Why invest in ITI Large and Midcap Fund NFO for the long term in the current market scenario

ITI Mutual Fund has launched a New Fund Offer (NFO), ITI Large and Midcap Fund. As per SEBI’s mandate, large and midcap funds must invest at least 35% of their assets in large cap stocks (top 100 stocks by market capitalization) and minimum 35% of their assets in midcap stocks (101st to 250th stocks by market capitalization). ITI Large and Midcap will be the 11th equity scheme of ITI MF. The large and midcap funds category is a very popular with investors. As on 31st July 2024, there are 29 large and midcap equity schemes with combined assets under management (AUM) of Rs 2.57 lakh crores and more than 1 crore folios. The NFO will open for subscription on 21st August 2024 and will close on 4th September 2024.

The case for Indian equities

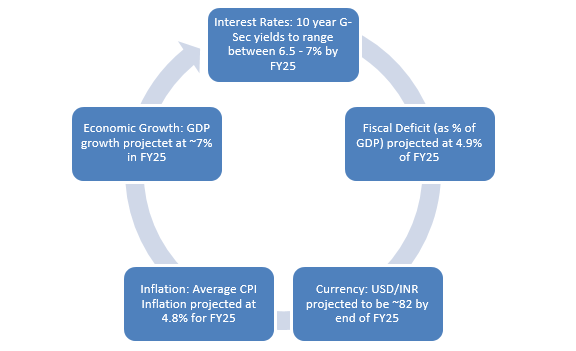

- India is a macro sweet spot according to the broad macroeconomic indicators.

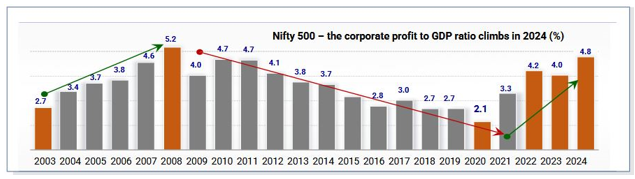

- Corporate profit which had been declining for a long time (2011 to 2020) has started rising from 2021. The corporate profit to GDP ratio climbed to 4.8% in 2024.

Source: Motilal Report, 2024

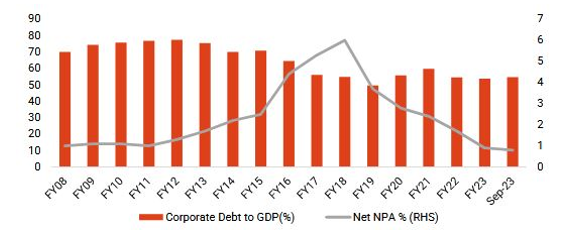

- Corporate balance sheets have got considerably deleveraged. The NPA situation has also improved significantly.

Source: ITI MF, RBI

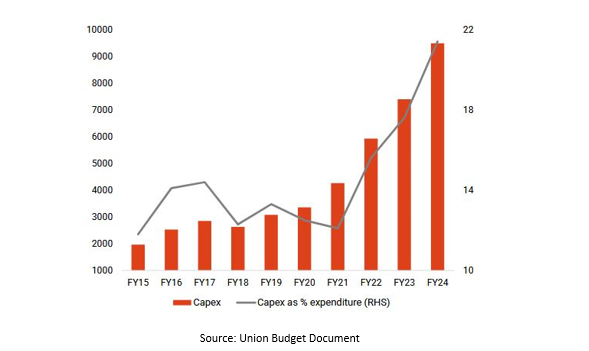

- Government capex spending has picked at a rapid pace since the COVID-19 pandemic. Capex as a percentage of Government expenditure has also been increasing. In the last 3 years, the Government spend Rs 23 lakh crores on infrastructure development in areas of roads, highways, ports, power transmission etc. The capex outlay for FY 2025 is Rs 11.11 lakh crores, which is Rs 1.1 lakh crore higher than the previous fiscal year. Government spending is likely to have a multiplier effect on private capex investments and industrial growth in India.

Source: Union Budget Document

Why invest in large and midcap funds?

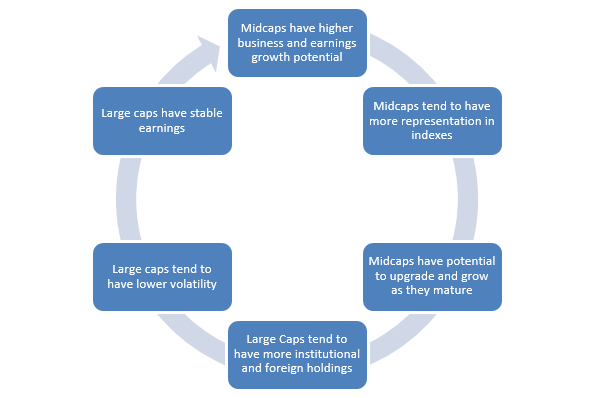

- Strength and Agility

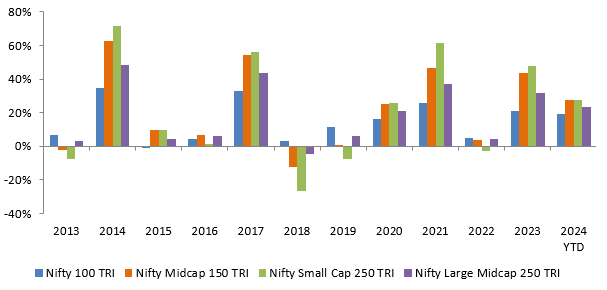

- Winners rotate across market cap segments – Large and midcaps can add growth and also provide relative stability to your portfolio.

Source: Advisorkhoj Research, as on 31st July 2024

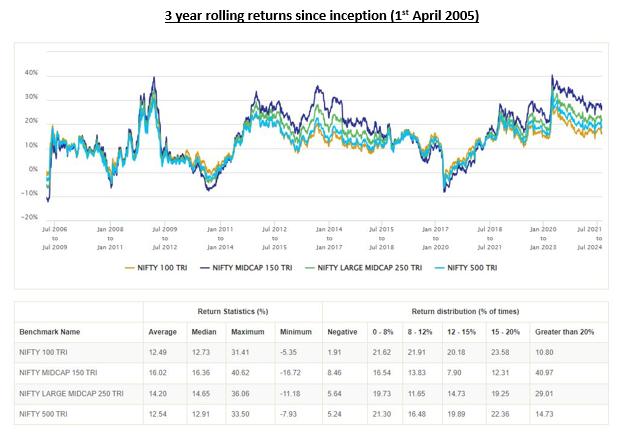

- Superior risk return trade-off – Higher returns than large caps and broad market; lower downside than midcaps

Source: Advisorkhoj Research, Period: 1st April 2005 to 31st July 2024

Why invest in large and midcap funds now?

- Since last 3 instances, (30-Jun-23/31-Dec-23/30-Jun-24), 21 companies went from mid cap to large cap and 37 companies went from small cap to mid cap. Usually, upgrades from one market cap segment to an upper market cap segment are accompanied by valuation rerating.

- An active Large & Mid cap fund could capture these upgrades, be on the lookout for the downgrades, and invest for the growth from 250th rank onwards.

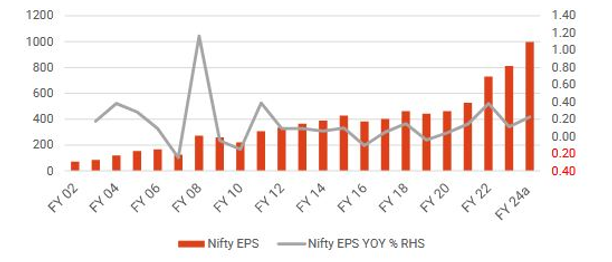

- Earnings growth has been strong for the last few years. This will support equity market and valuations

Source: ITI MF

- Since the Government has a majority in Lok Sabha, we can expect policy continuity in terms of fiscal prudence, infrastructure capex spending and economic policies. This may result in:-

- Maintaining GDP growth trajectory

- Tax buoyancy

- Job creation

- Higher corporate earnings in the medium to long term

- Interest rate reversals

- Large cap valuations are reasonable, while midcap and small cap valuations are higher than historical average. Overall, valuations look fair.

Source: Kotak Securities, as on 20th July 2024

Features of ITI Large and Midcap Fund

- STRENGTH: Volatility under check with potential stability of large cap companies

- AGILITY: Potential growth thrust from midcap companies

- CORE PORTFOLIO: Participates majorly in top 250 companies – 82% of the listed market capitalization

- UPGRADES: Potential to capture the growth and upgrade journey from mid to large & world’s leading businesses

- OPTIONALITY: Fund Manager has the option to choose small cap companies for potential alpha and diversification

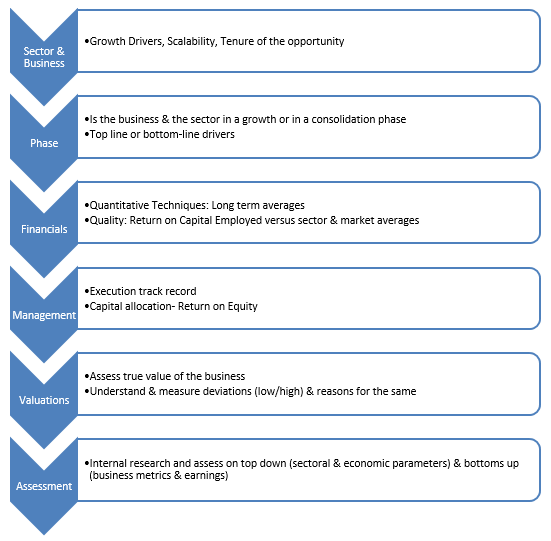

Stock selection process

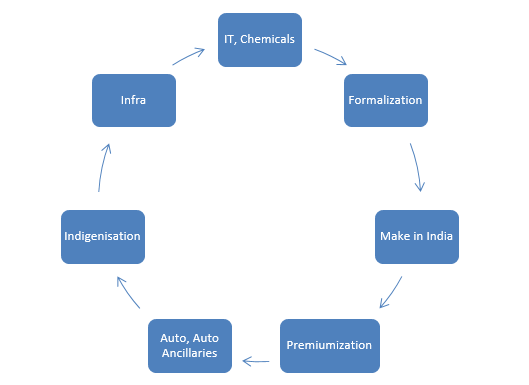

Key investment themes

Why invest in ITI Large and Midcap Fund?

- The scheme scouts for viable, well managed & scalable businesses

- The scheme has a large coverage of about 500+ stocks

- Process rigor towards adhering to internal risk parameters to avoid over allocations

- Diversification with ample exposure to large & midcap top 250 companies

- The investor gets a meaningful equated participation within 82% & above of listed businesses market cap

- Fresh portfolio – no legacy stocks

Who should invest in ITI Large and Midcap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors who are looking at core portfolio investments, could consider as the fund invests in large & mid cap companies

- Investors who have an investment horizon of five years and above

- Investors who are considering to invest in a blended participative mode by investing in top 250 companies (both large and midcap stocks)

- The Product is suitable for investors who are aware of market volatility esp. in midcaps and are therefore looking forward the addition of large caps for potential stability

- You need to have high to very high risk appetites for this fund

- You can invest in this fund from your regular savings through SIP

- Investors should consult their financial advisors or mutual fund distributors if ITI Large and Midcap Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Multi Cap Fund

Apr 29, 2025 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC CRISIL IBX Financial Services 3 to 6 Months Debt Index Fund

Apr 28, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Silver ETF Fund of Fund

Apr 28, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team