Should you invest in Mirae Asset Healthcare Fund

Healthcare as a theme has tremendous growth potential and includes businesses in diagnostics, hospitals, medical equipment, specialty chemicals, insurance, and other allied sub sectors. Investment into healthcare themed funds allows investors to participate in the growth potential of this sector. In this article we will take a closer look at the Mirae Asset Healthcare Fund. At the onset, let us understand the potential that the Healthcare Industry has in India.

When we speak of the Healthcare sector, it not only includes pharmaceuticals, but also includes hospitals, diagnostic centres, health insurance, biotechnology, telemedicine and medical equipment, etc.

Healthcare Industry in India

- India gained a foothold in the global arena, with reverse-engineered generic drugs and active pharmaceutical ingredients (API) and now seeks to become a major player in outsourced clinical research and the contract research and manufacturing services (CRAMS) segments. (Source: Study on Indian Pharmaceutical Company EXIM Bank India)

- India is a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports. India supplies over 50% of Africa’s requirement for generics, ~40% of generic demand in the US and ~25% of all medicine in the UK. Close to 30% of the total market volume of medicines in the US is supplied by the Indian pharmaceutical companies. (Source: Invest India website)

- The Government has been working towards providing a favourable investment environment through FDI policy reforms, PLIs and other policies including PMJAY, the world’s largest healthcare scheme (source: National Health Authority, Government of India)

- The allocation of the Government of India to the Healthcare sector has increased by nearly 13% in 2022-2023 compared to 2021-22. (Source: Mirae Asset MF)

- There are 500 API manufacturers contributing about 8% in the global API industry. India is the largest supplier of generic medicines. It manufactures about 60,000 different generic brands across 60 therapeutic categories. (Source: Invest India website)

Growth potential for the Indian Pharmaceutical Industry

- “India’s exports of pharmaceutical products rose to 2.37 times in April-February 2022-23.” (Shri Piyush Goyal, Minister of Commerce and Industry and Textiles and Consumer Affairs, Food and public Distribution, Ministry of India)

- Medicine spending in India is projected to grow by 9-12 % by 2025 (Source: Mirae Asset MF)

- India is the world’s largest exporter of generics with 20% share in the global exports.(Source: Invest India website)

- The cumulative FDI equity inflow in the pharmaceutical sector in India has been US$20.96bn during the period April 2020 to September 2022. (Source Mirae Asset MF)

- The pharmaceutical industry in India is currently valued at $50 Bn. It is expected to reach $65 Bn by 2024 and to $130 Bn by 2030. (Source: Invest India website)

- Government’s policies are likely to boost the healthcare sector in the medium to long term. The budgetary allocation to the health sector for FY 2023-24 was Rs 89,155 crore, a hike of around 13% as against Rs 79,145 crore allocated in FY 2022-23 (source: Union Budget 2023-24). Pradhan Mantri Jan Arogya Yojana (PMJAY) is a big step towards universal health coverage in India.

- The digital healthcare market in India is expected to reach US $485 billion by 2024, driven by rising income, better health awareness, lifestyle diseases and increasing access to insurance and technology. (Source Mirae Asset MF)

- The hospital industry was valued at $61.79bn in the financial year 2017 and it is expected to reach a value of $132bn by 2023. With a CAGR of 16%-17%. (Source: Invest India website)

Investment in Healthcare Sector

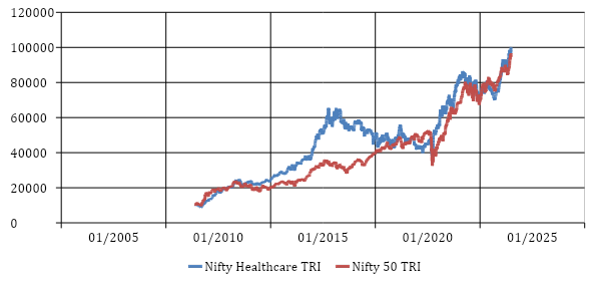

Over the last 15 years, the Nifty Healthcare TRI outperformed the benchmark Nifty 50 TRI (See chart below). As evident from the chart, the Healthcare index underperformed between 2015 to 2019 as a result of the US price erosions. However, the Nifty Healthcare index picked up and outperformed in the aftermath of the COVID-19 pandemic. In the last 15 years Nifty Healthcare TRI gave 16.6% CAGR return versus 16.3% CAGR for the Nifty.

Source: Advisorkhoj Research, as on 28th December 2023

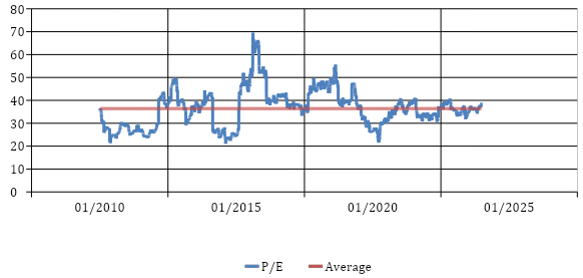

Below is the chart showing the PE ratios of the Nifty Healthcare Index from 1st January 2010 to 28th December 2023. You can see that the Healthcare Index was trading around the long term historical average PE.

Source: Advisorkhoj Research, as on 28th December 2023

The Short Term and Long-term potential of Healthcare Industry in India

Short Term Outlook

- Price erosion evident in the US markets in the last year is expected to stabilize in the near term. This would help to stabilize the gross margins in the US market.

- Margins are further expected to improve with price increase in branded business taking effect over the next few quarters.

- Over the last 12 months, increased cost escalation across various heads like raw materials, packaging, freight, cost etc. in the pharma industry was seen as a result overall commodity price increase. Normalization of these costs is expected to lead to better levels of margins over the next few quarters.

Long Term Outlook

- The Indian Healthcare sector has continued focus on cost optimization.

- The regulatory inspections and compliance have lent a much better position to Healthcare and deemed the industry de-risked in case of any challenges.

- There is a diversification of export revenue from geographies outside the US and other businesses.

- There is an increased focus on building branded generic business with comparatively better and stable cash flows via M&A or in-licensing opportunities.

Mirae Asset Healthcare Fund

The Mirae Asset Healthcare Fund is an open-ended Sectoral/ Thematic Equity Fund that invests in healthcare and allied sectors. The scheme was incepted on 2nd July 2018 and performs against the benchmark S&P BSE Healthcare Index (TRI). The fund is managed by Mr. Vrijesh Kasera, who has a professional experience of more than 16 years. The NAV of the regular plan growth option of the Marae Asset Healthcare Fund as on 27th December 2023 was 28.03. The AUM of the fund as on 30th November 2023 was Rs 1974.05 Crore.

An amount of Rs 1 Lakh invested in the fund at the time of inception (July 2018) would have grown to Rs 2.82 Lakhs generating a CAGR return of 20.81% (return as on 28th Dec 23).

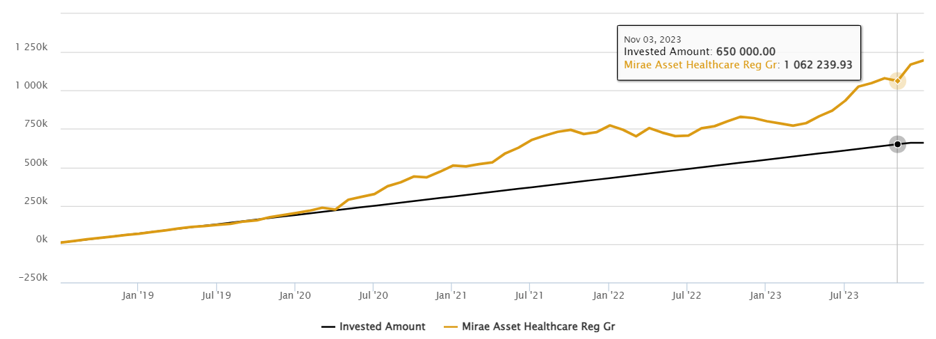

SIP Investment in Mirae Asset Healthcare Fund

A monthly SIP of Rs 10,000/- started at inception of the fund would have grown to Rs 12.06 Lakhs giving a XIRR return of 22% compared to the return of 10.07% of its benchmark S&P BSE Healthcare TRI index. The chart below shows how the Mirae Asset Healthcare Fund outperformed its benchmark in the same period.

Source: Advisorkhoj research

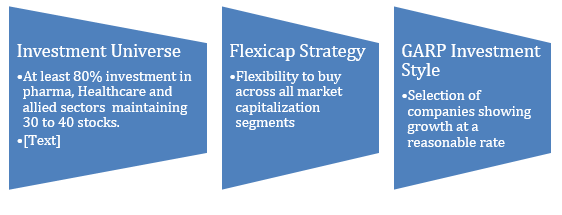

Investment Strategy of the fund

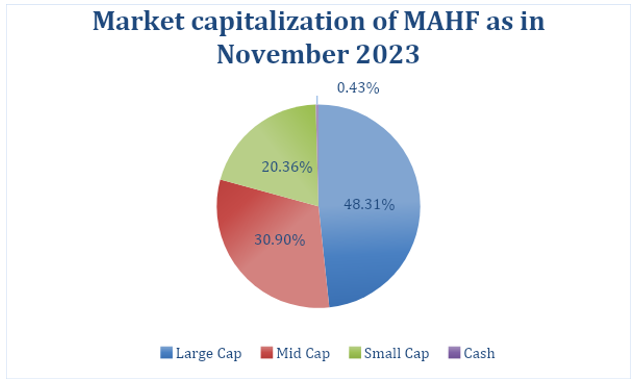

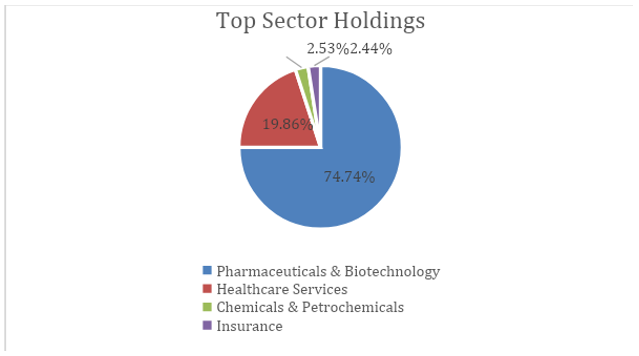

Market Capitalization and Top Sector holdings of Mirae Asset Healthcare Fund (MAHF) - as at end of November 2023

Top Sector Holdings

Who should invest in Mirae Asset Healthcare Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from healthcare theme.

- Investors with high to very high-risk appetites who understand the risk of investing in thematic and sectoral equity funds.

- Investors with minimum 5-year of investment tenures.

- Investors can invest either in lumpsum and SIP depending on their investment needs and cash flow situation.

Investors should consult with their financial advisors or mutual fund distributors if Mirae Asset Healthcare Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team