Why Principal Equity Savings Fund is a good scheme for moderate risk appetite investors

Principal Equity Savings Fund is an open ended hybrid equity oriented mutual fund scheme. The scheme was launched in May 2002. From a taxation standpoint, this fund is treated like an equity fund scheme. The scheme benchmark is 30% Nifty and 70% Crisil Liquid fund index. The fund manager of this scheme is Sudhir Kedia and Gurvinder Singh Wasan.

Minimum one-time investment amount in this scheme is Rs 5,000 and minimum additional investment amount is Rs 1,000. You can also invest in this fund through Systematic Investment Plan (SIP). Minimum SIP investment amount is Rs 2,000. The expense ratio of the scheme is 2.25% and there is no exit load in this fund. The zero exit load feature can enhance income for investors looking for regular withdrawals from their investments (we will discuss this in more details later in the post).

Asset Allocation Strategy

Let us now discuss the asset allocation strategy of this fund to understand why the risk profile of this fund is much more moderate than equity funds and even traditional balanced funds. The overall exposure to equity and equity related securities ranges from 65% to 90%, as a result of which the fund enjoys equity taxation. However, fund’s active (un-hedged) equity allocation ranges between 15 to 50% with the objective of capital appreciation. 15 to 75% of the portfolio is allocated to completely hedged equity positions with the objective generating arbitrage profits. 10 to 35% of the portfolio is invested in fixed income and money market instruments with the objective of generating income. Therefore, 50 to 85% of the portfolio has moderate to low volatility and generates stable returns. Over a sufficiently long investment horizon, the active equity allocation can also generate capital appreciation for investors.

Investment Strategy and how does it work.

- Arbitrage: 15 to 75% of the fund’s portfolio can be allocated to arbitrage. Currently 20 - 30% of the portfolio is allocated to Arbitrage which by definition is risk free profit, by exploiting pricing mismatches in the market. Capital safety, returns and liquidity are important considerations in arbitrage strategy. In fact, in volatile market conditions arbitrage funds can provide comparable or even higher returns than low risk money market mutual funds. For the arbitrage portion of the fund portfolio, the fund managers take completely hedged positions to minimize any risk for the investor.

- Fixed Income and Money Market: 10 to 35% of the fund’s portfolio can be allocated to fixed income and money market instruments. Currently, around 26% of the portfolio is allocated to Fixed Income and Money Market investments (primarily in money market). With the fixed income / money market portfolio, the fund manager employs an accrual strategy to generate income and minimize interest rate risk. The credit quality of the fixed income portfolio is very high (AAA/AA). The fixed income portfolio has a moderate duration of 330 days and so the interest rate risk for the investors is very low.

- Active Equity: 15 to 50% of the fund’s portfolio can be allocated to active (un-hedged) equity with the objective of capital appreciation. Currently, 30 -35% of the portfolio was allocated to equities, net of futures positions. This shows that the fund manager is bullish on equities to deliver alphas within the investment strategy framework of this scheme. The fund manager, however, has the flexibility to reduce the equity allocations and increase exposures to safer options, if volatility increases in the stock market. This investment strategy ensures moderately low volatility for investors.

Moderately Low Volatility and benefits

The main advantage of equity savings funds are low volatility and income. Risk and return are directly related; higher the risk, higher is the return. The asset allocation strategy of Principal Equity Savings Funds provides benefits of stability, moderate volatility (limited downside risk) and inflation beating returns(through limited equity exposure).

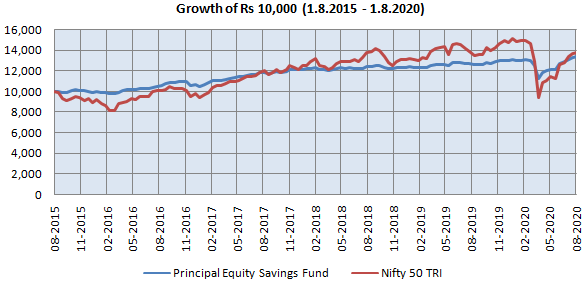

The chart below shows the growth of Rs 10,000 lump sum investment in Principal Equity Savings Fund and Nifty 50 TRI over the last 5 years (ending 1st August 2020).

Source: Advisorkhoj Research

You can see in the chart above that the growth of Principal Equity Savings Fund was much more stable than Nifty. The maximum drawdown of Principal Equity Savings Fund in the last 5 years was around 14%, while that of Nifty 50 TRI was 38%. Clearly, the downside risk of Principal Equity Savings Fund is limited compared to Nifty. The standard deviation of monthly returns (measure of volatility) of Principal Equity Savings Fund over the last 5 years is 7%, while that of Nifty 50 TRI is 19%. Despite much lower volatility / limited downside risks, the absolute return of Principal Equity Savings Fund and Nifty are almost the same.

Principal Equity Savings fund versus traditional fixed income investments

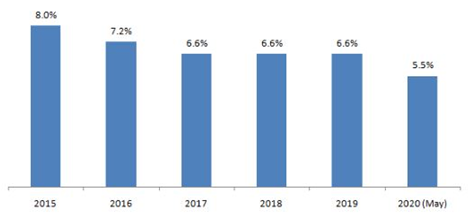

Reliability of cash-flows from investments is a critical need for some investors who depend on investment income. These investors usually relied on traditional fixed income products like bank fixed deposits and small savings schemes. But declining interest rates and the taxability of interest income from the traditional fixed income products have these investors now concerned about how to meet their income needs. FD rates are likely to come down further in the near to medium term given RBI’s accommodative monetary policy stance to revive economic growth.

Source: Advisorkhoj Research

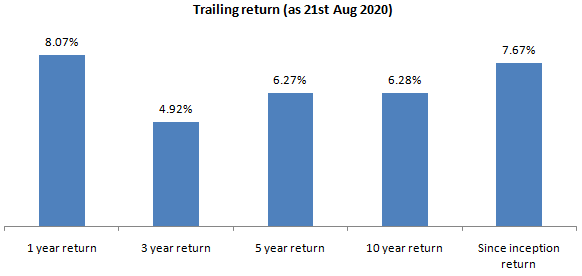

The chart below shows the annualized trailing returns of Principal Equity Savings Fund over different time-scales (periods ending 21st August 2020). You can see that over longer investment tenures Principal Equity Savings fund can give higher returns than FD interests.

Source: Advisorkhoj Research

Regular Withdrawal Plan – Tax Advantage

Regular Withdrawal Plan (RWP) is a smart investment option offered by Principal. It gives investors the flexibility to draw the amount they need from their mutual fund investments at a regular frequency (e.g. monthly), by redeeming a certain number of units based on applicable Net Asset Values. The balance amount remains invested in the scheme and continues to earn returns for the investor. Unlike mutual fund dividends, which have to be paid from the profits of the scheme and therefore cannot be assured, investors can get fixed cash-flows regularly using “Regular Withdrawal Plans”.

Regular Withdrawal Plan from Principal Equity Savings Fund is also more tax efficient than other fixed income options. Interest income from traditional fixed income schemes are taxed at the applicable tax rate of the investor. Long term capital gains of equity or equity oriented funds up to Rs 1 lakh are tax free and taxed at 10% thereafter. So for investors in the 20% or 30% tax slabs, regular withdrawal plan from Principal Equity Savings Fund offers significant tax advantage versus traditional fixed income investments.

A feature which makes Principal Equity Savings Fund more attractive than other products in the category is thezero exit load feature. Many investors are forced to postpone their withdrawals from their mutual funds by as much as a year or sometimes longer due to exit load. The zero exit load feature of Principal Equity Savings Fund offers investors the convenience of initiating their withdrawals at any point of time, as per their needs.

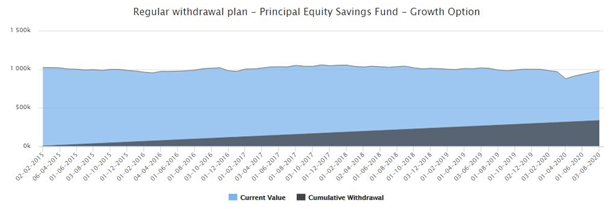

The chart below shows result of SWP beginning one month after a lump sum investment of Rs 10 lakhs in the scheme made on 1st January 2015. The withdrawal rate is 6% per annum. You can see that, even after cumulatively withdrawing Rs 3.35 lakhs from the investment, you would have been able to preserve most of your initial investment.

Source: Advisorkhoj SWP Returns Calculator

Conclusion

Volatility can be stressful for retail investors and many investors prefer to sit on cash or low yielding term deposits, earning little or no real post tax returns, because they are scared of losing their money in the stock market. Psychological considerations aside, low volatility is often a necessity for investors who want regular income from their investments.

For long term investors with moderate risk appetite, Principal Equity Savings Fund has the potential to generate both income and capital appreciation. Investors can take advantage of Regular Withdrawal Plan to generate regular income. Investors should consult with their financial advisors if Principal Equity Savings Fund is suitable for their long term investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team