The return of optimism: Is the DSP Black Rock TIGER Fund ready to roar

There are plenty of reasons to be optimistic about Indian equities. The Lok Sabha election has given an historic verdict. For the first time since 1984, a single party has an absolute majority in the Parliament. This should improve market sentiments significantly. The new government is likely to have a major thrust on infrastructure. With better governance and faster decision making processes, project execution is likely to pickup pace. In our previous articles on sector performance (please refer to our articles, BSE sector performance and pointers for future outperformance: Part 1 and Part 2) we have seen that cyclical sectors like Banking, Capital Goods and Infrastructure have generally underperformed in the last 5 years. With the pick-up in capex cycle and stronger GDP growth, cyclical sectors are poised for a strong recovery. In this article we will review the DSP Black Rock TIGER (The Infrastructure Growth and Economic Reforms) fund, which is strongly positioned to benefit from the recovery in the cyclical sectors. The DSP Black Rock TIGER fund is oriented to cyclical sectors like Infrastructure, BFSI, Energy, Telecom and Materials. About 23% of the fund’s portfolio is invested in Public Sector Undertakings. With the NDA government strong past track-record in PSU reforms and disinvestment, the fund is well positioned to benefit from the policy initiatives in that area. The DSP Black Rock Tiger Fund is essentially a diversified equity scheme. CRISIL, however, categorizes this fund in the infrastructure sector funds category, due to its direct and indirect exposure to the infrastructure sector. This fund has been ranked 2 (a good performer) among infrastructure sector funds by CRISIL in their latest (March 2014) mutual funds rankings.

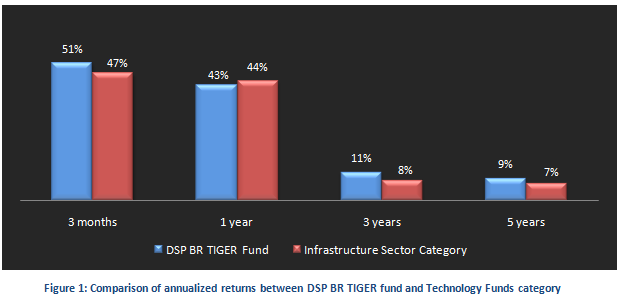

The fund has outperformed the infrastructure sector category across most time periods. See the chart below for the trailing annualized returns of the DSP Black Rock TIGER fund and the infrastructure sector funds category over the 3 months, 1 year, 3 years and 5 years time periods. NAVs as on June 4.

DSP Black Rock TIGER fund – Fund Overview

This fund is suitable for well informed active investors looking for good investment opportunities in the short to medium term. The fund was launched in May 2004. It has an AUM base of about Rs 977 crores. The expense ratio of this fund is 2.14%. The fund manager of this scheme is Rohit Singhania. The scheme is open both for growth and dividend plans. The current NAV (as on June 4 2014) is 59.2 for the growth option and 17.48 for the dividend option.

Portfolio Construction

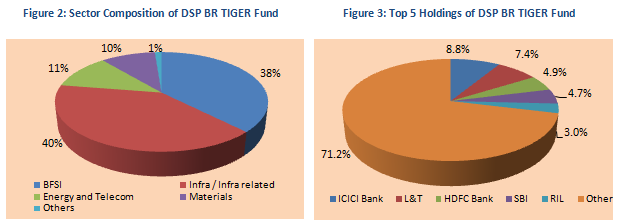

The fund invests in basket of diversified cyclical stocks, with a large cap and high growth focus.From a sector perspective, the portfolio has an infrastructure bias, but also has substantial exposure to BFSI, Energy and Telecom and Materials. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, ICICI Bank, L&T, HDFC Bank, SBI and RIL for only 29% of the total portfolio value. Even the top 10 stock holdings account for less than 42% of the total portfolio value.

Risk & Return

We have seen in Figure 1 that, the DSP Black Rock TIGER fund has outperformed it’s category across most time periods. The last one year returns have been particularly strong at nearly 41%. The returns over the 3 to 5 year periods have been low, because the cyclical sectors were generally very subdued during this timeframe. From a risk perspective, the volatility of the DSP Black Rock TIGER fund is slightly higher than the infrastructure sector funds category. The annualized standard deviation of monthly returns of the fund is 27%, as compared to 25.4% for the category. However, on a risk adjusted returns basis, as measured by Sharpe Ratio, the fund has outperformed the infrastructure sector funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. The Sharpe Ratio of the DSP Black Rock TIGER fund is 0.18 versus 0.09 for the category.

Comparison with Peer Set

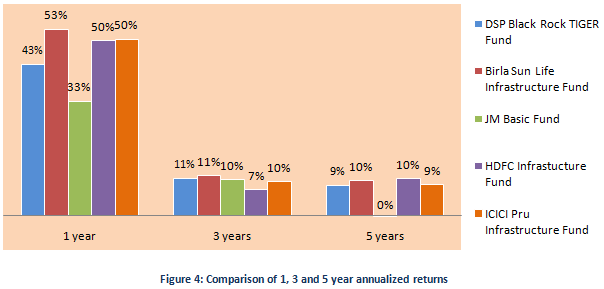

A comparison of annualized returns of the DSP Black Rock TIGER fund (growth option) versus its peer set over one, three and five year time periods shows why this fund is considered a top pick in its category. See chart below for comparison of trailing annualized returns over three, five and ten year time periods. NAVs as on June 4 2014.

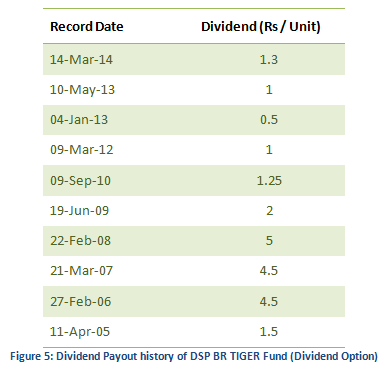

Dividend Payout Track Record

DSP Black Rock TIGER fund Dividend Option has an excellent dividend payout track record. Since inception in 2004, the fund has paid dividends every year, except in 2011.

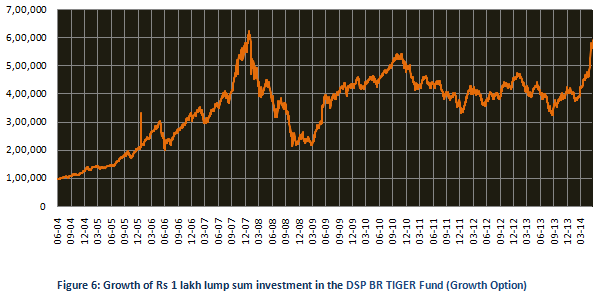

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the DSP Black Rock TIGER fund (growth option) since inception. A lump sum investment of Rs 1 lakh in the NFO (growth option) would have grown to over Rs 6 lakhs by the end of 2007. There fund NAVs saw sharp correction in the stock market crash in 2008, and has been quite volatile over the last 5 years. However, the fund NAV has reclaimed its historical high.

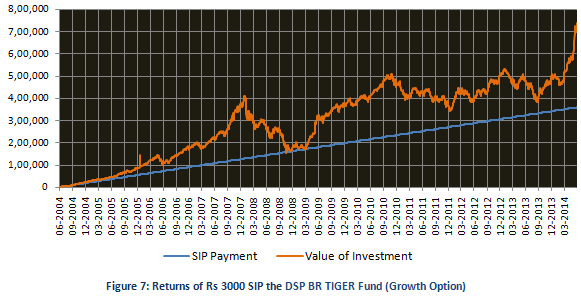

The chart below shows the returns since inception of Rs 3000 monthly SIP in the DSP Black Rock TIGER fund (growth option). The SIP date has been assumed to be the first working day of the month.

The chart above shows that a monthly SIP of Rs 3000 started 5 years back in the DSP Black Rock TIGER fund (growth option) would have grown to nearly Rs 7.5 lakhs, while the investor would have invested in total only Rs 3.6 lakhs. The SIP returns (XIRR) is nearly 14%. The SIP returns are low, because the cyclical sectors have been grossly underperforming over the last 5 years. However, once the economic growth revives, the SIP returns will undoubtedly improve.

Future Outlook

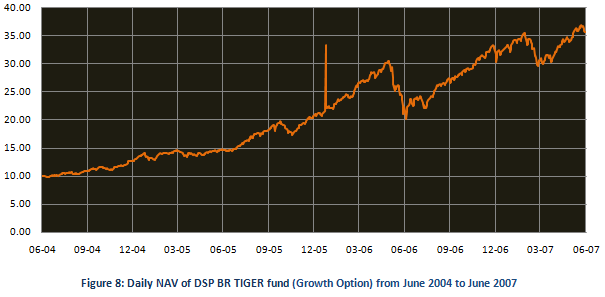

The future outlook for cyclical sectors looks very positive, for reasons described at the beginning of the article. Cyclical sectors do very well in bull markets. Let us take a look at history to get an indication. The DSP Black Rock TIGER fund was launched just after the Lok Sabha elections of 2004. The period from 2004 to 2007 was one of the strongest bull markets in the history of Indian equities. The chart below shows the growth in NAV of the DSP Black Rock TIGER fund from June 2004 to June 2007.

The NAV of the fund grow more than 3.5 times in 3 years. It gave a compounded annualized return of 53%. We are at a similar juncture now. In many ways, from the equity market perspective the political situation is much better now than in 2004. In 2004, the UPA – 1 Government had to rely on the support of the Left Front, which was opposed to economic reforms. The NDA Government, on the other hand, has a comfortable majority in Lok Sabha. In fact, BJP by itself, has an absolute majority, and therefore will be free from the compulsions of coalition politics. This will enable the government to pursue economic reforms more aggressively. On the monetary policy side, the RBI governor in the latest policy review has indicated that the interest rate tightening regime is now probably over. As the RBI moves to a more benign monetary policy, it will provide a stimulus to the cyclical sectors. The DSP Black Rock TIGER fund with its focus on domestic cyclical sectors is thus well positioned to gain from the revival of economic growth. The fund has already given a trailing return of 51% in the last 3 months, and is poised to go from strength to strength. However, investors should also note that, cyclical and high beta stocks also tend to be volatile. Since DSP Black Rock TIGER fund is focused on cyclical sectors and stocks, investors in the fund should be prepared for high volatilities. Therefore, investors need to have a sufficiently long time horizon if they want to invest in this fund. Investors with high risk appetite and moderate to long term time horizon can consider buying the scheme through the systematic investment plan (SIP) or lump sum route. Investors should consult with their financial advisers if the DSP Black Rock Tiger fund is suitable for their individual risk profiles and time horizons.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF FOF

Jan 9, 2026 by Advisorkhoj Team

-

Mahindra Manulife Mutual Fund launches Mahindra Manulife Innovation Opportunities Fund

Jan 9, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team