Principal Focused Multi Cap Fund: Good risk adjusted performance

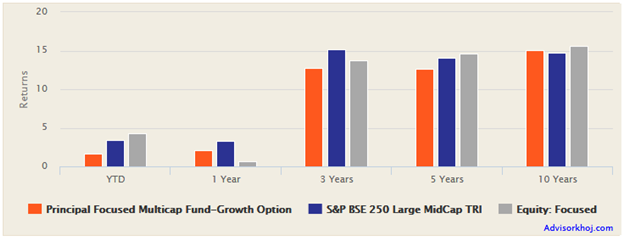

If you had invested Rs 1 lakh in Principal Focused Multi-Cap Fund (erstwhile Principal Large Cap Fund) at the time of its launch (NFO) towards the end of 2005, your investment would have multiplied to nearly Rs 6 lakhs (as on May 13th 2019); the CAGR return since inception is 14%, which is quite good given the risk profile (predominantly large cap) of this scheme. Though the scheme has underperformed versus its benchmark index, BSE – 250 Large Midcap Index, in the last one year, it has outperformed the index over the last 10 years. The chart below shows the trailing returns of Principal Focused Multi-Cap Fund versus its benchmark index and Focused funds category over various time-scales.

Source: Advisorkhoj Research

As we present the chart above, we must caveat that Focused Fund is a new category which came into being in the wake of SEBI’s mutual fund re-classification directive which was implemented by the fund houses last year. While some of the schemes, currently classified as Focused Fund, may have had a focused investment strategy (including Principal Focused Multi-Cap Fund) concentrated on a limited number of stocks, other funds may have undergone considerable change in their fundamental attributes. This makes past performance comparison very tricky and often misleading for investors.

Principal Focused Multi-Cap Fund or erstwhile, Principal Large Cap Fund predominantly had a large cap orientation and continues to have so; large caps continue to constitute nearly 75% of Principal Focused Multi-Cap Fund stock portfolio. Other schemes in the category may have had a higher allocation to midcap, which may have resulted in outperformance or underperformance depending on the timeframe of analysis.

Principal Focused Multi-Cap fund, for example, outperformed the focused funds category in the last one year, when large cap outperformed midcap. However, schemes with higher allocations to midcap would have outperformed over different time-scales when midcaps outperformed large cap. Given the challenges of comparing past performance of the Principal Focused Multi-Cap Fund versus the Focused Funds category, we will discuss the attributes of this scheme on a standalone basis.

Fund overview

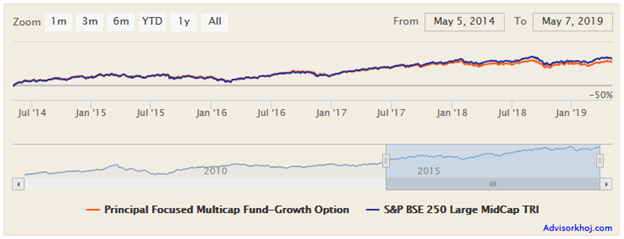

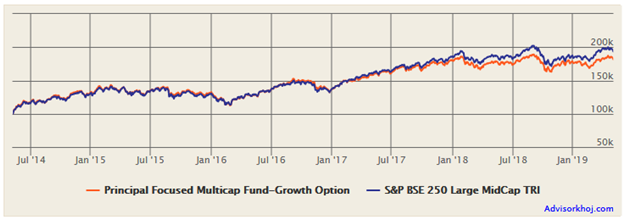

The scheme was launched in November 2005 and has nearly Rs 320 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.54%. The scheme benchmark is BSE – 250 Large Midcap Index and Dhimant Shah is the fund manager. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

The investment objective of this scheme is to provide capital appreciation and /or dividend distribution by investing in companies across market capitalization and is suitable for investors looking for long term capital gains. The scheme follows a multi-cap strategy with flexibility to invest across market cap segments. The scheme endeavors to invest in about 30 stocks with adequate diversification across sectors - it invests in high conviction concentrated portfolio of companies across market capitalization.

Are Focused Funds risky?

There is a misconception among many investors and financial advisors that focused funds are risky compared to diversified equity funds. The distinction between focused funds and diversified equity funds is misleading because there is no such distinction in reality. Our view in Advisorkhoj is that, focused funds are a subset of diversified equity funds; Principal Focused Multi-Cap Fund is also a diversified equity fund because it diversifies across industry sectors and market capitalization segments. While theoretically, company concentration risks in focused funds are higher (due to limited number of stocks) than more diversified funds (which invest in larger number of stocks), well documented research has shown that 30 stocks can provide adequate diversification across sectors. There is no evidence of systemic underperformance of focused funds versus more diversified funds in certain market cycles. On the other hand, focused funds may be better positioned to meet certain risk appetite / return objectives of investors.

Suggested reading: The importance of goals in investing

Portfolio Strategy of Principal Focused Multi-Cap Fund

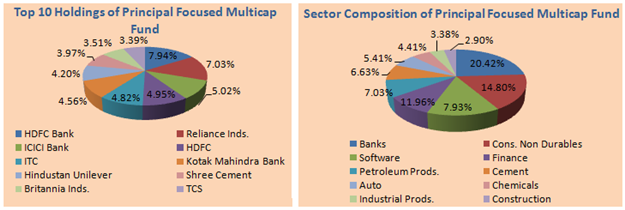

As discussed earlier, the scheme follows a multi-cap strategy and limits the number of stocks in its portfolio to 30. At present, the scheme is predominantly large cap with about 74% of the portfolio weight is in large cap, 14% weight in midcap and 10% weight in small cap (as on March 31st 2019). Around 2% of the portfolio is in the cash and cash- equivalents.

The Top 5 sectors in the scheme portfolio (as on March 31st) are Banks (20%), Consumer non-durables / FMCG (15%), Software (12%), Finance (8%) and Petroleum Products (8%). The scheme is well diversified in terms of company concentration with the Top 5 stock holdings HDFC Bank, Reliance Industries, ICICI Bank, HDFC Limited and ITC constitute about 30% of the scheme portfolio.

The chart below shows the top sector / stock holdings of the Principal Focused Multi-Cap Fund portfolio.

Source: Advisorkhoj Research

Rolling Returns

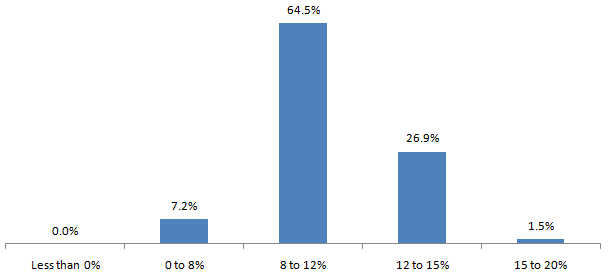

The 3 year rolling returns performance of the scheme over the last 5 years, covering different market conditions is quite good. The average 3 year rolling returns of the scheme over the last 5 years was 11%, while the median 3 year rolling returns of the scheme over the same period was also around 11%. The maximum 3 year rolling return of the schemeover the last 5 years was 15.4%, while the minimum 3 year rolling return of the scheme was 6.4%. Even in the worst case scenario, this scheme beat fixed income returns on a post-tax basis. The chart below shows the returns consistency of the scheme on a 3 year rolling return basis, over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that the investor never made a loss in Principal Focused Multi-Cap Fund over 3 year investment periods in the last 5 years. Further, the scheme gave more than 8% (typical fixed income returns) returns over a 3 year investment period, nearly 93% of the times over the last 5 years. 28% of the times, 3 year returns exceeded 12% CAGR. These are good risk adjusted returns.

Lump Sum and SIP Returns

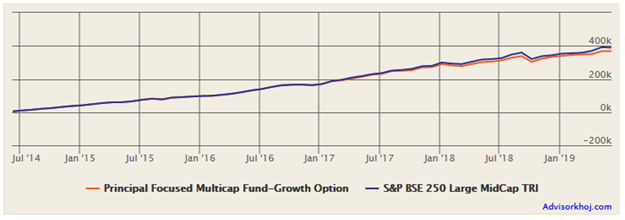

The chart below shows the returns of Rs 1 lakh lump sum investment in Principal Focused Multi-Cap Fund (growth option) over the last 5 years. You can see that the investment would have grown to Rs 1.65 lakhs in the last 5 years (11% CAGR).

Source: Advisorkhoj Research

The chart below shows the returns of Rs 5,000 monthly SIP in Principal Focused Multi-Cap Fund (growth option) over the last 5 years. You can see that the value of the SIP have grown to Rs 3.6 lakhs, with a cumulative investment of Rs 3 lakhs only (7.5% XIRR). However, the SIP returns since inception has been very impressive. Rs 5,000 invested through SIP would have grown to Rs 18.64 Lakhs against total investment of Rs 8.15 Lakhs (11.53% XIRR).

Source: Advisorkhoj Research

Conclusion

In this blog post, we reviewed Principal Focused Multi-Cap Fund. The fund has delivered good risk adjusted returns over long investment tenors. The fund is suitable for investors with moderately high risk appetites looking for long term capital appreciation and relative stability in volatile markets. You may invest in this scheme, either in lump sum or SIP, for your long term financial goals like children’s education, marriage and retirement planning. If you lump sum funds, but are worried about near term volatility then you can invest your funds in Principal Liquid Fund and transfer your money systematically to Principal Focused Multi-Cap Fund through STP over 3 to 6 months. Investors should consult with their financial advisors, if Principal Focused Multi-Cap Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Jio BlackRock Mutual Fund launches Jio BlackRock Short Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches Jio BlackRock Low Duration Fund

Jan 8, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Small Cap Fund

Jan 8, 2026 by Advisorkhoj Team

-

Bank of India Mutual Fund launches Bank of India Banking and Financial Services Fund

Jan 8, 2026 by Advisorkhoj Team

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team