Reliance Tax Saver Fund: Form is temporary but class is permanent

Reliance Tax Saver Fund, which was one of the best performance ELSS a couple of years back, has slipped a bit in rankings based on short term performance, but in our view it still remains a good ELSS mutual fund for investors with long investment horizon.

We, in Advisorkhoj, ask investors not to select mutual fund schemes based on short term performance because short term performance is biased by a number of factors which may not be relevant in the long term. It is true that Reliance Tax Saver Fund has underperformed in the last 1 year, but it’s 10 year performance track record is still very strong; it is one of the best performing Equity Linked Savings Schemes in the last 10 years (please see our Top Performing Mutual Funds (Trailing returns) - Equity: ELSS).

If you had invested Rs 1 Lakh in Reliance Tax Saver Fund 10 years back, your investment would have grown in value to nearly Rs 5.4 Lakhs by now (CAGR of 18.3%). The Systematic Investment Plan (SIP) return of Reliance Tax Saver Fund over the last 10 year is also quite impressive. If you had started a monthly SIP of Rs 5,000 in Reliance Tax Saver Fund 10 years back, by now you would have accumulated a corpus of nearly Rs10.7 Lakhs with a cumulative investment of just Rs 6 lakhs.

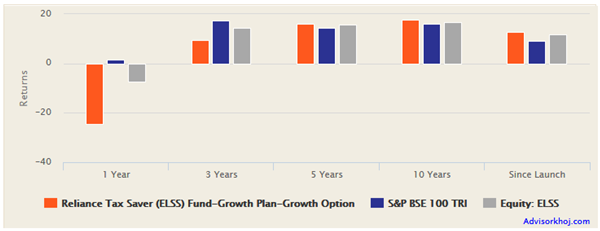

Fund Performance versus Category

The fund has generated nearly 13% CAGR returns since its inception in September 2005. See the chart below, for the comparison of trailing annualized returns over three, five, and ten year periods of Reliance Tax Saver fund (Growth Option) versus benchmark BSE 100 TRI and the ELSS funds category. As you can see, the fund has outperformed the category and benchmark over longer time-scales, despite the underperformance in the last 1 year.

Source: Advisorkhoj Research

It is important to analyze trailing or point to point returns before we make investment decisions based on them. As discussed before in our blog post, ELSS mutual funds are nothing but diversified equity schemes with a lock-in period; they invest across market cap segments with a flexible mandate and in that respect are similar to multi-cap funds.

Reliance Tax Saver Fund historically had a bias towards the midcap and small cap stocks, which resulted in very high returns for the scheme in bull markets. However, the last 1 year had been very punishing for midcap and small cap segments; in the last 1 year, the Nifty Midcap 100 index has fallen over 17%, while the Nifty Small Cap 100 index has fallen over 30%. As a consequence, Reliance Tax Saver Fund also underperformed relative to its peers who had less exposure to small and midcap stocks.

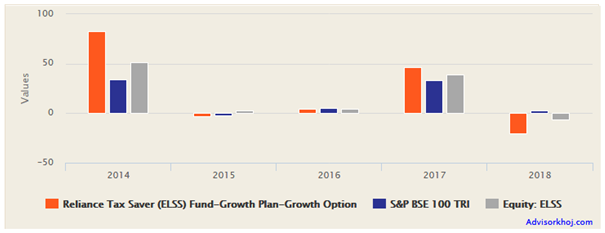

Since short term performance may be biased by prevailing market conditions, investors need to look at different types of analytics before making an informed investment decision. The annual returns of Reliance Tax Saver Fund over the last 5 years provide more insights into the scheme performance in different market conditions. You can see that the scheme outperformed in the bull market years of 2014 and 2017. It matched category performance in 2015 - 2016, which was bear market period, less volatile for midcaps. It underperformed in 2018, which was a range-bound (albeit volatile) market for large caps, but clearly bear market for small and midcaps.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 3 years rolling returns of Reliance Tax Saver Fund versus its benchmark BSE 100 TRI over the last 5 years. Investors should note that, BSE 100 TRI is a large cap index since the 100 largest stocks by market cap are categorized as large cap stocks according to SEBI’s definitions. The large cap nature of the benchmark and the midcap orientation of the scheme will naturally be reflected in rolling returns. We are analyzing 3 year rolling returns of the scheme versus benchmark because ELSS funds have a 3 year lock-in period; investors need to remain invested for at least 3 years in ELSS mutual funds.

You can see that Reliance Tax Saver Fund outperformed the benchmark till March / April 2018 and has been underperforming thereafter. The reason for the outperformance of rolling returns was outperformance of midcap and small cap relative to large cap prior to the inflexion point, from where small / midcaps started underperforming; the subsequent underperformance is due to the market cap orientation of the scheme.

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 Lakh lump sum investment in Reliance Tax Saver Fund over the last 5 years. You can see that your investment would have doubled in 5 years despite the sharp correction in the last 1 year.

Source: Advisorkhoj Research

The chart below shows the return of Rs 5,000 monthly SIP in Reliance Tax Saver Fund over the last 5 years. The SIP returns are not as impressive as lump sum returns because small and midcap prices were extraordinarily high in 2017 and the correction thereof muted SIP returns for the scheme. Nevertheless, investors would have made a profit of around Rs 65,000 by investing Rs 3 Lakhs (on a cumulative basis) in Reliance Tax Saver Fund through monthly SIP over the last 5 years.

Source: Advisorkhoj Research

About Reliance Tax Saver Fund

What distinguishes Reliance Tax Saver Fund from most of its peers is the midcap orientation of its fund portfolio, as opposed to the large cap of most ELSS mutual funds. As such this fund is an aggressive Equity Linked Savings Scheme. Our readers know midcap stocks could be more volatile than large cap stocks, but they also have the potential to provide higher returns than large cap stocks. The fund has an AUM base of over Rs 9,800 Crores with an expense ratio of just 2.25%. The fund manager, Ashwani Kumar, is managing the fund since its inception. Kumar is an industry veteran and has a great track record of generating high alphas as a fund manager. As a fund manager, Kumar likes to employ a bottoms stock picking approach to his portfolio and identifies companies at attractive valuations with high growth potential. About 45% of the portfolio holding of Reliance Tax Saver Fund is in midcap stocks.

Outlook

In our experience, the biggest mistake investors make is assuming that current market conditions will last forever. This makes investors over enthusiastic in bull markets and pessimistic when markets correct. While it is easier said than done, investors should realize that prevailing market conditions (rally or corrections) will not last forever. The last 1 year has been difficult for markets, particularly for midcap and small cap stocks and funds. But the sharp correction in mid and small cap segments provides attractive investment opportunities to buy great stocks at low prices.

Midcap and Small cap stocks were trading a very high valuation (P/E) premiums compared to large caps. With the sharp correction in small and midcaps, the valuation premiums are all but gone. Many investment experts, including fund managers we interview, are of the view that midcaps are trading at discounts to large caps in terms of forward P/Es. As such, they think that there are very attractive investment opportunities in this segment, from a long term perspective. Reliance Mutual Fund has the reputation of being one of the best fund houses in managing the small and midcap product categories. Reliance MF schemes in small and midcap categories have been, over the years, the top performers in their respective product classes. That is why we think that the short term dip in performance is temporary and Reliance Tax Saver Fund will bounce back over a medium to long term investment horizon.

Conclusion

Reliance Tax Saver Fund completed more than 13 years of wealth creation and has a proven long term track record. Both the AMC and Fund Manager have strong track records and this ultimately matters in the long term. Investors looking to save taxes under Section 80C of The Income Tax Act 1961 can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route with a long time investment horizon. While investing in equity mutual funds or in ELSS mutual funds, investors must ensure that the investment objectives of the fund are aligned with their individual risk profiles, time horizon and financial planning objectives. You should consult with your mutual fund advisor if Reliance Tax Saver fund is suitable for your tax planning and investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team