Why Mirae Asset Hybrid Equity Fund can be a good investment option for uncertain times

A strong rally in the equity markets witnessed the Nifty 50 index crossing the historic 20,000 levels in September 2023. Since mid-September, we saw investors booking profits and the Nifty correcting nearly 700 points (as on October 20, 2023) from its historic all-time high. Since then the market has recovered, though Nifty has been range-bound in 19,500 to 20,000 levels.

- The uncertainty in interest rates has caused yields from US Treasury Bonds to surge to 16-year highs. High US Treasury bond yields can continue to provide headwinds against equity markets rally.

- There is uncertainty about global economic outlook; the global economy is expected to experience slowdown in 2024 but there are differing opinions on the extent of slowdown.

- The WTI crude price is down from its highs, but the implications of the Israel / Hamas war on crude prices continues to be a matter of concern. So far the conflict has largely been confined to Gaza, but if it spreads to other parts of the Middle East, then it might have an effect on crude prices.

- Among other geo-political risks, escalating US China tension continues to be a risk factor in the medium term.

In uncertain times, investors should focus on asset allocation, which means avoiding investment into a single asset. Investments in uncertain periods should be spread across different asset classes like equity, debt, etc. Asset allocation can aim to maintain a balance between risk taken and returns and provide stability to the investment portfolio in volatile markets. Hybrid mutual funds provide asset allocation solutions for investors of different risk appetites and investment needs. In this article, we will review Mirae Asset Hybrid Equity Fund.

Features of Aggressive Hybrid Funds

Aggressive hybrid funds are a class of mutual funds which invest in both equity and debt asset classes in some ratio. SEBI has laid down the mandate for a fund to be called an aggressive hybrid fund provided it invests minimum 65% and maximum 80% of its assets in equity and equity related securities. The rest of the assets to a maximum of 35% and minimum 20% should be invested in debt and money market securities. The fund managers manage the asset allocation within these ranges.

The short-term capital gains arising from holding these investments for a period of less than 12 months are taxed at 15%. The long term capital gains that arise from holding the investments for a period of more than 12 months, exceeding Rs 1 lakh, are taxed at 10%.

Mirae Asset Hybrid Equity Fund

Mirae Asset Hybrid Equity Fund was launched in July 2015 and has an asset under management or AUM of Rs 7611.06 crores as on October 31st 2023. The scheme has a total expense ratio of 1.74% and has given a CAGR of 11.71% since inception, as on 23rd November 2023. Mr. Harshad Borawake, Mr.Vrijesh Kasera, (Equity Portion) & Mr. Mahendra Jajoo (Debt Portion) are the Fund managers for this scheme. As of 31st October 2023, the fund has invested 71.7% in domestic equities of which 54.7% is in Large Cap stocks, 8.6% is in Mid Cap stocks and 8.3% in Small Cap stocks. The debt allocation of the fund stand at 28.3%, of which 6.76% is in Government securities, and the rest is in low risk securities.

Performance of Mirae Asset Hybrid Equity Fund

Lumpsum Returns -

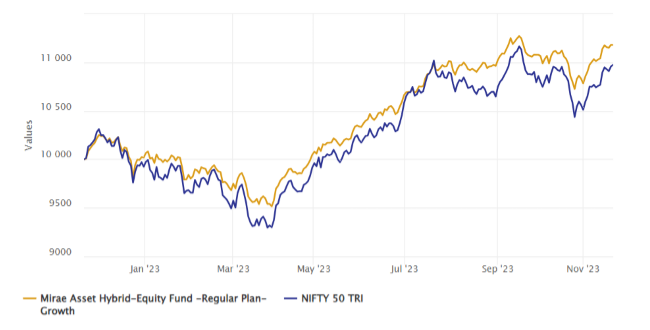

The chart below shows the growth of Rs 10,000 lumpsum investment in Mirae Asset Hybrid Equity Fund versus Nifty 50 TRI in the last year (ending 23rd November 2023). As can be seen, the scheme has outperformed the Nifty 50 TRI Benchmark in spite of the highly volatile markets in this period. The scheme gave a return of 11.71% against the Nifty 50 TRI returns of 9.76% (Return as on 23rd November 2023)

The long-term performance of Mirae Asset Hybrid Equity Fund also shows that asset allocation and regular rebalancing can produce superior risk adjusted returns even over long investment tenures. The 3 year CAGR of the scheme is around 14.3% (as on 23rd November 2023).

Source: Advisorkhoj Research, as on 23rd November 2023. Disclaimer: Past performance may or may not be sustained in the future

SIP returns -

The chart below shows the growth of a Rs 10,000 monthly Systematic Investment Plan (SIP) in Mirae Asset Hybrid Equity Fund since the scheme allotment date of 29 July 2015. The scheme has given approx. 12.5% XIRR return – A total investment of Rs 10 lakhs (Rs 10,000 per month x 100 instalments) is now worth Rs 17.03 Lakhs!

SIPs are generally misconstrued as suitable for only Equity funds. However, it can be seen that Mirae Asset Equity Hybrid Fund gave good long term SIP returns, even though it is not a pure equity fund.

Source: Advisorkhoj Research, as on 23rd November 2023. Disclaimer: Past performance may or may not be sustained in the future

Limited Downside Risks -

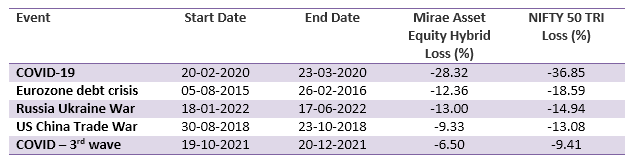

The table below shows the impact of the 5 largest drawdowns in the equity market over the last 15 years on Mirae Asset Hybrid Equity Fund and Nifty 50 TRI. You can see that the drawdown in the scheme was much smaller than that of Nifty 50 TRI. The asset allocation of the scheme was able to limit the downside risk for investors in the volatile market.

Source: Advisorkhoj Research, as on 23rd November 2023. Disclaimer: Past performance may or may not be sustained in the future

Performance versus peers -

The chart below shows the three year rolling returns of Mirae Asset Hybrid Equity Fund versus the average three year rolling returns of the Aggressive Hybrid Funds category since the inception of the fund. We have chosen a 3 year rolling return period because investors should have a minimum 3 year investment horizon for Aggressive Hybrid Funds. You can see that the scheme consistently outperformed the category average across different market conditions. The fund may have underperformed at certain times during this period, but the long term track record of the fund gives us confidence that the fund has consistently been able to rebound in performance relative to peers in the medium to long term.

Source: Advisorkhoj Research, as on 23rd November 2023. Disclaimer: Past performance may or may not be sustained in the future

Investment Strategy -

The fund is actively managed to take market dynamics into consideration. The following is the broad investment strategy of the fund -

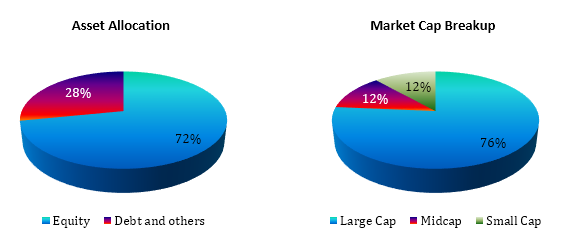

- The allocation to Equity is maintained in the range of 65% to 80%. With an optimistic outlook on equities following the bullish market, current asset allocation towards equity has been around 72%.

- When the equity market rallies, the allocation towards equity increases. Rebalancing the portfolio brings allocation within range and also helps to book profits at higher levels.

- Similarly, when equity markets correct, allocation towards equity reduces and rebalancing helps buy more equity at lower levels.

Current Asset Allocation -

The equity allocation of the fund was 72%, while the Debt was 28% (as on 31st October 2023). The equity portion of the scheme portfolio has a predominantly large cap bias; nearly 55% of the equity portfolio is in large caps while the balance is distributed between midcap and small cap in the ratio of 9% and 8%. The duration strategy of the debt portion is in the short to medium duration range.

As of 31st October 2023 the fund invests 71.7% in domestic equities of which 54.7% is in Large Cap stocks, 8.6% is in Mid Cap stocks, 8.3% in Small Cap stocks. The Debt allocation of the fund stands at 28.3%, of which 6.76% is in Government securities, and the rest is in low risk securities.

Source: Advisorkhoj Research, as on 31st October 2023

Why invest in Mirae Asset Hybrid Equity Fund?

- Compared to other asset classes, equity has demonstrated the highest potential of wealth creation in the long term. The scheme invests 65 – 80% of its assets in equity.

- The debt portion in the scheme minimizes downside risks and provides stability during volatility.

- Mirae Asset Hybrid Equity Fund invests judiciously between Equity and Debt.

- As compared to investors managing asset allocations at their end, the fund offers cost & operational efficiency for them.

- The fund is expected to generate capital appreciation for investors in the long term even in volatile market conditions where equity has a pull back.

Who should invest in Mirae Asset Equity Hybrid Fund?

- Investors who want capital appreciation and income over long investment horizons.

- Investors who do not want too much volatility in their investments e.g. new investors.

- Investors who aim to earn better returns compared to traditional savings products albeit with higher risks.

- Investors who have a moderately high to high-risk appetite.

- Investors should have minimum 3-to-5-years of investment horizon.

Investors should consult with their financial advisors or mutual fund distributor, if Mirae Asset Hybrid Equity Fund is suitable for their long-term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team