Principal Emerging Bluechip Fund: 12.5 times growth in 12 years

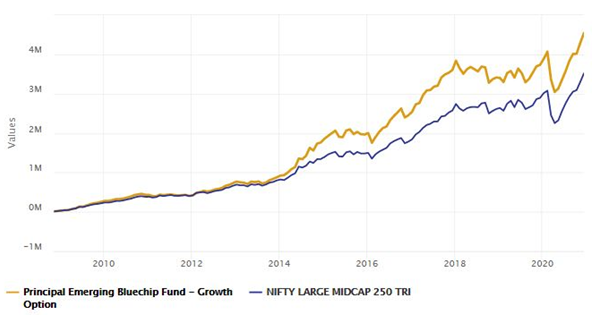

If you had invested Rs 1 lakh in Principal Emerging Bluechip Fund nearly 12 years back at the time of its inception (NFO), its market value today (as on 2nd December 2020) would be nearly Rs 12.5 lakhs. More than 12X growth in 12 years imply a CAGR of well over 20%, which is phenomenal by any standard.

There are funds which deliver high returns in favourable market conditions, but delivering 23.27% CAGR returns over such a long investment horizon (12 years), across several investment cycles (bull and bear markets), is indeed very impressive and a testimony to the wealth creation ability of the fund manager.

Source: Advisorkhoj Research (12th November 2008 to 2nd December 2020). Disclaimer: Past performance may or may not be sustained in the future

Fund Overview

Principal Emerging Bluechip Fund is a large and midcap equity fund. Large and midcap fund category by definition must have at least 35% investment in large cap stocks and at least 35% investment in midcap stocks. Large cap stocks as per SEBI’s definition are the 100 largest companies by market capitalization. Midcap stocks as per SEBI’s definition are the next (after large cap stocks) 150 largest companies by market capitalization. The large cap portion of these funds provide stability and limits downside risks in bear markets, while the midcap portion provides fund managers with opportunities to create alphas.

Within the large and midcap fund category, the Principal Emerging Bluechip Fund has been among the top 5 performers over the last 1 year (see Top Performing Large and Midcap Funds) delivering 16.9% return. The scheme was launched in November 2008 and has over Rs 2,100 crores of assets under management. The scheme expense ratio is 2.09% for the regular plan. Ravi Gopalakrishnan is the fund manager of this scheme.

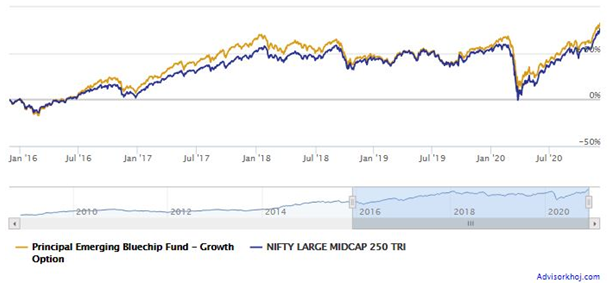

The portfolio turnover of the scheme is 49%. The portfolio turnover of the scheme is lower than average portfolio turnovers of other funds in the category, which shows that the fund manager mostly employs a buy and hold strategy for high conviction stocks. The chart below shows the NAV growth of the fund over the last 5 years.

Source: Advisorkhoj Research (as on 2nd December 2020). Disclaimer: Past performance may or may not be sustained in the future

Portfolio Composition

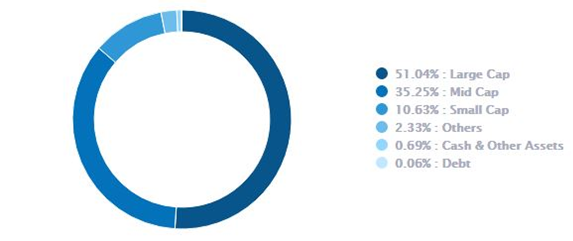

The fund currently has a large cap bias. The scheme’s investment style is growth at a reasonable price (GARP). The fund manager also seeks to invest in stocks that have the potential to become bluechips in the future. The chart below shows the market cap composition of the scheme as on 31st October 2020.

Source: Principal MF (as on 31st October 2020)

The chart below shows the top 10 sector allocations of the scheme portfolio. You can see that the fund manager has a bias towards cyclical sectors. With the economy showing early signs of recovery from the severe recession seen in Q1 of this fiscal, we think that the investment strategy of the fund manager will play out well in terms of returns. Cyclical sectors are the worst affected in economic recessions and outperform in the ensuing recovery from the recession.

Source: Advisorkhoj Research (as on 31st October 2020).

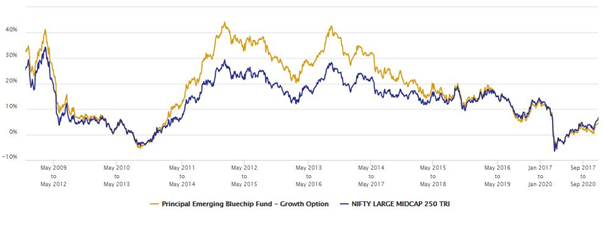

Rolling Returns

The chart below shows the 3 year rolling returns of Principal Emerging Bluechip versus its benchmark, Nifty Large Midcap 250 TRI since its inception. You can see that the fund has consistently beaten its benchmark most of the times since inception. The average 3 year rolling return of the scheme since inception is 18.2% (versus 13.4% for the benchmark). The median 3 year rolling return of the scheme since inception is 17% (versus 14.3% for the benchmark). The fund has delivered 12%+ CAGR returns in nearly 65% of the instances over 3 year investment tenures since inception.

Source: Advisorkhoj Research (12th November 2008 to 2nd December 2020). Disclaimer: Past performance may or may not be sustained in the future

SIP Returns

The chart below shows the returns of Rs 10,000 monthly SIP in the fund (growth option) since inception. With a cumulative investment of Rs 14.5 lakhs, you could have accumulated a corpus of Rs 45.50 lakhs. The monthly SIP annualized return (XIRR) since inception was 17.7%. The SIP returns of the Principal Emerging Bluechip fund is a testimony of the benefits of systematic investing. The investors who continue to make systematic investments through bear and bull market cycles get excellent returns.

Source: Advisorkhoj Research (12th November 2008 to 2nd December 2020). Disclaimer: Past performance may or may not be sustained in the future

Suggested reading: Strong long term SIP, STP and SWP Performance from Principal Emerging Bluechip Fund

Conclusion

The Principal Emerging Bluechip Fund recently completed 12 years since launch. It has a great wealth creation track record since inception. The fund is suitable for investors planning to make investments for long term financial goals, like retirement planning, children’s education, wealth creation etc. Investors should have moderately high risk appetite and long investment horizon, ideally 5 years or more, so that they can get the best results by investing in this fund. Onecan consider investing in the schemeboth through the systematic investment plan (SIP) or lump sum route.If you have lump sum funds but are worried about volatility going into next year, then you can also invest through a 3 to 6 months systematic transfer plan (STP) from Principal Cash Management Fund. Investors should consult with their financial advisors, if Principal Emerging Bluechip fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team