SBI Magnum Monthly Income Plan: A good hybrid mutual fund scheme for conservative investors

SBI Magnum Monthly Income Plan balances the need for capital safety with inflation beating returns. The fund achieves the balance by investing around 85% of its portfolio corpus in debt and money market, and around 15% in equity market. The fund has given 12 – 14% returns to investors over the last 1 to 3 years. These are excellent returns for a conservative monthly income plan (aggressive monthly income plans invest 25 to 30% in equities). If you see the 1 year rolling returns of SBI Magnum Monthly Income Plan over the last 10 years, you will see that, except during the global financial crisis of 2008, the fund always preserved the investor’s capital (even during stock market corrections in 2011 and 2015 – 16).

Source: Advisorkhoj Rolling Returns Calculator

The rolling returns chart of a mutual fund scheme reveals very useful characteristics of the scheme, if you observe the chart carefully. Firstly, you can see that the returns are a little volatile (like all other mutual funds, monthly income plans are subject to market risks and cannot give investors assured returns). However, you can also see that, the rolling returns are much less volatile than equity (for most periods you can see that, the returns fluctuated between 0 to 10%. The chart shows that, your capital was always preserved except during the financial crisis of 2008.

The financial crisis of 2008 was an extreme event of global liquidity crisis; events like these occur once in several decades (the financial crisis of 2008 was the worst crisis after the Great Depression of 1930s). In such crisis no asset classes (stocks, bonds or even gold) are spared.

In 2008 stock market crashed by more than 50%; gold fell around 25%. The 1 year rolling returns chart of SBI Magnum Monthly Income Plan shows that, fund value fell by less than 10% in 2008. During severe liquidity crisis events, Governments and central banks (in our case the RBI) pro-actively take fiscal or monetary measures (stimuli) to inject liquidity and restore confidence in the markets.

The rolling returns chart of SBI Magnum Monthly Income Plan shows how quickly the fund recovered all its losses. After 2008, we again had stress in capital markets several times, in 2011, 2013 and 2015 / early 2016. You can see that, even in those stressful times, as mentioned earlier, the fund was able to show resilience and preserved the investor’s capital.

Now focus your attention on the peak rolling returns. You can see that the peak rolling returns were all in double digits; in fact the maximum 1 year rolling returns (circled red) of the fund was more than 20%. This is the effect of the equity kicker; in other words, SBI Magnum Monthly Income Plan was able to capture bull market upsides to give investors higher returns than what they would get from a debt fund investment. Monthly income plans provide high degree of capital safety to investors (through high debt allocation) and on an average, over a sufficiently long investment horizon, can give investors higher income than what they can get from risk free fixed income investments (through equity allocaton).

Fund Overview

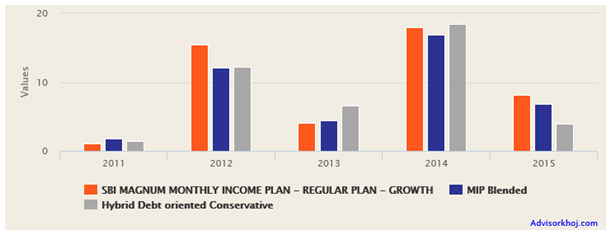

SBI Magnum Monthly Income Plan was launched in 2001 and has around र 525 crores of assets under management (AUM). The expense ratio of the fund is 2.2%. Dinesh Ahuja and Ruchit Mehta are fund managers of this scheme. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research

You can see that, the fund was able to beat the benchmark and its peers in most years. We had seen in the 1 year rolling returns chart of SBI Magnum Monthly Income Plan, that the volatility was much lower than equity investments. The effect of low volatility can be seen in the stable NAV growth of the fund over the last 5 years (please see the chart below).

Source: Advisorkhoj Research

In our opinion, investors should have a sufficiently long investment horizon, when investing in MIPs. Longer investment horizon reduces the impact of volatility and increases the possibility of capturing the equity market upside (equity kicker). The tax treatment of debt funds (MIPS are taxed as debt funds) further strengthens the case of at least a 3 year investment horizon for MIPs. Debt funds held for a period of over 3 years are taxed at 20% after allowing for indexation benefits. The indexation benefit reduces the tax obligation of the investor considerably. The chart below shows the 3 year rolling returns of SBI Magnum Monthly Income Plan, over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

In our blog, we repeatedly urge investors to use rolling returns in their investment decisions, because rolling returns are the most powerful performance measure of investments and give insights that most other performance measures fail to provide. You can see that, the three year rolling returns of SBI Magnum Monthly Income Plan (please see the chart below) over the last 5 years was always above 9%. The minimum 3 year rolling returns of the fund was higher than the best bank FD interest rates in the last 5 years. You can also see that, the fund gave double digit returns more than 70% of the times. Peak returns were north of 14%.

Risk Factors

There are three risk factors in SBI Magnum Monthly Income Plan:-

Interest Rate Risk:

SBI Magnum Monthly Income Plan is a debt oriented hybrid fund (83% portfolio corpus is invested in debt securities). The average maturity of the debt portion is 7.5 years. We had discussed a number of times in our fixed income blog posts that, longer the maturity of bonds or debt funds, higher is the interest rate risk. With debt portfolio’s average maturity of 7.5 years, SBI Magnum Monthly Income Plan is sensitive to interest rate risk.

The fund managers of the scheme aim to mitigate the impact of interest rate risk through an actively managed portfolio of floating rate and fixed rate debt instruments. Strong consistency in 3 year rolling returns over the past 5 years, which included periods of both rising interest rates and falling interest rates, is a testimony to good interest rate risk management by the fund managers. Readers should also know that, interest rates move in cycles, which imply that, interest rate risk reduces in the long term, because a long investment period (3 years or more) includes periods of rising as well as falling interest rates. Therefore, as discussed earlier, investors should have a long investment horizon (3 years or more) for MIPs, because a longer period automatically neutralizes interest rate risk to a large extent.Credit Risk:

The credit quality of the portfolio is high. 97% of the debt portfolio is rated AA and above. 83% of the debt portfolio is AAA rated. 50% of the debt portfolio corpus (45% of the total portfolio corpus) is invested in Government of India bonds.Equity market risk:

14% of the portfolio corpus is invested in stocks which are naturally exposed to equity market risk. But since, the overall portfolio allocation to stocks is limited only to 14% the equity risk is quite limited in the context of the overall portfolio risk. Within the equity portion more than 60% is invested in large cap stocks.

The volatility of SBI Magnum Monthly Income Plan, measured in terms of annualized standard deviation of monthly returns, is only 3.5%. To volatility of SBI Magnum Monthly Income Plan in context, the average volatilities of diversified equity funds are more than 17%.

Growth of र 1 lac investment over the last 5 years

The chart below shows the returns of र 1 lac lump sum investment in SBI Magnum Monthly Income Plan (Growth Option) over the last 5 years. Annualized return was 11.4%

Source: Advisorkhoj Research

Historical Dividends

SBI Magnum Monthly Income Plan (Monthly Dividend Option) has a very strong track record of monthly dividend payments. The fund has a very strong track record of making continuous monthly dividend payments in the last 5 years (please the see table below). Investors should note that, since SBI Magnum Monthly Income Plan is a debt fund, dividends are paid to investors after deducting dividend distribution tax (to know how dividends of debt funds are taxed, please read our post, Know your Mutual Fund tax implications in FY 2016-17).

Source: Advisorkhoj Historical Dividends

Conclusion

We had discussed in this post that, SBI Magnum Monthly Income Plan has a strong track record of performance. This fund can suitable for investors looking for regular income as well capital appreciation, on the bedrock of high degree of safety and liquidity. Investors should consult their financial advisors if SBI Magnum Monthly Income Plan is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team