SBI Dynamic Bond Fund: Good long term fixed income investment

Current interest rate and debt market scenario

The debt market has been affected by high inflation over past 12 months or so, with bond yields pushing higher. To cool inflation, Reserve Bank of India (RBI) has raised repo rate by 90 bps already this year. As per RBI data (as on 1st July 2022), the 10 year Government bond yield has risen more than 100 bps on a year on year basis. Recent CPI inflation data (June 2022 data) indicates that retail inflation (7.01% in June) is still much above RBI’s tolerance band of 2 – 6%. More rate hikes by RBI are expected in the coming months and quarters. However, future rate hikes by the RBI have been to a large extent discounted in bond prices and yields. The current 10 year bond yield is at 7.42%, which is still below the historical high. However, commodity price inflation is showing signs of cooling especially in commodities like food, oil and gas, metals etc.So we expect bond yields to stabilize in the coming months or quarters.

Impact of interest rate changes in bond market

Bond prices have inverse relationship with interest rates. Bond prices fall when interest rates go up and vice versa. In an uncertain interest rate environment, debt funds which have the flexibility to manage durations according to the interest rate outlook of the fund manager can be suitable investment options for investors with sufficiently long investment horizons.

Dynamic Bond Funds

Dynamic Bond Funds are debt mutual funds which invest in debt and money market instruments like Government Securities, corporate bonds etc. of different durations. These funds do not have any restriction with regards to duration or maturity of the securities they invest in. The fund managers invest across durations depending on their interest rate outlook. Dynamic bond funds are usually more volatile than short duration and medium duration debt funds, but they have the potential to give superior returns across different interest rate scenarios over sufficiently investment tenures.

SBI Dynamic Bond Fund

SBI Dynamic Bond Fund was launched in February 2004 and has Rs 2,313 Crores of assets under management (AUM). The expense ratio of the scheme is 1.66%.

The scheme aims to provide investors attractive returns through investment in an actively managed portfolio of high quality debt securities of varying maturities. The scheme invests across debt securities including Central and State Government securities, debt derivatives and money market instruments of various maturities on the basis of the expected interest rate scenario. Since the interest rates can be volatile at times, the fund will always endeavor to invest in highly liquid debt and money market instruments. The scheme follows an active duration management strategy.

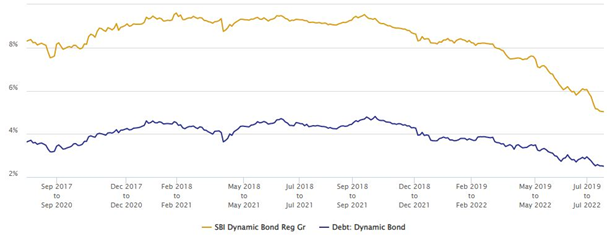

SBI Dynamic Bond Fund Rolling Returns

The chart below shows the 3 year rolling returns of SBI Dynamic Bond Fund versus the dynamic bond fund category over the last 5 years. We are showing 3 year rolling returns because in our view, you should have sufficiently long investment horizons for dynamic bond funds spanning multiple interest rate cycles. Over the last 5 years, we had multiple periods of rising (2018, 2022 etc.) and falling (2019, 2020 etc.) interest rates. You can see that the scheme consistently outperformed the category in terms of 3 year returns.

Source: Advisorkhoj Rolling Returns Research (as on 25.07.2022)

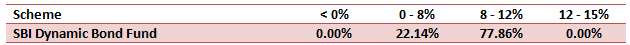

The table below shows the performance consistency of 3 year rolling returns of SBI Dynamic Bond Fund. You can see that the scheme gave more than 8% CAGR returns over 3 years investment tenures nearly 78% of the times in the last 5 years.

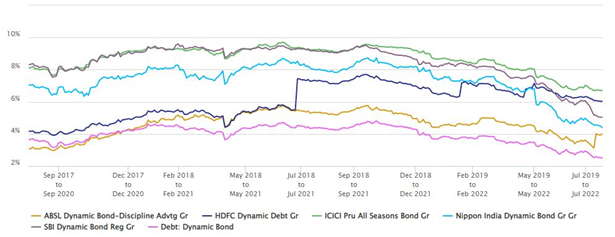

Comparison with peer funds

The chart below shows the 3 year rolling returns of SBI Dynamic Bond Fund versus some of its peer funds in the same category over the last 5 years. You can see that SBI Dynamic Bond Fund consistently outperformed most of its peers over the last 5 years.

Source: Advisorkhoj Rolling Returns Research (as on 25.07.2022)

Active Duration Management

In our view, the fund manager of a dynamic bond fund should be quick at taking the right duration calls in all interest rate environments. The fund manager should try to maximize returns in favourable interest rate regime and at the same, should be proactive in shedding risks (lowering duration) when interest rate outlook changes.

You can see that the fund manager SBI Dynamic Bond Fund was able to do it, as evidenced by strong returns in favourable interest rate environments and lower downside risks when interest rates were rising.

The rolling returns performance of the scheme in different market conditions gives us the confidence, that the scheme has the potential of continuing its outperformance when bond yields stabilize and interest rate cycle reverses.

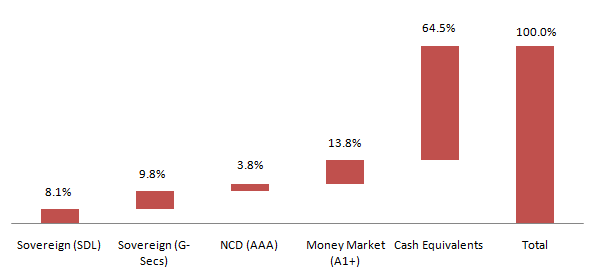

Strong credit quality

Credit risk is always an important concern for fixed income investors. You can see in the chart below that the SBI Dynamic Bond Fund only invests in the highest rated debt and money market instruments.

Source: SBI MF Fund Factsheet (as on 30th June 2022).

Summary

The fund manager has been actively managing the duration of the scheme based on his interest rate outlook. The Macaulay Duration of the scheme is 1.3 years (as on 30th June 2022) which indicates moderate interest rate risk. However, investors should be prepared for volatility. Investors must have long investment tenure of at least 3 years in this scheme. Over 3 years or longer investment tenure, investors get the tax advantage of long term capital gains. Long term capital gains in debt mutual funds are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce tax obligations for investors considerably.

Investors should consult with their financial advisors, if SBI Dynamic Bond Fund is suitable for their fixed income investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team