SBI Magnum Medium Duration Debt Fund: A good investment for long term debt investors in current interest rate scenario

Global financial markets have been volatile over the past 6 months due to high inflation. Bond yields have been rising for the nearly 18 months and the 10 year Government Bond yield is at a 3 year high now (as on 6th June 2022). Bond prices have an inverse relationship with interest rate / yield changes i.e. prices go down when interest rates go up and vice versa. The sensitivity of bond prices with interest rates is directly related to the duration of the bonds; longer the duration, higher is the price sensitivity to interest rates. As such, longer duration debt mutual funds have been underperforming for the past one year.

In the past, investors with conservative to moderate risk appetites preferred gold as an asset class, when equity markets were volatile and interest rates were rising. However, gold prices have rallied considerably and gold has been underperforming for the past couple of months primarily due to rising US Treasury Bond yields. Then, what should investors with moderate risk appetite do in such a situation?

Trajectory of interest rates

Inflation has been on the higher side, led by crude oil prices, for the good part of last 12 months. Initially central banks like US Federal Reserve, RBI etc. thought that the high inflation is transitory. However, persistently high inflation has forced central banks to change their tune and adopt a more hawkish monetary policy stance. The US Federal Reserve has already hiked interest rates by 75 bps in 2022, while the RBI has hiked repo rate by 40 bps in May 2022 and by 50 bps in June 2022.

Interest rate is one of the main tools in arsenal of central banks to control inflation. If the Fed or RBI increases interest rates, the money supply in economy will go down because borrowers will not want to borrow at high interest rates. If money supply goes down, prices will also go down because demand will go down. How much will interest rates go up further?

Most economists are predicting a number of rate hikes before the rate tightening cycle ends. Goldman Sachs predicts 7 rate hikes of 25 bps each by the US Fed; we have seen two rates hikes till end of May and so a fair amount of tightening is yet to come in the US. RBI is likely to follow a similar trajectory because higher interest rates in the US will put pressure on the INR.

Trajectory of bond yields

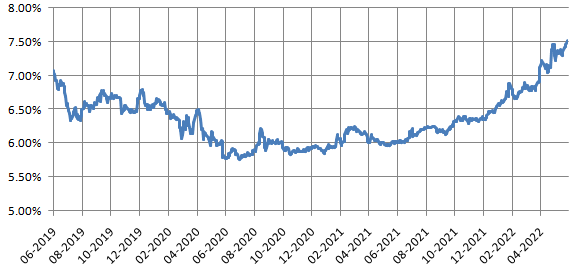

Bond yields have already priced in some of the rate hikes that are yet to come. The chart below shows the trajectory of 10 year Government Bond yield over the last 3 years. You can see that, the yields have been rising for the last 18 – 20 months and are at a 3 year high. Rising bond yields is often a leading indicator of rate hikes, so the debt market is expecting more aggressive rate hikes.

Source: Investing.com, as on 6th June 2022. Disclaimer: Past performance may or may not be sustained in the future

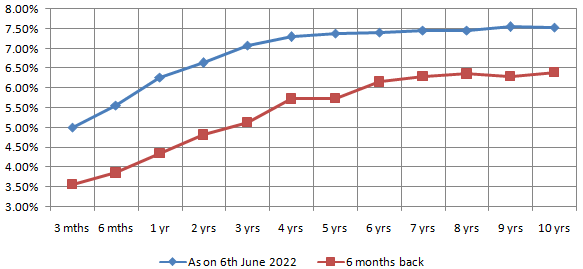

Current yield curve and traditional fixed income interest rates

The chart below shows the yield curve of Government Bonds (G-Secs) of different maturities. You can see that the yields of bonds maturing in 3 to 5 years are in 7.1 – 7.5% range. For investors with long investment horizons and moderate risk appetites, these are much higher yields compared to traditional fixed income investments. 3 to 5 year FD rates of leading public and private sector banks are in the range of 5.45 – 5.75% for general citizens (non-senior citizens).

You can take advantage of higher yields by investing in medium duration debt funds. Medium duration debt funds invest in debt instruments with durations of 3 to 4 years. However, you must have minimum 3 years investment horizons for these funds, because they can be volatile in the short term.

Source: Investing.com, as on 6th June 2022. Disclaimer: Past performance may or may not be sustained in the future

Medium versus shorter duration debt funds

As per AMFI data, very short duration debt funds (less than 12 months duration) have seen large inflows in April since conservative investors are concerned about the impact of higher interest rates. However, you can see in the chart above that, yields in the 4 to 5 year maturities are 200 bps+ higher than very short term (3 to 6 month) yields. Investors with moderate risk appetite and long investment tenures (3 years plus) can get these higher yields by investing in medium duration funds.

About SBI Medium Duration Fund

SBI Magnum Medium Duration Fund is one of the best performing medium duration funds in the last 3 to 5 years (see the top performing medium duration funds). It is also one of the most consistent performers in the medium duration debt category (see the most consistent performing medium duration funds).

The scheme was launched in 2003 and has Rs 9,968 Crores of assets under management (AUM). The expense ratio of the scheme is just 1.21%. Mr. Dinesh Ahuja has been managing this scheme since 2011. The scheme invests in debt and money market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years. The fund manager actively manages interest rate and credit risk in the portfolio.

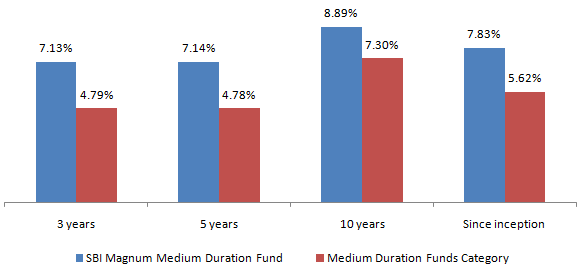

Performance of SBI Medium Duration Fund

The chart below shows the annualized returns (CAGR) of SBI Magnum Medium Duration Fund versus the medium duration fund category across different time-scales. You can see that the fund has been able to beat the category average across all long term time-scales.

Source: Advisorkhoj Research, as on 6th June 2022. Disclaimer: Past performance may or may not be sustained in the future

Credit Quality

Around 28% of the scheme assets are invested in G-Secs and SDLs enjoying sovereign / quasi sovereign ratings. The corporate bonds / NCD portion of the portfolio (65% of scheme assets) is of high quality i.e. AAAs and AAs.

YTM and Duration – Risk return trade-off

The scheme yield to maturity (YTM) is 7.25% and the scheme duration is 2.87 i.e. for every 50 bps increase in interest rates, the impact on scheme returns will be around -1.43%. The risk return trade-off is reasonable for investors with moderate or moderately high risk appetites. As mentioned before, you should have minimum 3 years investment tenure for this scheme. Over 3 years plus investment tenure, you can also get the advantage of long term capital gains taxation.

Who should invest in SBI Magnum Medium Duration Fund?

- Investors looking for income over sufficiently long investment tenures

- Investors with moderate to moderately high risk appetites – the scheme may be volatile in the short term

- Investors with minimum 3 years investment tenures

- You can invest in lump sum or SIP depending on your investment needs

Investors should consult with their financial advisors if SBI Magnum Medium Duration Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team