Strong SIP performance over last 10 years from Reliance Equity Opportunites makes it a top pick

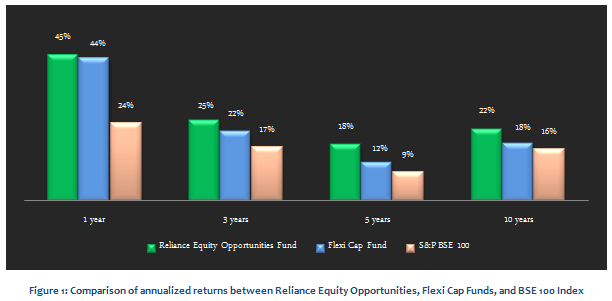

In one of previous fund reviews last year, we had discussed how flexible investment approach makes Reliance Equity Opportunities Fund a consistent performer across different market cycles. Consistent performers aim to outperform the market and generate good returns across all time scales from short to long term. Reliance Equity Opportunities Fund is one of the top consistent performers across all equity fund categories. This diversified equity fund, ranked 1 by CRISIL in terms of consistent performance has a flexible investment approach, with both mid cap and large cap companies in its portfolio. The bias of the fund is now towards mid and small cap companies. The fund has outperformed the flexi cap funds category across all time periods. The chart below shows the trailing annualized returns of the Reliance Equity Opportunities fund, flexi cap funds category and S&P BSE 100 over different investment periods.

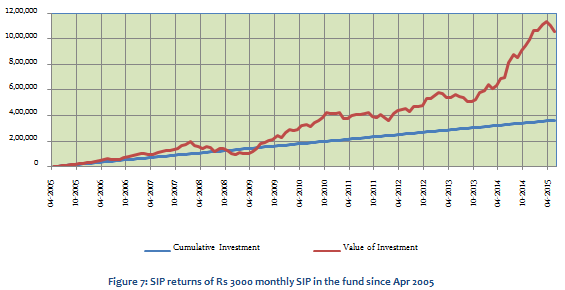

In terms of long term performance the Reliance Equity Opportunities Fund has delivered outstanding SIP returns. The fund has given over 20% SIP returns on a compounded annual basis over the last 10 years. Since prices of midcap stocks are intrinsically more volatile than large cap stocks, SIP is the ideal mode of investment in midcap oriented funds because SIPs can take advantage volatility through rupee cost averaging of the units. The strong SIP return of Reliance Equity Fund is a testimony of how SIPs, over a long investment horizon can use volatility to generate higher returns for the investor.

Reliance Equity Opportunities Fund – Fund Overview

This fund is suitable for investors looking for high capital appreciation over a long term, with limited downside potential in bear market conditions. During market downturns in 2008 and 2011, while annual returns from the Reliance Equity Opportunities Fund were negative, the fall was less than the category average. On the other hand in 2009, 2010, 2012, 2013 and 2014 when the market recovered the fund gave better annual returns compared to the flexi cap category average. As such the fund is suitable for investors planning for retirement, children’s education or other long term financial objectives. The fund was launched in March 2005 and has been very popular with investors. It has a huge AUM base of over Rs 11,000 crores. The expense ratio of the fund is 2.29%. The fund managers of this scheme are Shailesh Raj Bhan and Jahnvee Shah. Shailesh has been managing the fund since March 2005. Shailesh has been with Reliance AMC since 2003 and has established himself as an experienced portfolio manager running both diversified equity and sector funds. He focuses on inherently strong, cash rich companies with high growth potential. He also identifies high growth emerging themes, backed by robust research. The fund managers’ research oriented investment approach has led to excellent risk adjusted returns in different market conditions over the years.

Portfolio Construction

The portfolio mix is currently biased towards mid cap companies. Large cap stocks account for approximately 25% of the portfolio value while mid and small cap stocks form the balance 75% of the portfolio. The portfolio is oriented to cyclical sectors, which will benefit from the recovery in the Indian economy, but it also has substantial allocations to defensive sectors like Pharmaceuticals and IT. The portfolio is very well diversified, in terms of company concentration, with its top 5 holdings, SBI, HDFC Bank, Divi’s Lab, Bharat Forge and Cummins India accounting for only 21% of the total portfolio value. Even the top 10 company holdings account for less than 38% of the portfolio value.

Risk & Return

In terms of volatility measures, the annualized standard deviations of monthly returns for three to five year periods of the fund are in the range of 17 to 24%. This is lower than the volatility of flexi cap funds. See the charts below for comparison of risk versus return performance of the fund versus flexi cap funds category over three and five year periods.

Dividend Payout Track Record

Reliance Equity Opportunities dividend plan has an excellent dividend payout track record. The fund has paid out dividends every year since its inception except 2010.

SIP Returns

The chart below shows the returns since inception of र 3000 monthly SIP in the Reliance Equity Opportunities fund (growth option). The SIP date has been assumed to first working day of the month. The chart below shows the SIP returns of the fund. NAVs as on May 01 2015.

The chart above shows that a monthly SIP of र 3000 started on April 2005 in the fund would have grown to nearly र 11 lacs, while the investor would have invested in total only र 3.63 lacs.

Conclusion

The Reliance Equity Opportunities Fund has a strong record of delivering excellent performance across different market cycles. The fund navigated through the market downturns and volatile conditions much better than its peers. As discussed earlier, consistency of performance is an important criterion in selecting a mutual fund. The Reliance Equity Opportunities fund has been a top pick for many investment portfolios. Investors can consider investing in the fund through the systematic investment plan (SIP) route or lump sum route for their long term financial planning objectives. The fund also has a good dividend payout track record and as such is suitable for investors who prefer dividend payout option. Investors should consult with their financial advisors if this fund is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team