Where should you in invest when markets are near record highs: Nippon India Hybrid Funds

The equity market has been rallying in 2023 with the market at record highs for the past 3 months. The Nifty crossed the 20,000 level in September. Asset allocation is always for your portfolio stability, but in very high markets it assumes even more importance. We have seen some profit booking from market tops over the last few days. Rising US Treasury Bond yields and US Federal Reserve interest rate outlook over the next few quarters is reason why the market is showing weakness. Valuations are relatively high and market may be volatile; in these market conditions, hybrid funds provide good investment solutions to investors. Nippon India MF has products in all the hybrid categories. In this article, we will do a review of Nippon India hybrid funds. But first a quick overview of different types of hybrid funds:-

What are different types of hybrid funds?

- Aggressive hybrid funds: 65% to 80% equity and 20% to 35% debt. Suitable for investors with adequately high risk appetite. Nippon India MF product in this category is Nippon India Equity Hybrid Fund.

- Balanced hybrid funds: 40% to 60% equity and 40% to 60% debt. Suitable for investors with moderate to moderately high risk appetite. AMCs are allowed to offer either aggressive hybrid of balanced hybrid funds.

- Dynamic asset allocation funds / Balanced Advantage funds: Manage asset allocation between equity and debt dynamically based on market conditions. Suitable for investors with moderate to moderately high risk appetite. Nippon India MF product in this category is Nippon India Balanced Advantage Fund.

- Multi asset allocation funds: Minimum 10% asset allocation in at least 3 classes e.g. equity, debt, gold. Suitable for investors with moderate to moderately high risk appetite. Nippon India MF product in this category is Nippon India Multi Asset Fund.

- Equity savings funds: Gross equity exposure of minimum 65%, hedging is allowed, minimum 10% in debt. Usually positioned as a lower risk fund compared to other hybrid funds, except conservative hybrid funds and arbitrage funds. Nippon India MF product in this category is Nippon India Equity Savings Fund.

- Conservative hybrid funds: 10% to 25% equity and 75% to 90% debt. Suitable for investors with moderately low to moderate risk appetite. Nippon India MF product in this category is Nippon India Hybrid Bond Fund.

- Arbitrage funds: Uses arbitrage strategy with gross equity exposure of minimum 65%. Suitable for investors with low risk appetite. Nippon India MF product in this category is Nippon India Arbitrage Fund.

Hybrid funds for different risk profiles / return expectations

The infographic below shows the product positioning of different Nippon India MF hybrid funds in the risk return matrix.

Let us do a brief review of 5 Nippon India hybrid funds that you can use for your asset allocation depending on your risk profile and investment needs.

Nippon India Equity Hybrid Fund

Nippon India Equity Hybrid Fund endeavours to generate relatively better risk adjusted returns by investing in a combination of Equities and Fixed Income instruments. The fund attempts to optimize the benefit of Equity Growth potential with relative stability of fixed income investments. On the equity space the fund aims to maintain a large cap oriented portfolio with a tactical exposure to emerging leaders to generate alpha. The fixed income strategy is focused on generating higher accrual through investments in high quality instruments with a moderate duration. The fund has outperformed the benchmark in the last 1 – 3 years and has been among the top 2 quartiles for the last 3 years including YTD 2023.

Source: Nippon India MF, Advisorkhoj Research, as on 31st August 2023

Nippon India Balanced Advantage Fund

Nippon India Balanced Advantage Fund uses an in-house proprietary quant model that dynamically changes asset allocation between equity and debt. The key parameters are as follows:-

- Valuations: The model uses 1 year forward P/E. Valuations are fulcrum of the model

- Trend following/momentum: This is a unique parameter which aids in maximizing Upside Potential and Limiting downside risk

- Trade weighted US Dollar: A strong Dollar typically coincides with weaker phases of Equity prices, while a weaker Dollar coincides with strong equity performance

- Global Demand Indicators: A combination of Lumber/Copper/Nickel prices acts as a strong indicator of global economy and markets.

The fund has outperformed the benchmark since inception and has been in the top 2 quartiles in both 2021 and 2022.

Source: Nippon India MF, Advisorkhoj Research, as on 31st August 2023

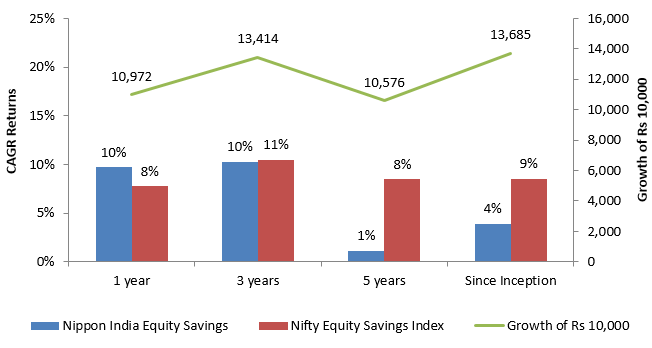

Nippon India Equity Savings Fund

The scheme employs various strategies which seek to exploit available arbitrage opportunities in markets along with pure equity investments. The strategy for different asset classes are as follows:-

- Net equity: The stock selection strategy is a blend of top down and bottom up approach without any sector or market capitalization bias. The fund follows GARP (Growth at Reasonable Price) strategy. It aims to create alpha through the divergence in valuation between large & midcaps in the same sector & also across sectors. Currently 70 – 75% of the equity portfolio is in large caps.

- Arbitrage: Arbitrage strategy uses completely hedged positions. The fund seeks to generate income through arbitrage opportunities arising out of pricing mismatch. It aims to have prudent balance of safety, returns and liquidity

- Debt: Focus on accrual through investments in medium to long term corporate bonds with optimal liquidity. The fund maintains moderate Portfolio Duration of 2.5 to 3.5 years depending on Interest Rate Scenario. The fund seeks to maintain a fine balance between liquidity and credit risk to capture spreads actively.

Source: Nippon India MF, Advisorkhoj Research, as on 31st August 2023

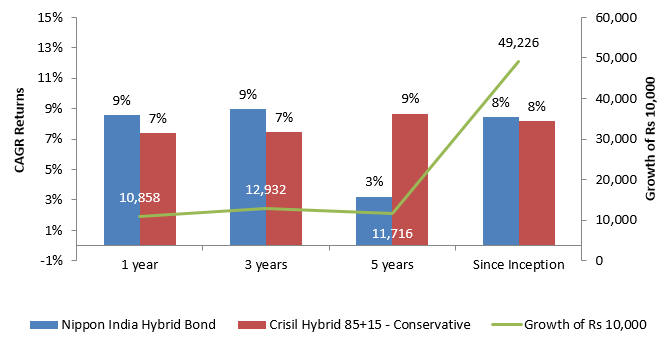

Nippon India Hybrid Bond Fund

Nippon India Equity Hybrid Fund intends to offer the power of equity along with the stability of debt. The current asset allocation is 90% debt and 10% equity. For the debt portion, the fund focuses on accrual strategy through right blend of short to medium term tenor corporate bonds. Fund aims to maintain low to moderate duration given the current market scenario. The fund invests in well researched credits primarily in AA & below rated papers. Spread between AAA and below AA rated issuers are attractive which may provide the opportunity to build relatively high accruals for investors. As far as the equity strategy is concerned, the fund aims to replicate Nifty 50 with a long term view. The fund has outperformed the benchmark in the last 1 – 3 years and since inception. It has consistently been in the top 2 quartiles for the last 3 years.

Source: Nippon India MF, Advisorkhoj Research, as on 31st August 2023

Nippon India Multi Asset Fund

The primary investment objective of Nippon India Multi Asset Fund is to seek long term capital growth by investing in equity and equity related securities, debt & money market instruments and Exchange Traded Commodity Derivatives and Gold ETF as permitted by SEBI from time to time. The current asset allocation / investment strategy of the fund is as follows:-

Source: Nippon India MF, Advisorkhoj Research, as on 31st August 2023

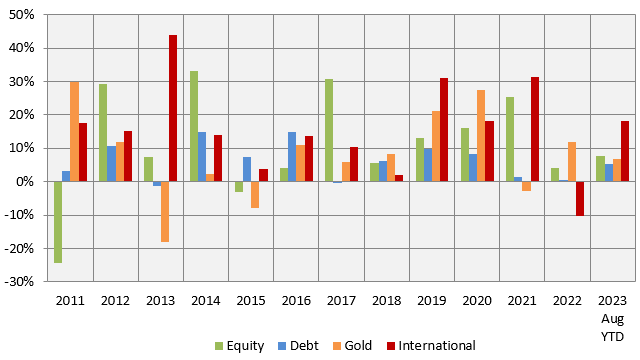

How does multi-asset allocation help?

- Asset allocation is considered to be the key driver of portfolio returns. According to a Study in 2001, “More than 90% of the portfolio returns are based on asset allocation decisions”.

- Asset classes follow different cycles over different time periods (see the chart below). It is difficult to predict which Asset class will outperform.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023. Equity as an asset class is represented by Nifty 50 TRI, debt as an asset class has been represented by Nifty 10-year benchmark G-Sec and for gold, we have used MCX spot prices, international is represented by S&P 500 in INR. Disclaimer: Past performance may or may not be sustained in the future.

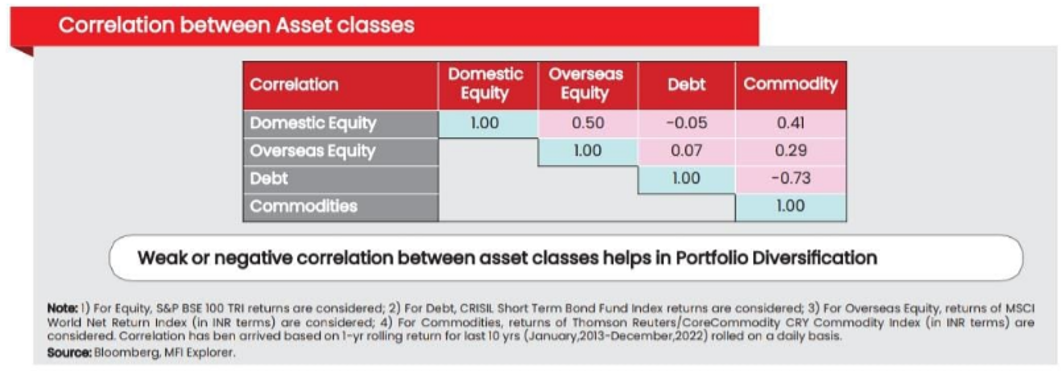

- Multi asset allocation helps in Portfolio Diversification and could lead to optimal returns. This diversification makes a strong case since there is weak or negative correlation.

- In an environment where equities are near record highs, high interest rates and sticky inflation, multi asset allocation strategy may be suitable for investors with long investment

- Nippon India Multi Asset Fund is a one-stop solution that may help to reap the benefit of Growth of Equity, Stability of Debt & Diversification from Commodities

Investors should consult with their financial advisors or mutual fund distributors to see which Nippon India MF hybrid funds can be suitable for their investment needs and risk appetites.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team