SBI Equity Savings Fund is a good tax efficient moderate risk hybrid fund

Equity Savings Funds are equity oriented hybrid funds whose risk profiles are more moderate (lower risk) than the traditional balanced funds and yet they enjoy the tax advantage of balanced funds. Balanced Funds allocate at least 65% of their assets in equity and the balance in fixed income. The asset allocation of balanced funds ensures equity taxation (tax free long term capital gains) for this category of mutual funds. While debt oriented hybrid funds offer investment solutions for investors not comfortable with 65%+ asset allocation to equities and the risks thereof, debt fund investors are at a considerable tax disadvantage compared to traditional balanced fund investors.

Equity Savings Funds are seen as a tax efficient investment solution for investors with moderate risk profiles. The fund manager is able to lower the risk, yet enjoy equity tax advantage, by hedging equity risk through the use of derivatives (not by allocating more to debt, unlike debt oriented hybrid funds). A portion of equity savings fund portfolio is invested in fixed securities but the overall equity asset allocation (hedged and un-hedged combined) is always kept at 65%+, thereby ensuring long term capital gains tax advantage.

The un-hedged equity component is exposed to equity market risk. The debt (fixed income) component is exposed to interest rate risk and credit risk. The hedged equity component is virtually risk free. While, the un-hedged equity and debt portions earns returns commensurate to the risk / return characteristics of those two asset classes, even the hedged equity portion earns returns by inefficiencies in the market which gives rise to arbitrage opportunities (the opportunity to generate risk free profit by exploit market inefficiencies).

Differences in spot (cash) and derivatives (F&O) markets provides arbitrage opportunities for investors to earn virtually risk-free returns, but these differences are difficult to spot and even more difficult to execute in an efficient way. Mutual fund managers have the necessary expertise in arbitrage which enables them generate excellent low risk arbitrage returns. As such, Equity Savings Funds are good tax efficient investment option for investors with moderate risk appetites and can provide solutions to a number of medium to long term investment objectives.

SBI Equity Savings Fund

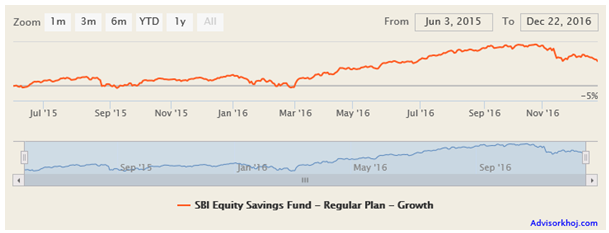

SBI Equity Savings Fund is an equity savings fund from one of the oldest and largest asset management companies in India. SBI mutual fund schemes are among the top performing funds across a large number of categories. The fund was launched in May 2015 and has र 342 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.52%. For redemption of units in excess of 9% of the investment within 365 days, the fund house will charge an exit load of 1%. Rachit Mehta and Neeraj Kumar are the fund managers of this scheme. In addition to growth option, the fund also has monthly and quarterly dividend options. The chart below shows the NAV movement of the scheme since inception.

Source: Advisorkhoj Research

Rolling Returns

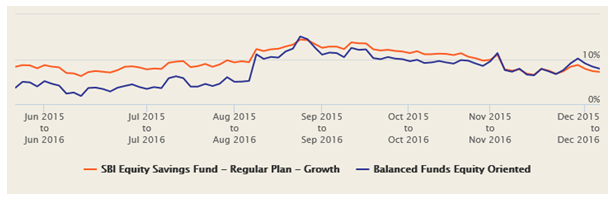

The chart below shows the 1 year rolling returns of SBI Equity Savings Fund versus the Balanced Fund category since the inception of the fund in mid 2015.

Source: Advisorkhoj Research

You can see that, SBI Equity Savings Fund was able to outperform balanced fund category in terms of one year rolling returns for most of the time over the past 18 months or so, when the market has been quite volatile. This shows that, this fund is suitable for investors with low appetite for volatility. While one cannot expect this fund to outperform SBI Magnum Balanced Fund, one of the best performing balanced funds out there, once the market regains momentum, one can certainly expect the returns of the SBI Equity Savings Fund to pick up in a market uptrend while retaining its moderate risk characteristics, due to the un-hedged and hedged equity components.

Since, SBI Equity Savings Fund is a fairly young mutual fund scheme (just over a year and half old), there is no point discussing the performance of this fund in any further detail. Let us focus on the investment strategy and outlook of this fund.

Investment Strategy and Outlook

- SBI Equity Savings Fund seeks to maintain gross equity exposure in the range of 65% to 90%. This will ensure equity taxation

- The debt (including money market) exposure of the fund will be in the range 10 – 35%. The risk profile of the debt investments will be low to medium. The objective of the debt and money market portfolio will be income accrual and providing margin for the derivatives transactions for hedging / arbitrage. Hence we can expect that, the interest rate and credit risk of the debt portion to be limited.

- The un-hedged equity exposure will be in the range of 20 – 50%. The balance equity portion will be hedged and the fund managers will aim to generate arbitrage profits in the hedged equity component of the fund portfolio.

- The un-hedged (net long) equity portion of SBI Equity Savings Fund will be invested in a diversified portfolio of stocks across industry sectors and market capitalization segments that will benefit from India’s long term economic growth.

- SBI Mutual Fund AMC has a robust credit risk framework in place and therefore, we can expect the fund house to manage credit risk in the SBI Equity Savings Fund debt portfolio in a prudent manner.

- Short to medium term volatility notwithstanding, the long term growth story of India is still intact. As such, many global investors believe, India to be the brightest spot among emerging economies in the long run. Improving macros, favourable global commodity prices and a number of structural reform measures implemented by the Government over the past 2 years will, hopefully, result in the demand recovery in a not too distant future. Therefore, it is reasonable to expect, the net long (un-hedged) equity component of SBI Equity Savings Fund to yield good returns in the long term.

- From a global perspective, however, a number of risk factors continue to cloud prospects of equity as an asset class in the short term. The trajectory of US interest rates will have an impact of capital flows to emerging markets like India. Crude price movement (beneficial for us over the past few years) will also have an impact on our fiscal deficit and inflation. The longer term implications of Brexit will continue to play out for some sectors like Technology.

From a local standpoint, demonetization (which we all hope will be good for the economy in the long term), is likely, as per economists, to have a short term impact on our IIP. From a political viewpoint, we have a number of state elections next year, which are likely (especially Uttar Pradesh elections) to have an impact on stock markets. Therefore, we can expect market volatility to continue for some more time. The hedged (arbitrage) equity and fixed income (debt) portion of SBI Equity Savings Fund will ensure limited volatility for investors, during times of market volatility.

Conclusion

SBI Equity Savings Fund has completed a little over 18 months since launch. Though 18 months is a very short time to judge the performance of a fund, the risk / return characteristics of the fund, the long term performance track record of SBI Mutual Fund schemes and most importantly, the long term economic growth potential of India make SBI Equity Savings Fund good investment opportunity for long term investors with a conservative orientation. The fund can give inflation beating returns in the long term due to the un-hedged equity exposure. The tax advantage enjoyed by this fund is an added benefit for investors. Investors should consult with their financial advisors, if SBI Equity Savings Fund is suitable for their financial planning requirements.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team