 96

Birla Sun Life Tax Relief 96 was launched on March 29, 1996. The fund has र 1,800 crores of assets under management, with an expense ratio of 2.38%. The fund is suitable for investment towards long term financial goals like retirement planning, children’s education, children’s marriage etc. Ajay Garg is the fund manager of this mutual fund scheme. Morningstar has a 4 star rating for Birla Sun Life Tax Relief 96 fund.

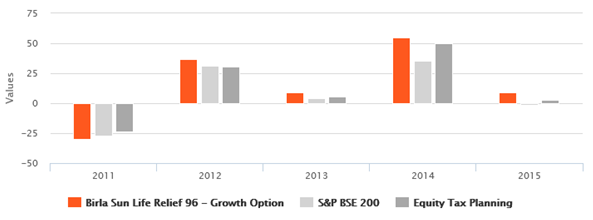

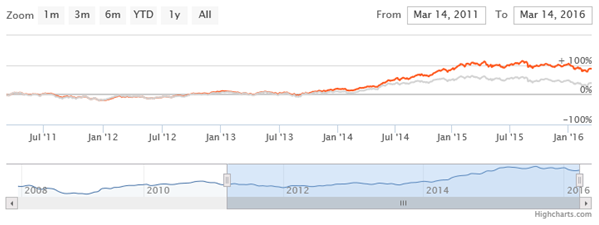

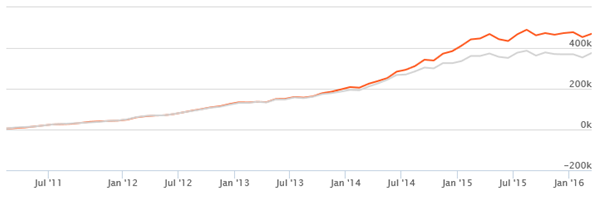

The charts below show the annual returns of Birla Sun Life Tax Relief 96 fund compared to the ELSS fund category and the NAV movement over the last 5 years.

Source: Advisorkhoj Research

Source: Advisorkhoj Research

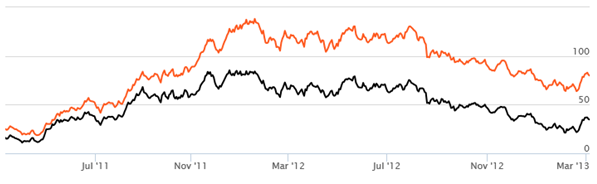

The outperformance of Birla Sun Life Tax Relief 96 Fund is evident from these two charts. The 3 year rolling returns of Birla Sun Life Tax Relief 96 Fund over the last 5 years show how consistent the performance of the fund has been relative to its benchmark. The orange line shows the rolling returns of Birla Sun Life Tax Relief 96 Fund, while the black line shows the rolling returns of the benchmark index BSE 200.

Source: Advisorkhoj Research

You can see that the fund has beaten the index 100% of the times over the last 5 years. The outperformance gap has also been quite stable over the past 5 years, which shows that the fund manager employs stable consistent strategy. You can also see that the 3 years rolling returns itself are quite good.

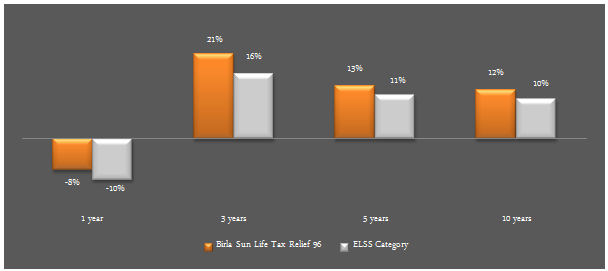

Finally, let us see the trailing returns of Birla Sun Life Tax Relief 96 over various timescales. Readers should note that trailing returns are biased by recent market performance. Therefore, trailing returns are not always a good indicator of future performance. As far as the trailing returns are concerned we would like to draw our readers’ attention to outperformance between Birla Sun Life Tax Relief 96 and the ELSS funds category.

Source: Advisorkhoj Research

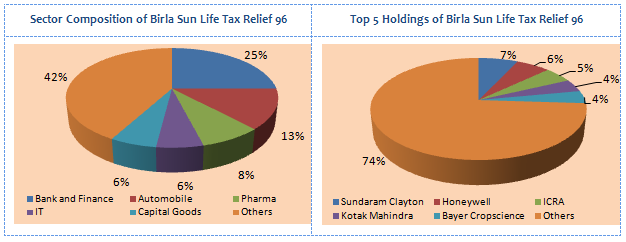

Portfolio Construction

Birla Sun Life Tax Relief 96 has a very well diversified portfolio. The portfolio is well balanced between large cap and small / midcap stocks. A portfolio that is well balanced between large cap and small/midcap stocks tend to do well across different market conditions, as is evident from the rolling returns of Birla Sun Life Tax Relief 96 Fund over the last years. From a sector composition viewpoint, the fund is biased towards cyclical sectors like banking and finance, automobile and auto ancillaries, cement and construction, capital goods etc. Within market cap segments, midcaps and within industry sectors, cyclical sectors tend to well in bull markets. Therefore, when we see a cyclical upturn in our economy, we expect Birla Sun Life Tax Relief 96 fund to give much better performance than what we have seen in the last one to two years. From a company concentration perspective, the fund is very well diversified with the top 5 holdings, Sundaram Clayton, Honeywell, ICRA, Bayer Cropscience and Kotak Mahindra Bank, accounting for only 26% of the portfolio holdings.

Source: Advisorkhoj Research

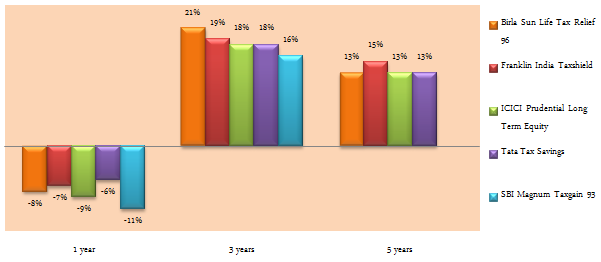

Comparison with Peer Set

Comparison of Birla Sun Life Tax Relief 96 returns with its peers of the same age shows why Birla Sun Life Tax Relief 96 is considered one of the best ELSS funds. It outperformed most of its peers over the last 1, 3 and 5 year periods.

Source: Advisorkhoj Research

Risk and Return

In terms of volatility measure, as measured by annualized standard deviation of monthly returns over a three year, Birla Sun Life Tax Relief 96 had lower volatility than the ELSS funds. Yet in terms of Sharpe Ratio, the fund outperformed the ELSS funds category by a good margin; a hallmark of a well managed fund.

The chart below shows the returns of र 5,000 monthly Systematic Investment Plan in Birla Sun Life Tax Relief 96 fund over the last 5 years.

Source: Advisorkhoj Research

With a monthly SIP of र 5,000 over the last 5 years, you would have accumulated a corpus of र 4.7 lacs with a cumulative investment of र 3.05 lacs; a profit of र 1.65 lacs on an investment of just र 3.05 lacs which imply annualized returns of 18%. Hopefully, this shows that SIPs is one the best investment modes for tax saving ELSS investments. Not only does SIP ensure that you remain disciplined in your tax planning investments and avoid last minute hassles, it also enables that you take advantage of market volatility through rupee cost averaging. Equity market in India is more volatile than equity market in developed markets and therefore SIP is one the best investment modes in India.

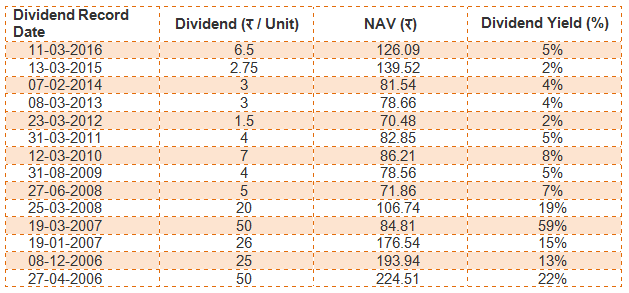

Dividend Payout Track Record

Birla Sun Life Tax Relief 96 has a terrific dividend pay-out. The dividend option of the scheme has paid dividends every year over the last 10 years, even during the bear market periods.

Source: Advisorkhoj Research

Conclusion

Birla Sun Life Tax Relief 96 will complete 20 years later this month. The wealth creation track record of this tax saving fund over twenty years has indeed been outstanding. The fund has sustained it strong performance even in the recent past. Investors should consult with their financial advisors if Birla Sun Life Tax Relief 96, an Equity Linked Savings Scheme is suitable for their tax planning needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team