Sundaram Large and Midcap fund: A top large and midcap equity mutual fund scheme

Large and Midcap market segment refers to the top 250 companies by market capitalization. The top 100 companies by market capitalization are large cap companies, while the next 150 companies are classified as midcaps. Mutual funds which invest in this broad segment are known as large and midcap equity funds. SEBI mandates large and midcap equity mutual funds to invest minimum 35% of their AUM in large cap stocks and minimum 35% in midcap stocks. The risk profile of this category is midway between large cap and midcap funds.Given the fairly broad nature of the mandate, fund managers of Large and Midcap equity mutual fund schemes have the flexibility to shift substantial allocations from midcap to large cap and vice versa, depending on their market outlook.

Suggested reading: What are equity mutual funds in India and their types

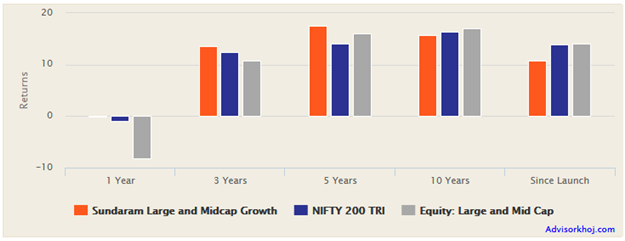

Sundaram Large and Midcap fund is one of the top performers in its category. It is the best performing large and midcap fund in the last 1 year. At a time when midcap stocks have suffered a deep correction and category average return was -8%, Sundaram Large and Midcap fund has been able to prevent investor losses. The scheme’s performance over longer tenors has also been very impressive. Sundaram Large and Midcap fund gave 13.6% annualized returns over the last 3 years and 17.8% annualized returns over the last 5 years.

The chart below shows the trailing annualized returns of the scheme versus the category and benchmark over various time-scales.

Source: Advisorkhoj Research

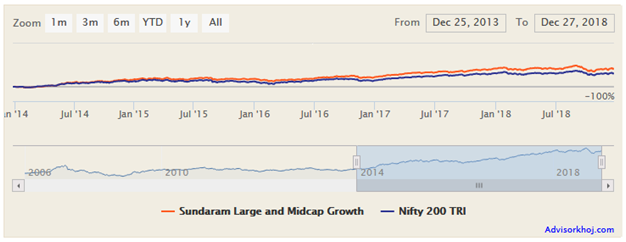

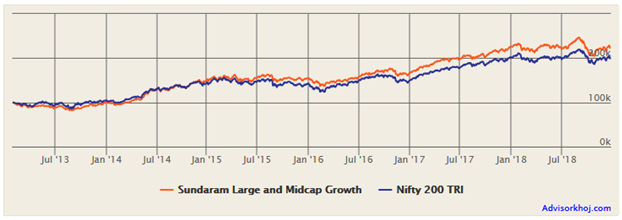

Sundaram Large and Midcap fund, previously known as Sundaram Equity Multiplier Fund, was launched in February 2007. The scheme has given around 11% annualized returns since inception. The expense ratio of the scheme is 2.84% (as on November 30, 2018). Sundaram Large and Midcap fund has Rs 462 Crores of assets under management (AUM). The scheme benchmark is Nifty 200 TRI. S Bharath and S Krishna Kumar are the fund managers of this scheme. The chart below shows the NAV growth of this scheme over the last 5 years.

Source: Advisorkhoj Research

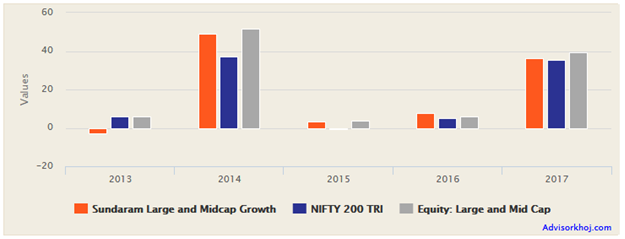

Sundaram Large and Midcap fund is one of the most consistent performers in the last 5 years. For the benefit of investors, we have built a tool on our portal, which shows the most consistent performers based on annual quartile ranks (fund ranking based on annual performance) over the last 5 years using our in-house proprietary ranking algorithm. Sundaram Large and Midcap fund is one of the most consistent performers in its category. The scheme was in the top 2 performance quartiles in 3 years out of the last 5 years. The chart below shows the annual returns of the scheme over the last 5 years versus its benchmark and category.

Source: Advisorkhoj Research

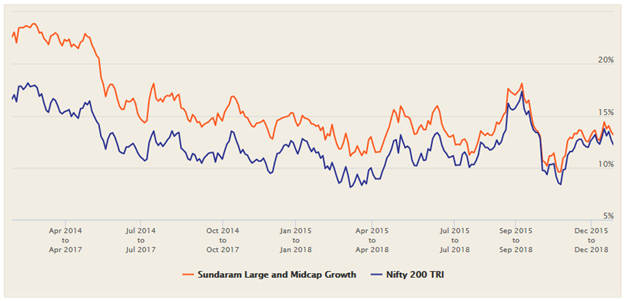

Rolling Returns

Regular Advisorkhoj readers know the importance of rolling returns in evaluating scheme performance consistency. Rolling returns measure scheme performance across different market conditions and is not biased by certain prevailing market conditions during a particular period. The chart below shows the 3 year rolling returns of Sundaram Large and Midcap fund over the last 5 years versus its benchmark, Nifty 200 TRI.

We have chosen a 3 year rolling returns period because we believe that investors should have a long term (at least 3 years) investment tenor for equity investments. Over the last 5 years, we experienced different market conditions, bull markets, bear markets, range-bound markets, volatile markets etc. So the rolling returns over the last 5 years should encompass different possibilities which an investor can encounter.

Source: Advisorkhoj Research

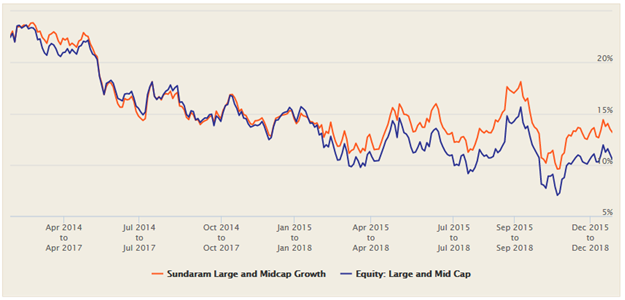

You can see in the chart above that the scheme has consistently beaten its benchmark in terms of 3 years rolling returns over the last 5 years. This is the hallmark of good fund management and shows that the fund managers have consistently been able to produce alphas across different market conditions. Let us now look at 3 years rolling returns performance of the scheme versus the Large and Midcap equity funds category over the last 5 years.

Source: Advisorkhoj Research

You can see that the fund has outperformed the category over most periods, across different market conditions. The average 3 years rolling return of the scheme over the last 5 years was 15.7%, while the median rolling return over the same period was 14.6%. The maximum 3 years rolling return of the scheme over the last 5 years was 24%, while the minimum 3 years rolling return of the scheme over the last 5 years was around 10%. These are outstanding statistics. The fund gave more than 12% annualized 3 years rolling returns more than 90% of the times of the last 5 years and more than 15% annualized 3 years rolling returns nearly 45% of the times.

Suggested reading: Most important analytical measures for selecting best mutual funds

Portfolio Construction

The investment objective of the scheme is capital appreciation. Sundaram Large and Mid Cap Fund is a multi-cap fund with 50-60% allocation to large caps and 40-50% to mid and small caps. Sundaram AMC has a strong track record as fund house particularly in the midcap and the small cap segments. The midcap allocation of the fund can create alphas for long term investors, while the large cap allocation provides stability to the investment in the short term. The chart below shows the top sector and stock concentrations of the scheme.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 Lakh lump sum investment in the scheme over the last 5 years. You can see that your investment in the scheme would have grown by more than 2 times over the last 5 years. The fund has given 127% absolute returns in the last 5 years.

Source: Advisorkhoj Research

The chart below shows the growth of Rs 5,000 monthly SIP in the scheme over the last 5 years. With a cumulative investment of Rs 3 Lakhs through monthly SIP, you could have accumulated a corpus of over Rs 4 Lakhs in the last 5 years. The fund has given 13.43% XIRR returns in the last 5 years.

Source: Advisorkhoj Research

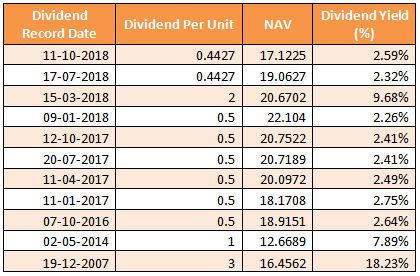

Dividend Payout Track Record

The dividend option of the scheme has been paying regular quarterly dividends since 2017. Investors should know that mutual fund dividends are paid from accumulated profits of the schemes and cannot be assured.

Source: Historical dividends of Sundaram Large and Midcap Fund

Conclusion

Sundaram Large and Midcap fund has completed more than 10 years. The scheme’s track record over the last 5 years is particularly impressive. Investors can select this fund for their long term financial goals like retirement planning, children’s education, children’s marriage and wealth creation. Both lump sum and SIP modes are suitable for investment in this scheme. If you have lump sum funds available for investment but you are worried about near term volatility, you can invest in this fund through the a 3 – 6 month STP. Investors should consult with their financial advisors if Sundaram Large and Midcap fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team