Should you go for mutual fund direct plans

In recent past, the word "direct plan" has created the buzz among the Mutual Fund Investors and has gained popularity. Direct plan may seem to be getting popular but I think Investor should not rush towards direct plan to save few basis points in expense ratio. I strongly believe that the direct plan is suitable to very small segment of investors, as it requires a lot of skills, knowledge and patience to select the right fund and manage the portfolio. When it comes to retail client and I also believe that some of the investors who have been attracted towards direct plan will also come back to the IFA (Independent Financial Advisor) seeking for the advice in a time to come.

Direct plan has only one and limited benefit over regular plan, that is saving in expense ratio which might be ranging from the 50 bsp to 100 bsp in equity oriented mutual fund schemes. And this cost saving is fixed and very small in terms of importance when we see the return differentiation among the schemes within the same category.

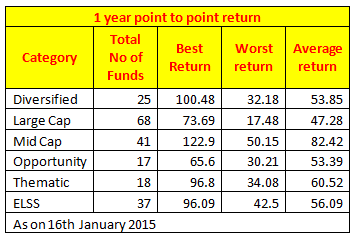

Just have a look at above table and you will see the return differentiation among the same category, the return difference between the best performing fund and worst performing fund in case of diversified equity fund is the 68.3%, while in large cap, mid cap, opportunity, thematic and ELSS category it is 56.21%, 72.75%, 35.39%, 62.72% and 53.59% respectively.

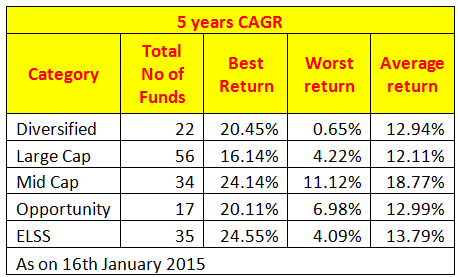

Similarly, if you look at the 5 years return also, the return differential is very big within the same category among the best, worst and average performance.

From above data we can say that the fund selection is the very important factor when it comes to the MF investments specifically in equity segment. It might be possible that the two people who invested into the same category of MF, say large cap fund, may get a very different return, and the difference can be anything from 1% to 50% plus (look at the above table).

Most of the investors, who choose the fund on their own, use very limited information and criteria while selecting the fund. In most of the cases the recent past performance and the star rating by some online portal are the two main criteria. Choosing the fund only on the basis of these two criteria may lead to bad decision. As we have seen in history, no single fund can be on the top for the continuous period of time that is year after year. The fund which is on top of the chart may not necessarily be on the top of chart forever.

The classic example is JM Basic Fund it seemed to be the first preference of almost all category of investors in 2006 and 2007 being top on the chart, someone who had invested based on the top ranking in 2007 in JM Basic fund would have seen the worst nightmare in terms of the returns from this fund.

Apart from the recent past performance there are many other criteria which one needs to look at before selecting the fund. Broader criteria like short term performance, long term performance, consistency in performance, risk factors like total risk (specific and market risk both), risk adjusted return etc. And to check any fund on the above broader categories, one needs to check the fund against minimum 20+ criteria.

For individual investor it is very tough and almost impossible to analyze hundreds of funds on 20+ criteria before investing and also at regular intervals to make sure that the funds selected are continuously performing better.

I have seen some of the so called educated investors who have started looking at the direct plan over regular plan just to save the small cost of 50bps to 100bps, which could be proved very costly in terms of wrong fund selection and lesser return. While selecting between direct plan and regular plan investor should not only consider the cost saving but also should look at the ability and expertise of the advisor in terms of scheme selection and regular advise over portfolio which can generate better return compared to "do it yourself" strategy.

Remember, to get the better quality product we always pay a little higher price be it cloths, car or mobile set. Similarly to get better returns and better guidance the price of additional expense of approx 50 bps to 100 bps is very reasonable.

What if you get the benefit of lesser cost say 0.5% which results into the lesser return say 5% than the good performing scheme suggested by the Advisor? Taking the help of professional advisor will always have the higher chances of getting the right and better scheme compared to fund selection directly done by the investor. Apart from scheme selection, the advisor also understands the suitability of the product to the client in better manner compared to the client choosing himself.

In nutshell, everything has two side of the story, going direct has a benefit in terms of cost saving but it also has limitations of lack of professional approach towards proper selection and continuous guidance. Do the cost-benefit analysis thoroughly and take the decision wisely.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund