Strong performance by ICICI Prudential Top 100 Fund

In the last one year ICICI Prudential Top 100 fund gave more than 28% returns and is one of the best performing large cap funds. The nearly 20 year old fund has a great history of wealth creation giving almost 20% annualized returns since inception. Rs 10,000 investment in ICICI Prudential Top 100 Fund NFO in 1998 would have grown 30 times to nearly Rs 3 lakhs (as on April 25, 2017). CRISIL has given this fund top ranking, whileMorningstar has a 4 star rating for this fund. The chart below shows the NAV growth of ICICI Prudential Top 100 Fund since inception.

Source: Advisorkhoj Research

Fund Overview

ICICI Prudential Top 100 Fund was launched in July 1998 and has over Rs 2040 Crores of assets under management (AUM). The expense ratio of this large cap fund is 2.4%. ICICI Prudential AMC CIO, Sankaran Naren and Mittui Kalawadia are the fund managers of this scheme. ICICI Prudential is one of the largest asset management companies, with a stellar track record of strong performance across several mutual fund product categories. ICICI Prudential Top 100 Fund has outperformed the large cap funds category across different time-scales. The table below shows the trailing returns of the fund and the large cap funds category, over the last 1, 3, 5 and 10 year periods.

Source: Advisorkhoj Research

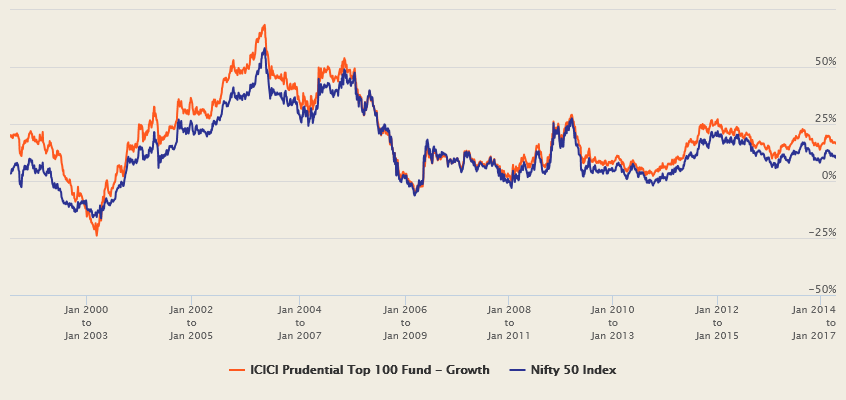

The chart below shows the 3 year rolling returns of ICICI Prudential Top 100 fund since inception versus the benchmark Nifty 50 Index. Rolling returns are the annualized returns of the scheme taken for a specified period on every day and taken till the last day of the duration. We have chosen a 3 rolling returns period because investors should have sufficient long investment tenure for equity funds.

Source: Advisorkhoj Rolling Returns Calculator

The rolling returns chart of ICICI Prudential Top 100 fund shows that performance of ICICI Prudential Top 100 Fund was exceptional till around 2007. The fund had a few average years following the 2008 financial crisis, but over the last 5 years or so, the fund has again started delivering outstanding outperformance, beating Nifty almost 100% of the times over the last 5 years. But we can also see that the from time to time the fund has given 50 to 100% annual returns.

SIP Returns

Volatility is an intrinsic attribute of equity asset class. Investors can in fact, take advantage of the volatility by investing through the monthly SIP mode. Let us see how much corpus an investor could have accumulated by investing Rs 3,000 monthly in ICICI Prudential Top 100 Fund through systematic investment plan (SIP) over the last 15 years.

Source: Advisorkhoj Research

By investing Rs 3,000 monthly in ICICI Prudential Top 100 Fund (Growth Option) through SIP over the last 15 years, an investor could have accumulated a corpus of almost Rs 23.5 lakhs with a cumulative investment of little over Rs 5.4 lakhs. This means that the investor would have made a profit of over Rs 18 lakhs on an investment of just Rs 5.4 lakhs. The XIRR of the SIP over 15 years is almost 18%.

Portfolio Construction

Large cap stocks account for 80% of the portfolio value. Though Sankaran Naren is known to prefer value style of the investment, the investment style in this scheme is a mix of value and growth styles. Large cap funds underperformed midcap funds in 2015, primarily because the 2015 / early 2016 bear market was primarily caused by Foreign Institutional Investors (FIIs) pulling money out of Indian stocks.Since FIIs invest primarily in large cap stocks, large cap stocks underperformed midcap stocks in 2015 - 2016. Midcap stocks have continued to outperform large cap stocks, even after the market recovered but these stocks are now trading at a premium to large cap stocks, which is an unusual situation and is worrying fund managers of midcap schemes.

In terms of sector allocations, the fund has a bias towards cyclical sectors like banking and finance, power, transportation, chemicals etc. While the market has rallied to its all-time high, causing some investment experts and market observers to worry about valuations, over a sufficiently long investment horizon, Indian stocks are expected to do very well given the favourable macro-economic fundamentals and the reforms initiated by the Government.

From a company concentration standpoint, the ICICI Prudential Top 100 fund is fairly well diversified. The top 5 stock holdings ICICI Bank, Power Grid, Tata Chemicals, SBI and HDFC Bank account for around 25% of the fund portfolio. The table below shows some key price statistics of top stock holdings of ICICI Prudential Top 100 fund.

Source: Moneycontrol.com

You can see that the Top Holdings of the ICICI Prudential Top 100 Fund are a mix of both value and growth stocks. It seems to be a good strategy in this market, but investors should be patient because value stocks may take some time to give good returns; over long investment tenure, however, value investing has worked wonders for investors.

Key Performance Statistics

The table below shows the key performance statistics of ICICI Prudential Top 100 Fund.

Source: Morningstar

You can see that the ICICI Prudential Top 100 Fund has outperformed the large cap funds category on all these performance parameters. This should reinforce investor’s confidence in the fund managers.

Dividend History

ICICI Prudential Top 100 Fund has a very strong dividend pay-out track record. The fund has paid dividends every year since inception, even in difficult market conditions. The dividend yield is also quite good, as you can see in the table below.

Source: Advisorkhoj Historical Dividends

Conclusion

ICICI Prudential Top 100 Fund has delivered 18 years of strong performance. Investors can investin this fund, both in lump sum or through the SIP mode, towards their long term financial goals like retirement planning etc. However, you should have a long investment horizon to get the best results. Investors who wish to earn tax free dividends can also invest in ICICI Prudential Top 100 Fund. While the fund has a great dividend pay-out track record, investors should remember that mutual funds cannot assure dividend pay-outs either with respect to the amount or the frequency of pay-outs. Investors should consult with their financial advisors if ICICI Prudential Top 100 Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team