Top Liquid Mutual Funds: Better options than savings bank for parking your surplus cash

Most of us keep our surplus cash lying in our savings bank account. It is safe and convenient, if we need to use the money on a frequent basis. However, we should, from time to time, take a look at our savings bank statement and ask ourselves, how much balance we should have in our savings bank account? We should always keep our funds for emergency purposes in our savings bank account. But very often we have much more lying in our savings bank, either because we are waiting for an upcoming expense or we do not know what to do with the money. Liquid fund is a much better option than savings bank for parking your surplus funds for short durations ranging from a month to a year.

Liquid funds are money market mutual funds and invest in instruments like treasury bills, certificate of deposits and commercial papers and term deposits. The objective of liquid funds is to provide the investors with an opportunity to earn returns, without compromising on the safety and liquidity of the investment. Typically liquid funds invest in money market securities that have a residual maturity of less than or equal to 91 days. Liquid funds have no exit load and therefore you can withdraw money either partially or fully at any point. Redemptions from liquid funds are processed within 24 hours on business days. Over the last one year top performing liquid funds have delivered more than 8% returns, which is much higher than your savings bank interest rate.

Savings Bank Interest

Most of us do not pay much attention to savings bank interest because the interest rate is too low and it does not show on our monthly bank statement. However, if your savings account average balance is high, then you may be losing a lot by keeping your money in savings bank account and not investing it in liquid funds, as we will see in this blog. But first let us understand how much interest your savings bank pays you.

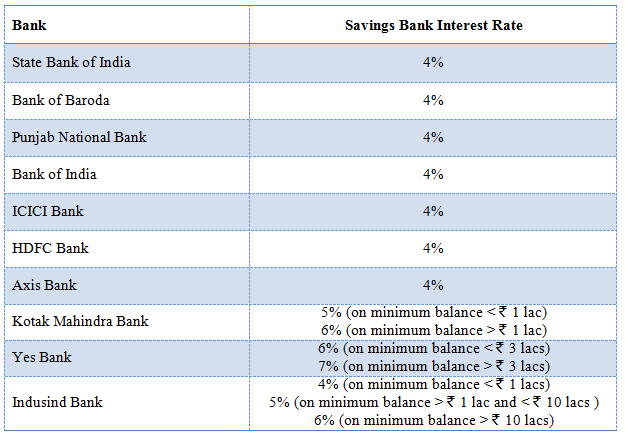

The vast majority of banks pay an annual interest rate of 4% in savings accounts. Some private sector banks, e.g. Kotak Mahindra Bank, Yes Bank etc pay a higher interest rate subject to certain conditions. The table below shows the current savings bank interest rate some of the largest private and public sector banks.

As per RBI guidelines, the savings bank interest has to be calculated on daily basis on the day’s closing balance. Let us understand this with the help of an interest. Let us assume you have र 100,000 balance in your savings bank account today and your savings bank interest rate is 4% per annum. The interest for the day will be calculated as below:

Today’s Interest = (100,000 X 4%) / 365 = 10.96

If you withdraw र 10,000 tomorrow, then your account balance will be र 90,000. The interest for tomorrow will be:-

Tomorrow’s Interest = (90,000 X 4%) / 365 = 9.86

If you deposit र 20,000 day after tomorrow then your account balance will be र 110,000. The interest for day after tomorrow will be:-

Day after tomorrow’s Interest = (110,000 X 4%) / 365 = 12.05

Therefore, the total earned by you over these three days will be र 10.96 + 9.86 + 12.05 = 32.86/-.

You should also understand the interest is not credited to your savings bank account every day. Actually, it is not even credited to your bank account at the end of the month. As per RBI guidelines, banks need to credit the savings bank interest on a quarterly basis. Some of us have the misconception that savings bank interest is compounded daily or monthly. It is important to understand that compounding cannot take place unless the interest is credited to your account. Since the interest is credited to your account on a quarterly basis, the compounding takes place quarterly.

Liquid Fund Returns

In selecting liquid funds, one must be careful and select top quality funds only. While AUM is not such an important consideration for equity funds, it is assumes importance when selecting liquid funds. Other considerations as per CRISIL are returns, volatility, downside risk probability, asset quality, concentration risk and liquidity risk. In today’s blog we selected 10 top performing liquid funds based on CRISIL’s ranking. Investors should note that unlike your savings bank interest rate, liquid fund returns are not assured. However, liquid funds offer high degree of capital safety and liquidity. Also, since liquid fund investments are done over short durations, one can get a good sense of the expected returns from recent trends, after allowing for a few basis points of downside or upside in yields. The table below shows the top liquid funds (returns are on a trailing basis, as on Sep 23, 2015). You should note that yields have been on a declining trend in India over the past year and therefore you should give more importance to the 1 month and 3 months returns rather than the 1 year returns.

Difference in returns between liquid funds and savings bank

Let us see with the help of an example. Let us assume, you always have र 500,000 in your savings bank account. Let us see how much interest you will earn in the period April 1, 2015 to September 30, 2015.

Let us now see, how much return you would have got if you invested र 500,000 in one of the top performing liquid funds, 6 months back. Assuming you got a return of 4.15% (you can see from the table of top performing liquid funds that you could have got up to 4.2% returns) your total returns would be र 20,750. This is more than double of what you would get from most savings bank accounts. Even if you got 7% interest rate in your savings bank account, the liquid fund returns are still much higher. In fact, all the liquid funds in our selection would have higher returns than the highest interest rate paid by savings bank.

Conclusion

Liquid funds are very good investment options for parking your short term funds. Though liquid funds do not provide the convenience of making deposits or withdrawals on weekends and after business hours (through ATMs), something which banks provide, if retail can plan their cash flow needs a few days in advance, they can earn higher returns by investing their surplus cash in liquid funds than having it lie idle in their savings bank account. Investors should consult with their financial advisors if these funds are suitable options for parking their surplus cash.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Union Mutual Fund launches Union Income Plus Arbitrage Active FOF

May 22, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 ETF

May 21, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 Index Fund

May 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty200 Quality 30 Index Fund

May 21, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Services Fund

May 20, 2025 by Advisorkhoj Team