Principal Nifty 100 Equal Weight Fund: A good index fund for long term investments

The severe economic shock caused by COVID-19 triggered lockdown has stocks around the world in a meltdown. Though Nifty-50 has recovered 20% from the March 2020 lows, it is still down almost 25% on a year to date basis. With infections and fatalities rising in India and the roadmap to normalcy uncertain, stock specific risks can be substantial in certain industry sector and stocks. Many financial advisors are recommending index funds as one of the best investment options to increase your asset allocation in equities and benefit from the eventual recovery in stocks.

Principal Nifty 100 Equal Weight Fund

Principal Nifty 100 Equal Weight Fund invests in the 100 largest stocks (by market capitalization) in the same proportion. The objective of the scheme is to replicate the performance of Nifty 100 Equal Weight Total Returns Index. This fund does not need active management and its costs are much lower than actively managed diversified equity schemes. The expense ratio of the scheme is 0.96% only. Over a long investment horizon lower expenses can lead to substantially higher returns due to compounding effect. The scheme aims to provide long term capital appreciation in line with market index returns.

What is Nifty 100 Equal Weight Index?

The index comprises of Top 100 stocks by market capitalization, investing equal amounts (1% of the portfolio value) in each stock. According to SEBI’s market capitalization definition, the Top 100 stocks by market capitalization are classified as large cap stocks. The portfolio is re-balanced quarterly to readjust the proportion of each stock in the portfolio back to 1% of the portfolio value

Benefits of Nifty 100 Equal Weight Index

- Nifty 100 Equal Weight Index comprises of large cap stocks only. Large cap companies have bigger (stronger) balance sheets and greater market share compared to smaller companies. As such, large cap stocks are less adversely affected by economic downturns compared to smaller companies.

- With 100 stocks, Nifty 100 Equal Weight Index is more diversified than indices which comprise of a smaller number of stocks e.g. Sensex (30 stocks), Nifty (50 stocks).

- Indices like Sensex and Nifty are market cap weighted indices. Stocks which have higher market capitalizations are given more weight in market cap weighted indices. Nifty 100 Equal Weight Index, on the other hand, gives equal weight to each stock in the index. Market cap weighted indices and Equal Weight indices have their pros and cons. One of the biggest advantages of equal weight index is lower concentration risk compared to market cap weighted index like Nifty. Concentration risk is an important factor in economic factor where unsystematic risks are high.

- Defensive sectors like Pharmaceuticals and FMCG which usually outperform in economic downturns have higher allocations in Nifty 100 Equal Weight Index compared to Nifty. Allocation to Pharma and FMCG in Nifty 100 Equal Weight Index is around 24% compared to only 16% in Nifty. Allocation to Pharma, which is expected to outperform in the current situation is 9% in Nifty 100 Equal Weight Index versus just 2% in Nifty.

- While Sensex and Nifty comprise of the largest of the large cap companies (often called blue-chip companies), Nifty 100 Equal Weight Index comprises of relatively smaller companies within the large cap segment in addition to the blue-chips. The size of the smaller companies within the large cap segment is much smaller than the largest companies which comprise Nifty or Sensex. These stocks in the long term have the potential to generate higher earnings per share (EPS) growth and higher returns than Nifty or Sensex stocks.

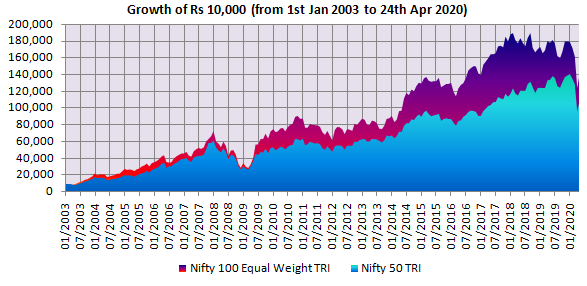

Nifty 100 Equal Weight Index versus Nifty in the long term

The chart below shows the growth of Rs 10,000 invested in Nifty 100 Equal Weight TRI versus Nifty 50 TRI since the inception of Nifty 100 Equal Weight Index (January 2003) till 24th April 2020. You can see that Nifty 100 Equal Weight TRI outperformed Nifty 50 TRI over the last 17 years. The value of your Rs 10,000 investment in Nifty 100 Equal Weight TRI over the last 17 years would have grown to Rs 1.37 lakhs versus Rs 1.06 lakhs in Nifty.

Source: National Stock Exchange, Advisorkhoj Research

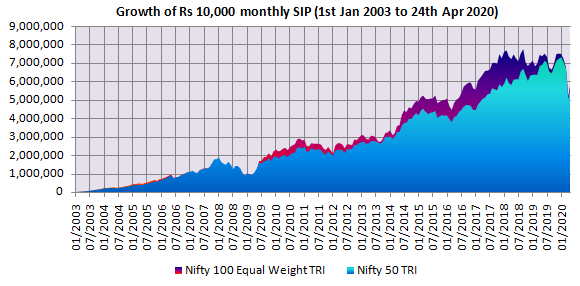

Nifty 100 Equal Weight Index – SIP

Principal Nifty 100 Equal Weight Fund combines the advantages of mutual fund investments like investment through SIP, STP etc, with the advantages of low cost index investing (e.g. ETFs). The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 100 Equal Weight TRI versus Nifty 50 TRI since 1st January 2003 to 24th April 2020. With a cumulative investment of Rs 20.8 lakhs, the market value of your SIP in Nifty 100 Equal Weight TRI would have been Rs 58 lakhs (as on 24th April 2020), while the value of your SIP in Nifty 50 TRI would have been Rs 55.5 lakhs.

The annualized SIP return (XIRR) of Nifty 100 Equal Weight TRI over the last 17 years was 10.84%.

Source: National Stock Exchange, Advisorkhoj Research

SIP of Rs 10,000 in Nifty 100 Equal Weight TRI – 1st Jan 2003 to 24th April 2020

SIP of Rs 10,000 in Nifty 50 TRI – 1st Jan 2003 to 24th April 2020

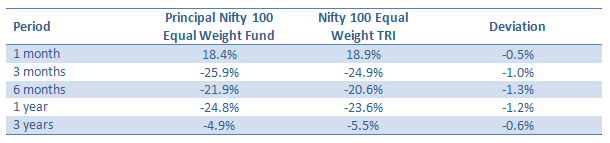

Principal Nifty 100 Equal Weight Fund versus Benchmark

Index funds do not aim to beat the benchmark index. They aim to give returns in line (as closely as possible) with the benchmark returns. Accordingly, one of the most important performance measures of index funds is tracking error i.e. how closely it tracks the index. The chart below shows the returns of the Principal Nifty 100 Equal Weight Fund versus its benchmark over various time periods. You can see that the tracking errors are quite low.

Source: Advisorkhoj Research

Why invest in Principal Nifty 100 Equal Weight Fund?

- Price of large cap stocks have fallen nearly 30% from their all time highs and are now trading at attractive valuations. Historical data shows that current valuations provide platform from which you can get good returns over long investment tenures.

- Due to the nature of downturn (caused by a pandemic) there is a high degree of uncertainty with regards to outlook of individual stocks. In such a situation, index funds are one of the best investment options to benefit from eventual recovery of equity.

- Nifty 100 Equal Weight Index has several advantages over more popular indices like Nifty and Sensex.

- Over long investment horizons, Nifty 100 Equal Weight Total Returns Index has created wealth for investors.

- Principal Nifty 100 Equal Weight Fund has low costs and low tracking error, both good attributes of an index fund.

- You can invest in this fund in lump sum or through SIP and STP depending on your financial situation and needs. You can also use investments in this fund to generate cash-flow stream for yourself through SWP or RWP.

Who should invest in this scheme?

- Investors with moderately high to high risk appetites

- Investors who are looking for market returns and want to avoid stock specific (unsystematic) risks

- Investors who have investment horizon of minimum 5 years

Investors should consult with their financial advisors if Principal Nifty 100 Equal Weight Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team