Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

Sundaram Select Midcap is one of the top performing midcap equity mutual funds in the last 10 years. If you invested र 100,000 in Sundaram Select Midcap Fund 10 years back, your investment would have grown to over र 417,722 by May 19, 2016 (Date range taken 19/05/06 – 19/05/16). The fund was launched in July 2002. It has र 3,430 crores of assets under management. The expense ratio of this fund is 2.31%. The fund manager of Sundaram Select Midcap Fund is S. Krishna Kumar, who is also the Chief Investment Officer of Sundaram Mutual Fund. It has given nearly 30% annualized returns since inception. The fund is rated highly by mutual fund rating agencies like Morningstar.

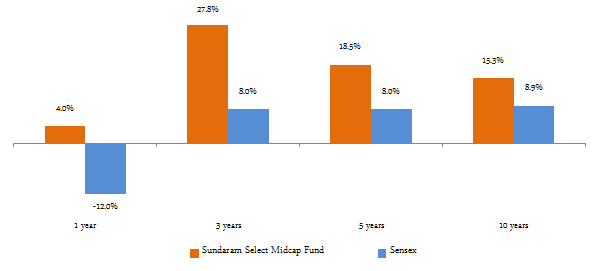

The fund has beaten the Sensex, in terms of trailing returns over different time-scales, by a wide margin. The chart below shows the trailing annualized returns of the fund and the Sensex over the last one, three, five and ten years (periods ending May 20, 2016).

Source: Advisorkhoj Research and Bombay Stock Exchange

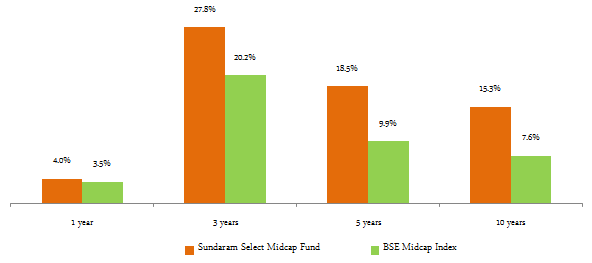

Since Sundaram Select Midcap Fund, invests primarily in midcap stocks (midcap and small cap stocks comprise 85% of the portfolio of the fund in value terms), BSE – Midcap Index is the appropriate benchmark index of this fund. The fund has outperformed even the BSE Midcap Index, by a large margin across different time-scales. The chart below shows the trailing annualized returns of the fund and the BSE Midcap Index over the last one, three, five and ten years (periods ending May 20, 2016).

Source: Advisorkhoj Research and Bombay Stock Exchange

One interesting point that you may have noticed in the two above two charts is that, while the BSE-Midcap Index outperformed the Sensex in terms of trailing 1 to 5 year returns, the Sensex has actually outperformed the BSE-Midcap Index in terms of trailing 10 year returns. However, Sundaram Select Midcap Fund has outperformed both the indices across all time-scales, implying that the fund has delivered good risk adjusted returns in different market conditions.

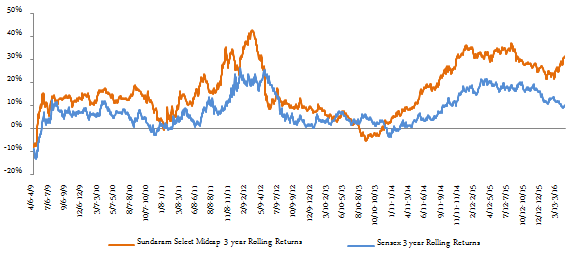

Rolling Returns of Sundaram Select Midcap Fund versus the Sensex

The chart below shows the 3 year rolling returns of Sundaram Select Midcap Fund versus the Sensex over the last 10 years. 3 year rolling returns of a fund means the annualized returns of the fund over a three year investment horizon during the period in considerations, 10 years in this case. We chose a 3 year rolling returns period because we think that 3 years should be the minimum investment tenure of an equity fund.

Source: Advisorkhoj Research

We can see that the fund has beaten the Sensex, in terms of 3 years rolling returns, nearly 88% of the times in the last 10 years. The rolling returns chart shows very strong performance consistency on the part of Sundaram Select Midcap Fund.

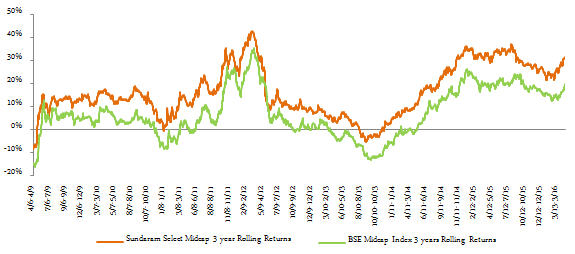

Rolling Returns of Sundaram Select Midcap Fund versus the BSE Midcap Index

The chart below shows the 3 year rolling returns of Sundaram Select Midcap Fund versus the BSE Midcap Index over the last 10 years.

Source: Advisorkhoj Research

The rolling returns chart of Sundaram Select Midcap Fund and the benchmark BSE Midcap Index over the last 10 years is a testimony of the performance consistency of this fund relative to its benchmark index. We can see that, the fund beat the benchmark index 100% of the times in the last 10 years. Moreover, we can also observe that, the rolling returns outperformance margin of the fund versus the benchmark is fairly stable most of the time. This is an evidence of structured fund management approach and prudent risk management practices.

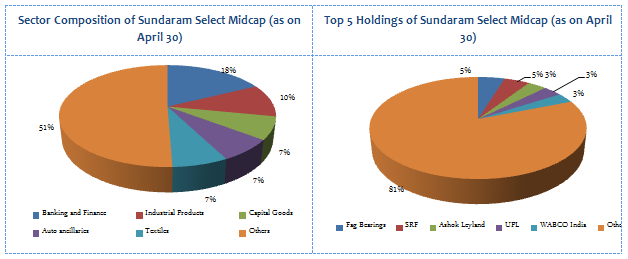

Portfolio of Sundaram Select Midcap Fund

S. Krishna Kumar, the fund manager of Sundaram Select Midcap Fund, is respected in the industry circles as one of most proficient fund managers, especially in the small and midcap space. Nearly 28% of the portfolio of Sundaram Select Midcap Fund is invested in small and midcap stocks. The investment style of Krishna Kumar for the Sundaram Select Midcap Fund is bottoms –up with a blend of growth and value investing. Speaking of the investment philosophy if the fund, the fund manager told us that, “The investment philosophy run on a 5S model, GARP valuation frameworks and the bottom up stock selection are key to its successful performance over the decade and we don’t intend to change any of them. Investing through the 5S approach means we go for simple businesses which operate in an environment of scalable opportunities under sound managements/promoters with certain sustainable competitive business advantage, leading to steady and growing cash flows, return ratios which in turn take care of all stake-holders expectations” (you can read the full transcript of Krishna Kumar’s interview with Advisorkhoj here).

The portfolio has a bias towards cyclical sectors like banking and finance, industrial products, capital goods, auto ancillaries and textiles. The fund manager is positive on cyclical sectors that feed on the economic recovery theme like industrials, engineering & capital goods, transportation and financials. In his interview to Advisorkhoj, the fund manager has said, “Infrastructure will be an important part of our portfolio taking into account the government's proposed spending in the sector. Private sector banks and NBFCs have been able to focus more on consumers / retail loans with strong control on spreads & credit costs. Herein again, we will allocate funds to this space, run by good managements. The urban consumer discretionary space looks good from a medium term perspective given the pay commission and OROP benefits. The Govt.’s renewed focus on the rural and farm sector particularly on back of expectations of a better monsoon this year is another theme we could play.”

In terms of the company concentration, the portfolio is well diversified with the top 5 stock holdings, Fag Bearings, SRF, Ashok Leyland, UPL and WABCO India accounting for only 19% of the portfolio value. Even the top 10 stock holdings account for only 33% of the portfolio value.

Source: Sundaram Mutual Funds April Factsheet

Wealth Creation by Sundaram Select Midcap versus Sensex and BSE – Midcap

The chart below shows the growth of र 100,000 lump sum investment in Sundaram Select Midcap Fund over the last 10 years, compared to the growth of र 100,000 lump sum investments in Sensex and BSE-Midcap Index over the same period.

Source: Advisorkhoj Research

The chart above shows that, र 100,000 lump sum investment in Sundaram Select Midcap Fund would have grown to over र 400,000 in the last 10 years. This is almost double the amount of wealth generation by both Sensex and BSE Midcap Index, as you can see in the chart above.

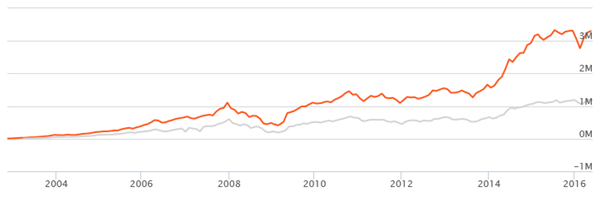

SIP Returns

The chart below shows the returns of र 3,000 monthly SIP in Sundaram Select Midcap Fund (growth option) since inception. The chart shows why Sundaram Select Midcap Fund SIP (shown by the orange line) has been one of the biggest wealth creators amongst all equity funds.

Source: Advisorkhoj Research

By र 3,000 monthly SIP in Sundaram Select Midcap Fund (growth option) since inception, you could have accumulated a corpus of around र 33 lakhs (as on May 20, 2016), while cumulative investment would have been less than र 5 lakhs. The annualized SIP returns of the fund since inception have been nearly 25% XIRR. By contrast, the SIP returns of the benchmark index (shown by the grey line) have been around 13% only.

Conclusion

The Sundaram Select Midcap Fund has delivered over 10 years of strong and consistent performance. We have seen that, Sundaram Select Midcap fund has outperformed the Sensex and BSE-Midcap Index across different performance measures. No wonder, Sundaram Select Midcap Fund is one of the biggest wealth creating midcap equity mutual funds in the last 10 years. Investors should consult with their financial advisors if Sundaram Select Midcap Fund is suitable for their mutual fund portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team