Principal Hybrid Equity Fund: One of the best performing aggressive hybrid funds in last 5 years

Asset allocation is important in achieving your financial goals, whether in bull market or bear market. Many investors ignore asset allocation when the market is favourable but this can be harmful to their financial interests in the long run because they may take more risks than warranted by their risk profiles and financial goals.

The stock market is at record high and you should review and rebalance your asset allocation. Hybrid mutual funds are effective and tax efficient asset allocation solutions. These funds invest in both debt and equity securities. Aggressive Hybrid Funds are equity oriented hybrid funds, where minimum equity allocation is 65%. Aggressive Hybrid Funds enjoy equity taxation. Long term capital gains (investment tenure of more than 1 year) up to Rs 1.00 Lakh are tax exempt; long term capital gains in excess of Rs 1.00 Lakh are taxed at 10%. Dividends paid by aggressive hybrid funds are taxed as per the income tax rate of the investor.

Principal Hybrid Equity Fund is one the best performing aggressive hybrid fund in the past five years (please see the Top Performing Aggressive Hybrid Funds in our MF Research Section). Principal Hybrid Equity Fund, formerly known as Principal Balanced Fund, was launched in January 2000 and has around Rs 1,049 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.23% (as on 31st Jan,21).

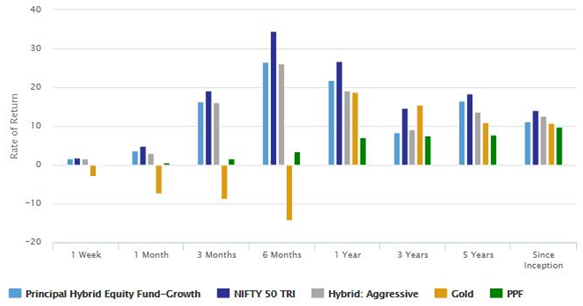

The chart below shows the annualized returns of Principal Hybrid Fund versus the Aggressive Hybrid Funds category over trailing 1, 3, 5 and 10 years.

You can see that the scheme outperformed Aggressive Hybrid Funds category over most periods. You can also see that the scheme outperformed other asset classes like Gold and Fixed Income over different investment time-lines.

Source: Advisorkhoj Research (Periods ending 12.02.2021)

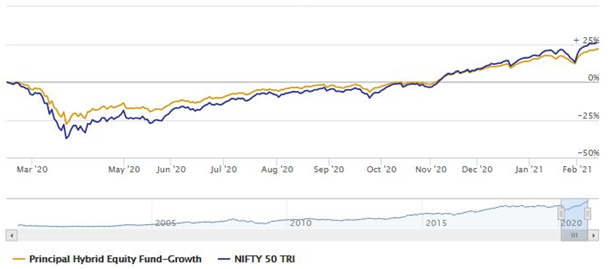

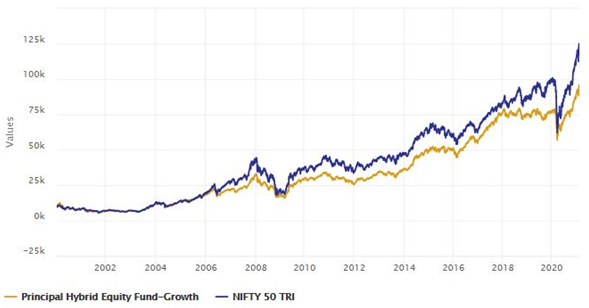

The chart below shows the Net Asset Value growth of Principal Hybrid Equity Fund over the last 1 year versus Nifty 50 TRI. The last 1 year period saw extreme volatility. You can see that the scheme was much less volatile than Nifty. Ravi Gopalakrishnan, Ashish Aggarwal and Bekxy Kuriakose are the fund managers of this scheme.

Source: Advisorkhoj Research

Rolling Returns of Principal Hybrid Equity Fund

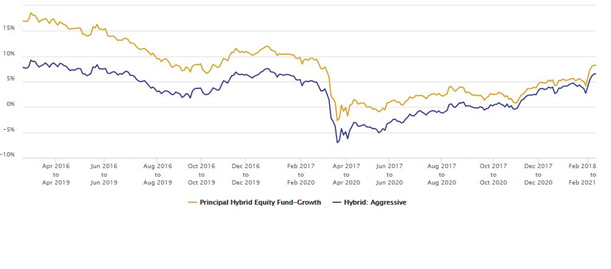

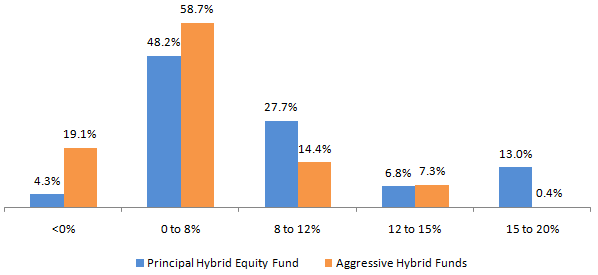

The chart below shows the 3 year rolling returns of Principal Hybrid Equity Fund over the past 5 years. We have chosen a 3 year rolling returns period because investors should have at least 3 year investment tenor for investing in equity oriented hybrid funds. Over longer tenor aggressive hybrid funds can leverage the wealth creation potential of equity as an asset class. You can see that Principal Hybrid Equity Fund beat the Aggressive Hybrid Funds category consistently over 3 year rolling periods of in the last 5 years. Outperformance consistency across different market conditions is the hallmark of well managed funds.

Source: Advisorkhoj Rolling Returns Calculator

The maximum 3 year annualized rolling return of the Principal Hybrid Equity Fund was around 18.6%, whereasthe average maximum Aggressive Hybrid Funds was 15.2%.

This shows that the scheme was able to outperform Aggressive Hybrid Funds category in both good and bad market conditions. The chart below shows the 3 year rolling returns performance consistency of Principal Hybrid Equity Fund versus the Aggressive Hybrid Funds category.

Source: Advisorkhoj Rolling Returns Calculator

We can make several important inferences from the chart above. Firstly, Principal Hybrid Equity Fund was able to provide better downside protection relative to many of its peer funds. Secondly, Principal Hybrid Equity fund was able to give more than 8% returns (average expected fixed income returns over similar periods in 7 – 8%, traditional fixed income gave less returns) about 48% of instances (times) over 3 year investment tenures across different market conditions (bull markets and bear markets).

At the same time, the percentage of instance of negative returns was only around 4%. So from a risk / return trade-off perspective, the scheme has low risk (only around 4% instances of negative returns) versus 48% possibility of getting more than typical fixed income returns; in other words, the risk return trade-off for the scheme is favourable.

Asset Allocation and Portfolio Construction

The asset allocation mandate of Principal Hybrid Equity Fund as per SEBI’s category guidelines is 65% to 80% Equity; within equity there are no sub limits on market cap segments. The current asset allocation of the fund is 75% equities and 25% debt and cash or cash equivalents. The equity portion of the scheme portfolio is predominantly large cap (62% of overall portfolio). The debt strategy of the Principal Hybrid Equity Fund’s portfolio is active duration management and some tactical trading positions to optimize returns.

Lump sum returns

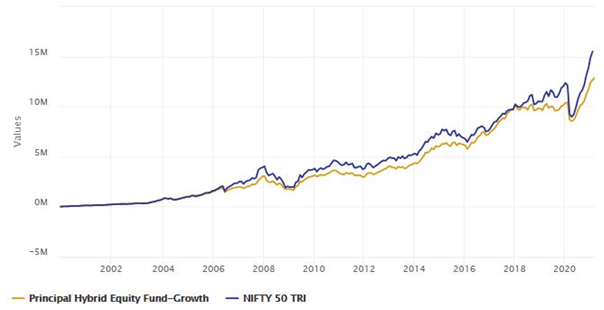

The chart below shows the growth of Rs 100,000 lump sum investment in Principal Hybrid Equity Fund since inception. Your investment of Rs 100,000 would have multiplied nearly 10 times to Rs 959,500 over the last 21 years or so. Annualized return since inception is 11.3% (as on 12th February 2021).

Source: Advisorkhoj Research

SIP returns

The chart below shows the growth of Rs 10,000 monthly SIP investment in Principal Hybrid Equity Fund since inception. The SIP performance of the fund shows its wealth creation over long investment horizons. Annualized SIP return (XIRR) since inception was 13.55%.

Source: Advisorkhoj Research

Conclusion

Principal Hybrid Equity Fund has completed more than 20 years last year. The scheme has also been a consistent performer over the past 5 years. The scheme has a proven long term track record of wealth creation. This scheme is suitable for your long term financial goals like children’s higher education, children’s marriage, retirement planning and wealth creation. Investors with very high risk appetites can invest in this fundboth in lump sum and by way of SIP with a sufficient long investment horizon. In our view you should have minimum 5 years investment horizon for Principal Hybrid Equity Fund. Investors should consult with their financial advisors if Principal Hybrid Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team