Principal Multicap Growth Fund: Good Long Term Performance

Principal Multicap Growth fund invests in large, mid and small sized companies which are fundamentally strong with characteristics like superior management quality, distinct and sustainable competitive advantage, good prospects to grow revenues and profits in the future and financial strength. One of the main advantages of investing in multi-cap fund is that, these schemes have a flexible approach towards investing in companies of different sizes across various industry sectors depending on the fund manager’s outlook on growth potential of the stock and the sector. Accordingly, they can perform well across in the different market conditions in the long term.

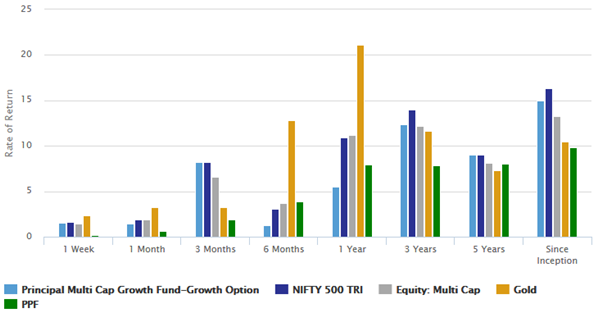

The chart below shows the trailing annualized returns of Principal Multicap Growth Fund over different time-scales (periods ending 3rd January 2020) versus its benchmark index (Nifty 500 TRI), multicap funds category and different asset classes. You can see that the scheme was able to beat multicap fund category across longer (3 years and longer) time periods. You can also see that the scheme outperformed gold and fixed income over longer investment tenures. Please note that we use PPF as an example for fixed income asset class because PPF interest rate is the highest among all traditional fixed income schemes.

Readers may note that the scheme underperformed versus the benchmark and category average over the last one year, but as discussed several times in our blog, one should not evaluate equity funds, especially multicap funds based on short term performance.

The objective of multicap funds is to provide good risk adjusted returns to investors in the long term and investment strategy is focused towards that objective. Readers should observe that despite underperforming in the last one year, Principal Multicap Fund bounced back in the last 3 months.

Some readers may also be concerned about the underperformance of the scheme versus the benchmark index (Nifty 500 TRI) over the past 3 years. However, you should take into account the market conditions prevailing over the evaluation period when comparing scheme performance. Multicap funds invest across market cap segments. Two out of the last 3 years were bad for midcap and small cap stocks – large cap stocks outperformed midcap and small caps by wide margin over the last 2 years. Nifty 500 TRI is based on full market cap and large cap stocks account for more than 80% of the index value; in fact, Nifty 50 stocks comprise more than 70% of the Nifty 500 index value. Multicap funds diversify across different market cap segments and in such market conditions it is understandable that the scheme underperformed versus the benchmark. In our view, with midcaps showing clear signs of bottoming out, Principal Multicap Fund has the potential to deliver alphas in the long term.

Scheme Overview

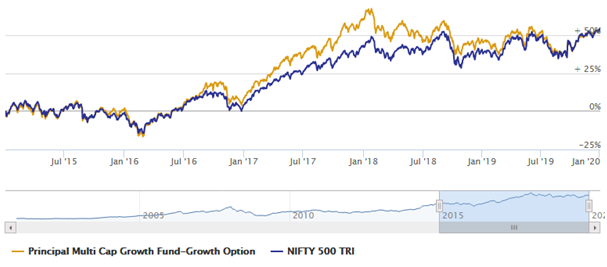

The scheme was launched in October 2010 and has Rs 742 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.45%. Ravi Gopala Krishnan and Siddarth Mohta are the fund managers of this scheme. The scheme has given nearly 15% CAGR returns since inception. The chart below shows the NAV growth of the scheme over the last 5 years (ending 3rd January 2020)

Rolling Returns

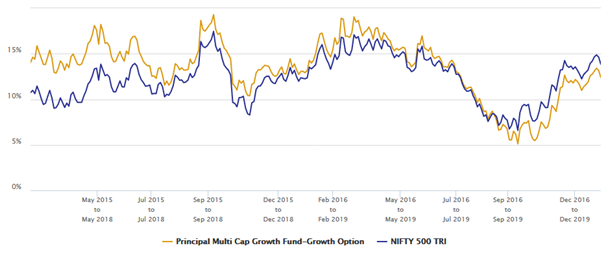

The chart below shows the 3 years rolling returns of Principal Multicap Growth Fund versus its benchmark Nifty 500 TRI over the last 5 years. We are looking at 3 year rolling returns because investors should have a minimum 3 year investment horizon for equity funds. You can see that the fund has consistently been outperforming Nifty 500 TRI till about 2.5 years back. We have explained the reason for the underperformance in the last 2 years and believe that scheme has the potential to bounce back based on the longer term rolling returns track record.

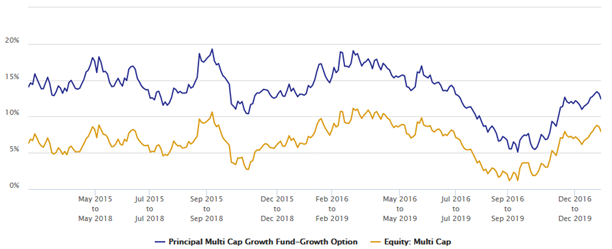

The chart below shows the 3 year rolling returns of the scheme versus the multicap funds category over the last 5 years. You can see that the fund has consistently been outperforming the category during the entire period.

Portfolio construction

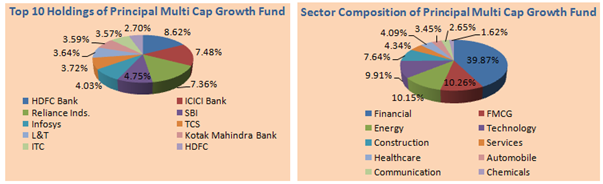

The fund manager likes to buy good stocks which can deliver high growth in revenues and profits in the future and hold them for long periods. There are no restrictions regarding allocating investments to companies of a certain size. Currently, the portfolio is biased towards large sized companies with nearly 65% of assets invested in such companies with the remaining portfolio largely in midcap stocks. The charts below show the top stock holdings and sector allocations of the scheme.

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the Principal Multicap Growth Fund’s growth option over the last 5 years (Investment date 1st Jan, 15). Your investment in the scheme would have grown more than1.5 times in value (as on 1st Jan, 20) over the last 5 years.

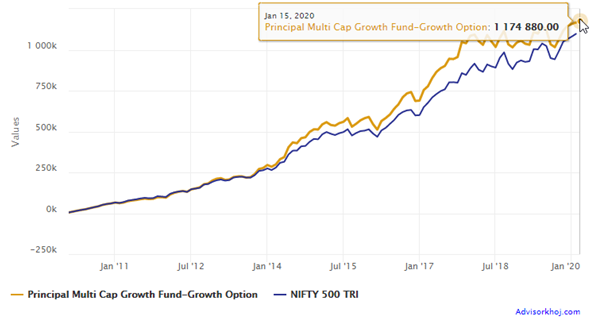

The chart below shows the returns of Rs 5,000 monthly SIP in the Principal Multicap Growth Fund’s growth option over the last 10 years. With a cumulative investment of Rs 6 Lakhs, you could have accumulated a corpus of nearly Rs 11.75 Lakhs in the last 10 years – cumulative profit of nearly Rs 5.75 Lakhs. The SIP return of the fund has been 13% during the period (SIP Start date 1st Feb 2010. SIP value / return based on NAV of 14/01/2020)

Summary

Principal Multicap Fund will celebrate its 20th anniversary later this year. The scheme has a strong track record of wealth creation. If you invested Rs 1 lakh in the scheme at its inception (NFO), your wealth would have grown to nearly Rs 15 lakhs by now. Midcaps stocks have been badly beaten over the last 2 years and many are now available at attractive values. There are signs of midcap stocks bottoming out and consolidating over the last 3 – 4 months. In the past, midcaps bounced back strongly from 20%+ corrections over the following 3 to 5 years. The flexible mandate of Principal Multicap Fund will enable it to take advantage of recovery in midcaps in the long term, while providing stability in the short term due to its current large cap stance. This scheme is suitable for your long term financial goals like retirement planning, children’s education, children’s marriage, wealth creation in general etc. In our view, you should have minimum 5 year investment tenure for this scheme. Investors should consult with their financial advisors if Principal Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team