Investing in Gold

Gold as an asset category has a huge cultural significance for Indians. But cultural considerations aside, how is gold as an investment option? Apart from buying gold for weddings and other auspicious occasions, gold is also a good investment in the long term for 2 reasons:-

- Over the long term, gold is an effective hedge against inflation.

- Gold price usually has a negative correlation with equities. When equity prices move southwards gold prices usually move

Therefore, from an overall portfolio perspective, gold serves to diversify the total portfolio risk and as such should form a part of a well balanced portfolio of investments. However, you must remember that, historically, over the long term, equities have given higher returns than gold. You should keep this in mind when you decide on your overall portfolio asset allocation.

How can one invest in gold?

Buying gold in the form of jewellery:

This is the most traditional and popular form of buying gold in our country. While gold jewellery has its own aesthetic and cultural appeal, it is disadvantageous from an investment perspective. The making charges of gold jewellery can be 15 – 20% of the total cost. When you sell the jewellery, the jeweller will deduct the making charges from the selling price. The jeweller may also deduct an additional amount for impurities when you sell gold. Gold in physical form usually involves storage costs, since security is an important concern. For example, if you store your gold jewellery in your bank locker, you will have to pay locker charges to the bank. Physical gold also attracts wealth tax, if its value is over Rs 30 lakhs.Buying gold in the form of bars or coins:

You can also buy gold in the form of bars and coins, from either banks or jewellers. Buying gold in the form of bars and coins mitigates some of the disadvantages of buying gold jewellery for investment. There are no making charges and risk of impurities. You can sell the gold bars and coins to the jewellers. However, you may still have to incur storage costs. Also, like gold jewellery, wealth tax applies if the value is over Rs 30 lakhs.Buying gold exchange-traded funds:

A gold exchange-traded fund (or GETF) is an exchange-traded fund (ETF) that aims to closely track the price of gold. Gold ETFs are units representing physical gold which may be in paper or dematerialised form. The units of the gold ETFs are traded on the stock exchange like shares of a company. There are a number of gold ETFs listed on the stock exchanges. These are the Axis Gold ETF, Goldman Sachs Gold Exchange Traded Scheme, UTI GOLD Exchange Traded Fund, HDFC Gold Exchange Traded Fund, ICICI Prudential Gold Exchange Traded Fund, Reliance Gold Exchange Traded Fund, Kotak Gold Exchange Traded Fund, Birla Sun Life Gold ETF, SBI Gold Exchange Traded Scheme, to name a few. To buy and sell gold ETFs on the stock exchange, you need to have a demat and trading account. If you have a demat and trading account for share trading, you can use it to buy gold ETFs. You have to pay brokerage fees & other transaction charges to buy and sell ETFs. These can be in the range of 0.2 – 0.5%. In addition you will have to pay 0.5 – 1% as fund management fees. Wealth tax is not applicable for gold ETFs. Gold ETFs is a safe and secure way of investing in gold.Gold fund of funds:

These are gold mutual funds, which in turn investment in gold ETFs. For gold fund of funds, you do not need a demat and a trading account. Should you invest in a gold ETF or gold fund of funds? The answer lies in the charges involved. We discussed above the charges involved in gold ETFs. To invest in gold fund of funds, you do not have to pay brokerage. However, you do have to pay the fund management fees (0.5 – 1%) for the underlying ETFs in the gold fund of funds. In addition to the fund management fees for the ETFs, you also have to pay fund management fees (0.5 – 1%) for the fund of fund. So the trade-off is between the brokerage for the ETF and the fund management fees for the fund of funds. Fund of funds is generally, a more expensive compared to ETFs, especially if you are investing a large amount. However, if you do not have a demat and trading account, then fund of funds may be a more convenient option for you. Like ETFs, wealth tax is not applicable

Gold returns – a historical perspective

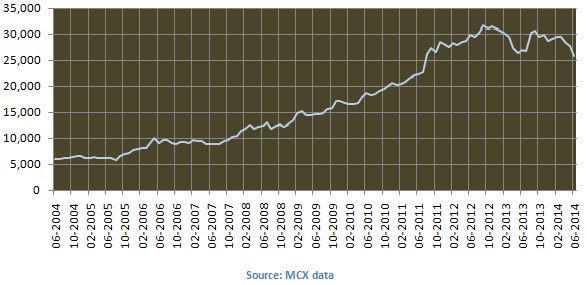

As discussed earlier, gold is an effective hedge against inflation and appreciates when equity prices correct. In fact, from Jan 2006 to Jan 20012, gold prices appreciated by 23% on an annualized basis. Over the last 10 year period, gold has given an annualize return of 16%. The chart below shows gold prices per 10 grams of gold over the last 10 years.

Let us compare this with Sensex returns over the last 10 years. During this period Sensex gave an annualized return of 15%. Please see the monthly price chart of the Sensex for the last 10 years.

From the 2 charts above we can see that gold and equities have given similar returns in the last 10 year period (in fact gold has given slightly higher returns). However, equities have been much more volatile compared to gold, as you can see in the chart above. This period has also been an exceptional period for gold, because equity markets were depressed for a long period of time from 2008 – 2011.

Impact of Tax

Equity investments, e.g. shares, equity funds, are exempt for long term capital gains tax. For gold investments long term capital gains tax is applicable. However, the taxation is different for different forms of gold investment. For physical gold, the minimum holding period for applicability of long term capital gains is 3 years, whereas for gold ETFs and gold fund of funds, the minimum holding period is 12 months. The long term capital gains tax rate is also different for physical gold and paper gold. For physical gold, the long term capital gains tax is 20% with indexation benefits. For gold ETFs and gold fund of funds, the long term capital gains tax is 10% without indexation and 20% with indexation, whichever is lower.

You can see that even from a tax perspective, gold ETFs and gold mutual funds (fund of funds) are more efficient, compared to physical gold. However, tax treatment asides, some investors do raise questions regarding the expense ratio levels of Gold ETFs and Gold mutual funds (fund of funds). We will discuss it, at some other time.

Is this a good time to invest in Gold?

As discussed earlier, gold prices usually have an inverse relationship with equity prices. Gold prices are also impacted by foreign exchange rates. While gold had given very strong returns from 2006 to 2012, over the past one year, equities are clearly outperforming gold. Investment experts believe that we are on the threshold of a long term secular bull market for Indian equities. The equity market has got the election results it was hoping for. This augurs well for Indian equities, but gold prices may see a further correction. Gold is trading close to its support levels ($1240 / oz). A breach of the support level, will take gold prices lower. Savvy investors should be overweight on equities and wait for gold prices to correct a bit, before increasing their exposure to gold. That said gold investment should be a part of your long term asset allocation plan.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team