SBI Emerging Businesses Fund: Strong potential in this midcap oriented fund

SBI Emerging Businesses Fund was launched in 2004. If you had started a monthly SIP of Rs 5,000 in SBI Emerging Businesses Fund since inception, by now you would have accumulated a corpus of over Rs 17 Lakhs (as on April 2, 2018). The annualized SIP return of this midcap oriented equity mutual fund over the last 14 years or so is more than 20%. By any measure, this is outstanding performance, but if you scan the mutual funds research websites, this mutual fund scheme is not among the star performers.

See the performance of SBI Emerging Businesses Fund along with other funds from the same category from SBI Mutual Fund.

Many investors and financial advisors take mutual fund ratings as the gospel of truth and invest on the basis of star ratings. In our blog post, Did you know what to analyze and ignore when selecting equity mutual funds, we discussed that, mutual fund ratings assigned by different websites may not always be the best fund selection criteria. Implicit in any methodology of mutual fund ratings are assumptions, particularly related to which parameters to use in fund rating and more importantly, the relative importance (weights) of the different parameters in the final rating.

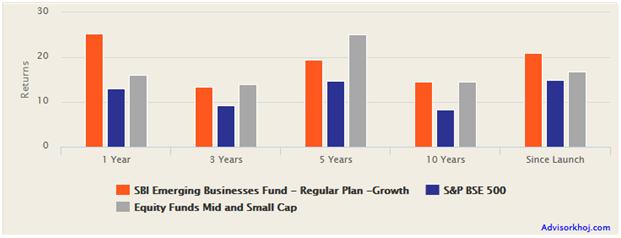

Let us expand a bit on the some of the points mentioned with regards to mutual fund ratings in the aforementioned post, particularly in relation to SBI Emerging Businesses Fund, so that investors can understand why they need to a delve slightly deeper than simply the fund ratings. The chart below shows the trailing returns of SBI Emerging Businesses Fund versus the small and midcap funds category and the benchmark index, BSE – 500.

Source: Advisorkhoj Research

We believe that, in most mutual fund research websites star ratings or fund rankings methodologies, a lot of importance or weight is given to 3 years or 5 years trailing returns relative to its peers (fund category). You can see that, SBI Emerging Businesses Fund was not able to outperform the category in terms of 3 years or 5 years trailing returns. Therefore, SBI Emerging Businesses Fund is likely to have not figured in the top 2 performance quartiles as per usual rating methodologies.

Now look at the performance of the SBI Emerging Businesses Fund in the last one year – it has outperformed both the benchmark and the category return by a huge margin. We are not suggesting that one year return is a better performance measure than three year returns. Fund performances go through their ups and downs, depending on the investment strategy of the fund manager in relation to the market conditions and investment cycles prevailing during the period in question. It is almost impossible to predict, which fund will be a top performer in the future and therefore, quartile rankings of a fund based on trailing returns may not be the best predictor of future outperformance.

In Advisorkhoj, we have received suggestions from many of our regular readers to assign star ratings to mutual funds, but we have refrained from giving star ratings thus far, for the reason explained above. Instead of assigning star ratings, we prefer to review high potential funds based on our interactions with the Asset Management Companies (AMC) and the fund manager’s track record – we think these two factors play a far more important role in the future performance potential of a scheme, as opposed to simple quantitative metrics like trailing returns.

R.Srinivasan the fund manager of SBI Emerging Businesses Fund is a veteran of SBI Mutual Fund AMC. Some of the other funds managed by Mr. Srinivasan, e.g. SBI Small and Midcap Fund are among the top performers in their category across several time-scales. This shows strong performance pedigree and bodes well for the future performance of SBI Emerging Businesses Fund, when the fund manager’s investment hypothesis will play out.

Investment Strategy

Though SBI Emerging Businesses Fund is categorizes as a midcap fund by most mutual fund research websites (including Advisorkhoj) because of the market cap bias of its portfolio composition, the fund manager maintains that, SBI Emerging Businesses Fund is a market capitalization agnostic fund; it may invest into large, mid and/or small cap stocks in any proportion based on the market conditions making the most of different market phases. The investment objective of SBI Emerging Businesses Fund is to participate in the growth potential presented by various companies that are considered emergent and have export orientation/outsourcing opportunities or are globally competitive.

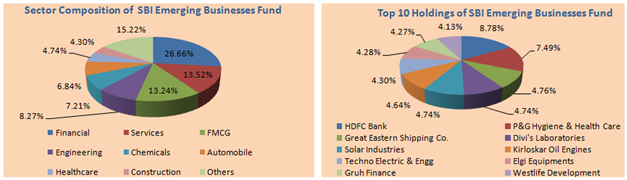

The fund may also evaluate Emerging Businesses with growth potential and domestic focus. The fund aims to maintain a high conviction concentrated portfolio with no sector bias. It is an actively managed, diversified equity portfolio, currently skewed towards mid and small caps given the price-value arbitrage due to lower coverage. The fund has the flexibility to invest across market caps. However, for liquidity purposes, it also maintains a meaningful proportion in large caps. Stock selection follows bottom up approach which uses a combination of factors including business model, profitability, growth, management and valuations. The chart below shows the portfolio composition of SBI Emerging Businesses Fund.

Source: Advisorkhoj Research

Risk and consistency related Quantitative Metrics

In Advisorkhoj, we do not simply go by the AMC / fund manager’s track record or what the AMC / fund manager is telling us. We also look at some of the risk and risk adjusted return metrics of the scheme, to get a sense of how the fund manager’s investment strategy is likely to play out in the future for the benefit of investors.

SBI Emerging Businesses Fund is in the top quartile in terms of volatility of monthly returns over the last three years. Please refer to our Volatility Ranking tool – note that the funds with the lowest volatility are ranked in the top quartile and those with higher volatilities are ranked in subsequent quartiles.

In Advisorkhoj, we give a lot of importance to downside volatility ranking, because most retail investors are concerned about downside risks (months in which the market was down). Accordingly, we have developed a tool, which measures volatility in down markets and ranks funds accordingly – please see our Downside Volatility Ranking tool. As per this tool, SBI Emerging Businesses Fund is ranked in the top two quartiles, at the cusp of the top quartile and the next quartile, upper middle quartile.

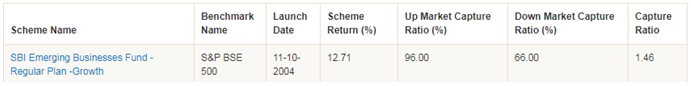

We also look at another tool, Market Capture Ratio. This tool measures, how the scheme performed relative to its benchmark in up markets (months in which the market was up) and down markets (months in which the market was down). Please see our Market Capture Ratio tool. The table below shows the market capture ratios of SBI Emerging Businesses Fund over the last 3 years.

Source: Advisorkhoj Research

You can see that, while SBI Emerging Businesses Fund was just about able to match the benchmark in up markets (not beat it) it was able to outperform the benchmark by a wide margin in down markets. The outperformance in down market more than compensated the lack of outperformance in up market. The Market Capture ratio (the ratio of up market capture ratio to down market ratio) of more than 1 is a measure of good risk adjusted performance.

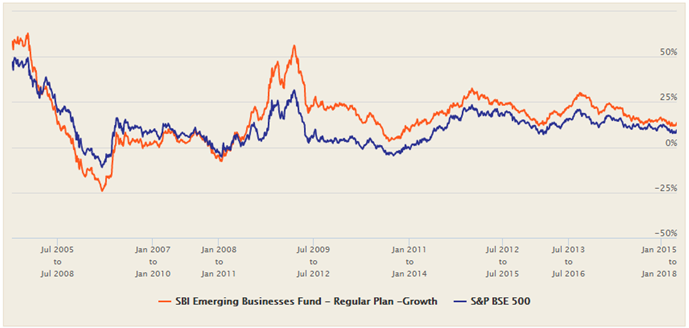

Regular readers of Advisorkhoj blog know that, rolling returns of a fund versus the benchmark are an excellent measure of the fund manager’s ability of delivering consistent performance and generating alpha for investors. The chart below shows the 3 years rolling returns of SBI Emerging Businesses Fund since inception. You can see that, the fund was able to consistently beat the benchmark over the last 10 years of so in terms of 3 years rolling returns.

Source: Advisorkhoj Rolling Returns

Conclusion

Based on the factors discussed above, we think that, SBI Emerging Businesses Fund has strong future performance potential. The performance over the last one year shows that, the fund is on an upward relative performance trajectory. The subscriptions of a few small and midcap mutual fund schemes are suspended temporarily. However, SBI Emerging Businesses Fund is open for subscriptions – you can invest both through lump sum and SIP. Investors should consult with their financial advisors, if SBI Emerging Businesses Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team