Top performing mutual funds outperformed ULIPs

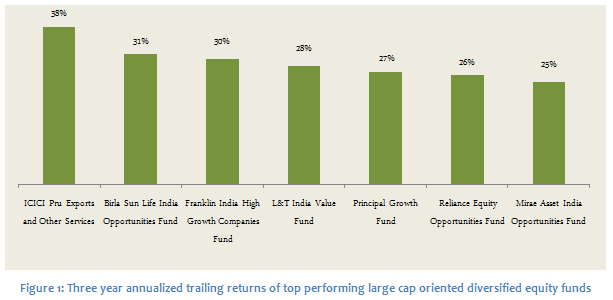

Top performing mutual funds have outperformed their Unit Linked Insurance Plan (ULIP) counterparts over a three year investment horizon. Top performing large cap oriented diversified equity mutual funds have given trailing annualized returns of 25 – 38% over a three year horizon. The chart below shows the three year annualised returns of top performing large oriented diversified equity mutual funds (growth option).

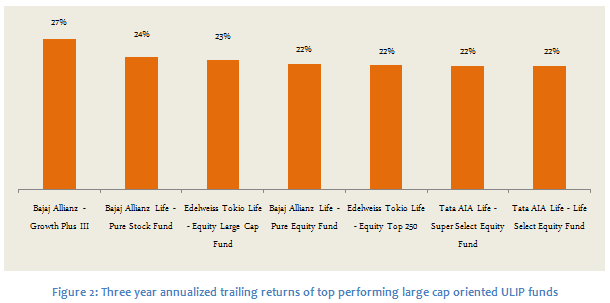

Top performing large oriented ULIPs have given trailing annualized returns of 22 – 27%. The chart below shows the three year annualised returns of top performing large oriented ULIPs.

While top performing ULIP funds have given very good returns in the last three years, we can see that top performing diversified equity funds outperformed large cap ULIP funds by 3 – 10% on an annualised basis. The current value of Rs. 50,000 annual investment in top performing diversified equity funds (shown in Figure 1) over the last three years will be, on average, Rs. 30,000 more than the current value of a similar investment in large cap ULIP funds (shown in Figure 2) over the same period, purely due to the difference in returns between mutual funds and ULIP funds. The actual difference in returns between a top performing mutual fund and an ULIP policy will be even more due to the applicable charges in ULIPs. These charges are:-

Premium allocation charges:

This is a percentage of the premium to be deducted upfront, before the units are allotted to the insured. This charge normally includes initial and renewal expenses apart from commission expenses.Policy administration charges:

These are the fees for administration of the plan and levied by cancellation of units. This could be flat throughout the policy term or vary at a pre-determined rate.Mortality charges:

It is the fee for the insurance cover. It depends on the age of the insured and the sum assured.Surrender charges:

If you are unable to pay the premium within the lock in period of 5 years, then surrender charges would apply for enchantment of the units.

Though the ULIP fees have been rationalised under the revised IRDA guidelines, the revised fees still have a significant impact on the returns at least in the initial years of the policy. Though the charges differ from policy to policy, for a typical ULIP policy the charges in the initial years can be as high as 6 – 7% (please read our article, Demystifying Unit Linked Insurance Plan (ULIP) Charges and Returns). This implies that, even if a ULIP fund gives a 25% return, the effective return for the investor or the insured is only about 18 - 19% for the first few years.

Difference between mutual funds and ULIP fund management

- Equity mutual funds are actively managed. The mutual fund managers actively manage their portfolios and try to beat market indices. ULIP funds are more passively managed and there is less portfolio churn. The company weights in ULIP funds usually track a benchmark market index.

- Diversified equity funds have more aggressive allocation to midcap companies compared to their ULIP counterparts. Therefore they are able to generate higher returns.

- Even the debt ULIP funds are more conservatively managed relative to debt mutual funds, in terms of the maturity profile of the portfolio.

- The fund management fees of mutual funds are higher than that of ULIPs. The fund management charges for ULIPs are capped at 1.35%. Total expense ratio of mutual funds is capped at 2.5% for the first

र100 corers of assets under management (AUM), 2.25% for the nextर300 crores, 2% for the nextर300 crores and 1.75% on the balance AUM. However, if 30% of new gross inflows are from tier 2 cities, then the AMCs are allowed to increase their expense ratio by 30 bps. On an average fund management charges for ULIPs are 120 – 130 bps less than average mutual fund expense ratios.

Are ULIPs better than mutual funds in the long term?

In the short to medium term mutual funds are definitely better investment options than ULIP policies, primarily because of the high ULIP fees in the initial years. However, some life insurance agents argue that, ULIPs are better than mutual funds in the long term, because beyond the initial years (usually 5 years), when the premium allocation charges and the other ULIP charges reduce substantially, the ULIP fees are lower than mutual fees. However, the investor is more concerned with net returns than with costs. So the question is, in the long term which investment will give better net returns, Mutual funds or ULIPs? Beyond the initial years, even if the ULIP costs are 100 – 120 bps lower than mutual fund costs (it cannot be lower than that), if the mutual fund return is 2% higher than ULIP fund return, then mutual fund is the better investment option. We have seen that top performing diversified equity funds outperformed top performing ULIPs by 3 – 5% over the last 3 years. Can mutual funds sustain this out performance in the future? Nobody can predict the future, but the key to out performance is fund management.

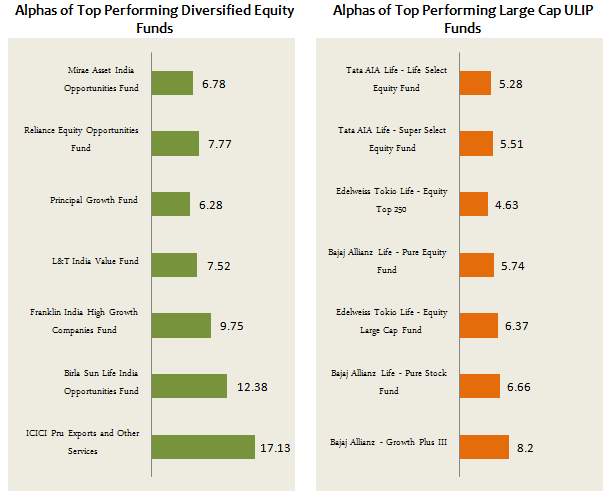

The measure of the value added by a fund manager is defined as alpha. Alpha is a measure of fund manager’s performance on a risk adjusted basis and is measured by the difference between a fund's actual returns adjusted for risk and the expected performance of a suitable benchmark index. It is reasonable to expect that, other factors remaining the same, a fund manager who has generated good alphas in the past can generate good alphas in the future. The chart below shows the comparison of alphas of top performing diversified equity funds and large cap ULIP funds.

We can see that the mutual fund managers have been able generate superior alphas compared to their ULIP counterparts, due to their active fund management. It must be noted that, ULIP also has an embedded life insurance component, but in this article we are just comparing the investment performance of mutual funds and ULIPs.

Not all funds give superior performance

There is a big performance differential between top quartile funds and bottom quartile funds (please see our article, Choose Best Mutual Funds wisely: A big performance differential between top and bottom performers). Fortunately, a lot of research is available in the public domain for mutual funds, which can help investors distinguish good performers from poor performers. Investors should also note that recent good performance is also not an indicator of future out performance. Investors should consult with their financial advisors to select good mutual funds which are suitable for their needs.

Conclusion

Under the revised IRDA guidelines, ULIPs have become much more attractive investment options than in the past when ULIPs were sold without any cost restrictions. Top performing ULIP funds have given very good gross returns in the last 3 years. However, mutual funds have done even better than ULIPs. The debate between mutual funds and ULIPs as investment options will continue with both sides putting forward their own perspectives. Investors should evaluate both investment options objectively, without being influenced by vested interests. Unbiased financial advisors can help investors make the right investment decision.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team

-

Bank of India Mutual Fund launches Bank of India Banking and Financial Services Fund

Jan 8, 2026 by Advisorkhoj Team

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team