Top 10 Diversified Equity Mutual Funds for investment in 2016: Part 3

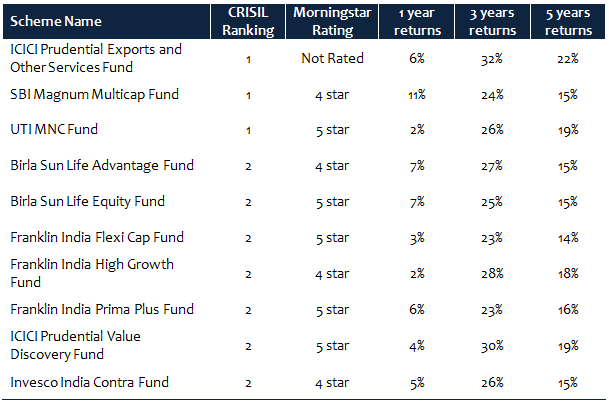

In the first part of this series, Top 10 Diversified Equity Mutual Funds for investment in 2016: Part 1, we saw the top 10 diversified equity funds, based on CRISIL’s latest mutual fund ranking (for quarter ended March 2016) and also our internal quartile ranking based criteria. Here is a brief re-cap of the top 10 diversified equity funds.

In the second part of this series, Top 10 Diversified Equity Mutual Funds for investment in 2016: Part 2, we did brief reviews of ICICI Prudential Exports and Other Services Fund, SBI Magnum Multicap Fund, UTI MNC Fund, Birla Sun Life Advantage Fund and Birla Sun Life Equity Fund. In the third and final part of this series we will do brief reviews of the other top diversified equity funds based on CRISIL and our own internal quartile ranking.

Franklin India Flexi Cap Fund

This is a popular diversified equity fund from the Franklin Templeton stable. The fund has launched in 2005 and has around र 2,865 crores of AUM. The expense ratio of the fund is only 2.31%. R Janakiraman, Lakshmikanth Reddy and Srikesh Nair are the fund managers of this scheme. The fund has given nearly 18% annualized returns since inception. The chart below shows the 3 year rolling returns of Franklin India Flexi Cap Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, the fund has not only beaten the benchmark consistently, but the three year rolling returns have consistently been exceedingly good. The fund has given more than 20% three year rolling returns over the last 5 years, nearly 80% of the times. From a portfolio perspective, the fund is biased towards large cap segment. From an investment style standpoint, the fund managers invest in growth stocks. While the volatility of the fund is below average, the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page).

Franklin India High Growth Companies Fund

This is another very popular fund from Franklin Templeton stable. Though this one of the youngest fund in our selection of top diversified equity funds, this is an investor favourite because of its strong performance over the last few years. The fund was launched in 2007 and has nearly र 4,550 crores of AUM.

The expense ratio of the fund is only 2.3%. Industry veteran, Anand Radhakrishnan is the fund manager of this scheme, along with Roshni Jain Srikesh Nair. The fund has given nearly 13% annualized returns since inception. Readers should not get a wrong perception by the slightly lower trailing returns of this fund since inception relative to the other funds that we have discussed so far in this series. Franklin India High Growth Companies Fund was launched nearly at the height of the bull market of 2007 and in the last one year, the market has corrected over 10%.

The combined effect of the start and end points of the period in question, i.e. since inception, makes the trailing returns of this fund seem slightly low. We have repeatedly mentioned in our blog that, trailing returns does not always show the true performance potential of a fund, because trailing returns are biased by the period in question. Rolling returns are a much better measure of a fund’s true performance, across different market conditions. The chart below shows the 3 year rolling returns of Franklin India High Growth Companies Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

If you see the 3 year rolling returns of Franklin India High Growth Companies Fund, you will realize that the performance of this fund has been truly outstanding. The fund has not only beaten the benchmark consistently, but the three year rolling returns have nearly always been above 20% on an annualized basis, returns over the last 5 years. As the scheme name suggested the fund manager prefers high growth stocks. The volatility of the fund is above average, but the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page).

Franklin India Prima Plus Fund

While Franklin India High Growth Companies Fund is one of the youngest funds in our selection of Top Diversified Equity Funds, Franklin India Prima Plus is the oldest. Franklin India Prima Plus Fund is not just one of the most well known funds from the Franklin Templeton stable; it has a legendary reputation in the entire mutual fund space as a great wealth creator. The fund was launched in 1994 and has over र 7,900 crores of AUM. The expense ratio of the fund is just 2.29%. Industry veterans, Anand Radhakrishnan and R. Janakiraman are the fund managers of this scheme. र 1 lac invested in the NFO of this fund would have grown to nearly र 46 lacs now.

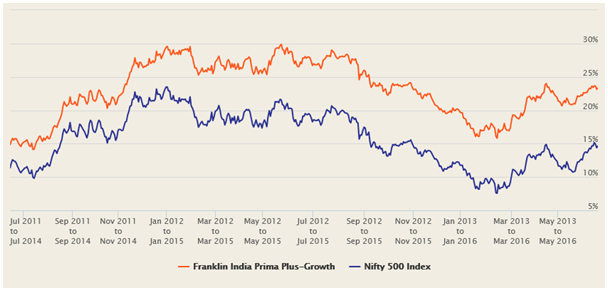

The chart below shows the 3 year rolling returns of Franklin India Prima Plus Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, the fund has not only beaten the benchmark consistently, but the three year rolling returns have consistently been very strong. The fund has given more than 20% three year rolling returns over the last 5 years, nearly 80% of the times. From a portfolio perspective, the fund is biased towards large cap segment. From an investment style standpoint, the fund managers invest in growth stocks. Even though the volatility of the fund is below average, the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page).

ICICI Prudential Value Discovery Fund

This is the second fund from ICICI Prudential stable in our selection of Top Diversified Equity Funds. In the last few years, if you ask which is the most popular equity fund, the name ICICI Prudential Value Discovery Fund is the first that would come to our minds. In terms of AUM base, this is the biggest fund (AUM of nearly र 12,400 crores) in our selection of Top Diversified Equity.

This fund is one of the biggest wealth creators in the last 10 years or so. The fund was launched in 2004 and has an expense ratio of the fund just 2.26%. Though ICICI Prudential Value Discovery was a midcap fund a few years back, it is now a diversified equity fund mainly because of its AUM size. Mrinal Singh is the fund managers of this scheme.

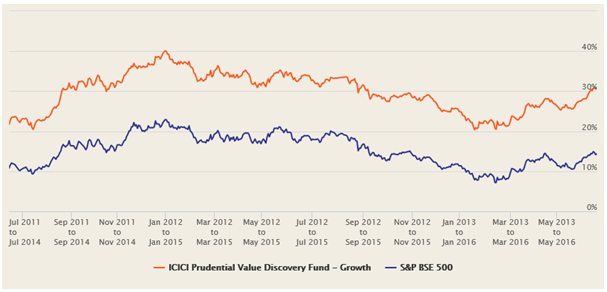

र 1 lac invested in ICICI Prudential Value Discovery Fund 10 years back would have grown to nearly र 6 lacs now. The chart below shows the 3 year rolling returns of ICICI Prudential Value Discovery Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

The rolling returns chart shows, why ICICI Prudential Value Discovery Fund has been the one of the most favourite funds for investors over the last 5 years. You can see that, the fund has beaten the benchmark consistently over the last 5 years, but pay more attention to the orange line. It has never fallen below the 20% mark.

This was truly exceptional performance and ICICI Prudential Value Discovery Fund truly deserves all the attention it received from investors and financial advisors over the last few years. From a portfolio perspective, the fund is now biased towards large cap segment, but has substantial allocations to midcap stocks also. In terms of investment style, as the scheme name suggests, the fund manager follows the value investment style. The volatility of the fund is above average, but the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page).

About six months back, we reviewed this fund in our post, ICICI Prudential Value Discovery Fund: Best performing diversified equity fund in the last 10 years. You may like to read it!

Invesco India Contra Fund

Invesco India Contra Fund is one of the youngest funds in our selection of top diversified equity funds. It is also the smallest fund, in terms of AUM size (little over र 220 crores) in our selection. The expense ratio of the fund is 2.43%. Vetri Subramanium and Amit Ganatra are the fund managers of this scheme. The fund was launched in 2007 and delivered around 13% compounded annual returns since inception. As discussed earlier, readers should not get a wrong perception by the slightly lower trailing returns of this fund since inception relative to the other funds that we have discussed so far in this series.

Rolling returns (a much superior measure of performance compared to trailing returns) of the fund has been quite strong. The chart below shows the 3 year rolling returns of Invesco India Contra Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, the fund has not only beaten the benchmark consistently, but the three year rolling returns have consistently been very strong. The fund has given more than 20% three year rolling returns over the last 5 years, nearly three quarters of the times. From a portfolio perspective, the fund is biased towards large cap segment. The investment style of the fund managers is value oriented. The volatility of the fund is above average, but the Sharpe Ratio is excellent (for more scheme performance and other details, please see our fund research page).

Conclusion

In this 3 part series, we reviewed the top 10 diversified equity mutual funds, based on a combination of CRISIL mutual fund ranking (for the quarter ended March 2016) and our quartile ranking based criteria. Diversified equity mutual funds should combine the core of an investor’s long term mutual fund portfolio. These funds will help investors create wealth over a long investment horizon (please see our post, How SIPs in Top 7 Best Diversified Equity Mutual Funds have created wealth) Investors should consult with their financial advisors, if the funds discussed in this series, are suitable for their mutual fund portfolios.

Related post:

Top 7 Best Mid and Small cap equity mutual Funds to invest in 2016

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team