Top 7 Best Mid and Small Cap Equity Mutual Funds to Invest in 2016: Part 1

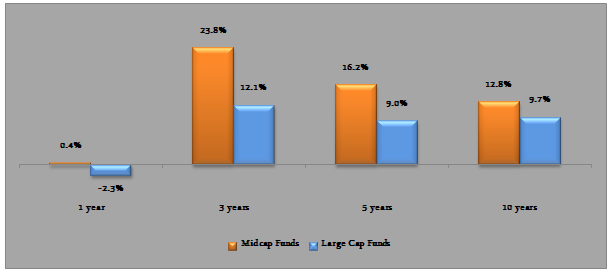

Small and Midcap equity mutual funds have been among the top performing mutual funds across all categories in the last few years. Small and Midcap funds have outperformed large cap funds both in terms of trailing returns and annual returns over few years. The chart below shows the annualized trailing returns of midcap and large cap fund categories over the last 1, 3, 5 and 10 years(period ending May 27, 2016).

Source: Advisorkhoj Research

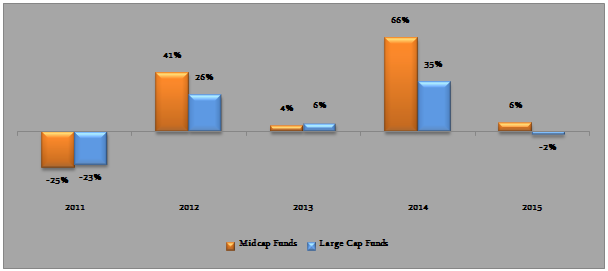

You can see that, even in the last 1 year when the market corrected sharply, midcap funds outperformed large cap funds. This is contrary to what we usually expect in volatile markets, when large cap stocks and funds are expected to outperform. A major reason behind outperformance of midcap funds relative to large funds last year was Foreign Institutional Investor (FII activity), which adversely impacted large cap stocks. Trailing returns are biased by recent prices, but even in terms of annual (yearly) returns Midcap funds outperformed large cap funds in most years. The chart below shows the annual returns of midcap and large cap fund categories over the last 5 years.

Source: Advisorkhoj Research

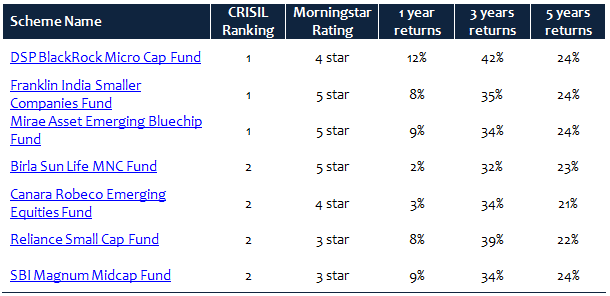

In this post we will review some of the top performing midcap funds for investment in 2016, based on CRISIL’s latest mutual fund ranking (for the quarter ended March 2016). CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company) and portfolio liquidity risk.

In addition to selecting funds based on their relative ranking within the small and midcap categories, we have also selected consistent performers among small and midcap funds. Each of the small and midcap equity funds in our selection has been assigned either Rank 1 or 2 by CRISIL. In addition to CRISIL ranking we have applied a secondary filter based on our own research. Our secondary filter is based on quartile ranking. Quartile ranking is an analytical tool which measures how well a mutual fund has performed against all other funds in its category. From the CRISIL top ranked midcap funds, we have selected only those funds, which are currently ranked in the top quartile based on trailing 3 year returns. Further, in order to see performance consistency, we have limited our selection to funds, which were in the top quartile in the previous two quarters as well (please see our quartile ranking tool for small and midcap funds).

The table below lists the top 7 small and midcap funds based on criteria discussed above.

Source: Advisorkhoj Research, CRISIL, Morningstar

Please note the fund categorization of CRISIL is slightly different from the fund categorization of our research team. While CRISIL categorizes Birla Sun Life MNC Fund as a midcap fund, our team categorizes it as a thematic fund and within thematic funds, Birla Sun Life MNC Fund has consistently ranked in the top quartile. However, for the purpose of the post, we will stick to the CRISIL categorization.

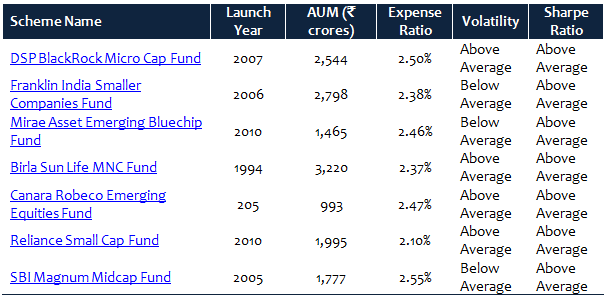

Let us look at some other key statistics, like launch year, Assets under Management, Expense Ratio, Volatility (measured in terms of standard deviation of monthly returns) and Sharpe Ratio (a measure of risk adjusted returns) of these Top 7 Midcap funds.

Source: Advisorkhoj Research

Conclusion (of this part)

In this post, we have seen the top 7 small and midcap funds, based on CRISIL’s latest mutual fund ranking (for quarter ended March 2016) and also our internal quartile ranking based criteria. In the next part of this post, we will do a brief review of each these funds. Stay tuned for more.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team