Principal Emerging Bluechip Fund: Money multiplied 10 times in 10 years

Principal Emerging Bluechip Fund has just completed 10 years since launch. If you had invested Rs 1 Lakh in this scheme at the time of its NFO, your investment would have grown to Rs 10 Lakhs. In compounded annual growth rate (CAGR) terms, the annualized return of the scheme since inception was 25.87%.

If you had invested Rs 5,000 per month in Principal Emerging Bluechip Fund through SIP, you could have accumulated a corpus of over Rs 16.90 Lakhs, with a cumulative investment of Rs 6 Lakhs only. The XIRR of monthly SIP in the scheme was 19.5%. This scheme has been an outstanding wealth creator for its investors.

Fund overview

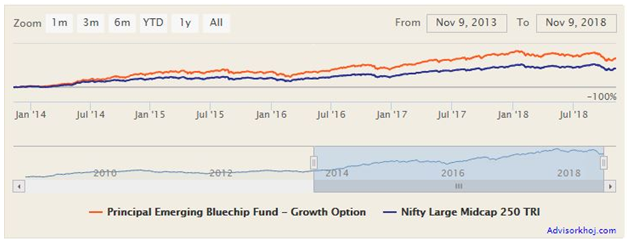

Principal Emerging Bluechip Fund was launched in November 12, 2008. The scheme has Rs 1,932 Crores of Assets under Management (AUM) with an expense ratio of 2.4%. Post SEBI’s mutual fund re-classification directive, this scheme is categorized as a Large and Midcap Fund. The scheme benchmark is Nifty Large Midcap 250 Total Returns Index (TRI). Dhimant Shah is the fund manager of this scheme. The scheme has beaten its benchmark as well as the Large and Midcap Fund category average returns across a number of trailing time periods (please see the chart below).

Source: Advisorkhoj Research

You can see in the chart above that Principal Emerging Bluechip Fund gave nearly 25% annualized returns in the last 5 years. The last 5 year performance of this scheme puts it among the Top 3 funds in its category (please see Top Performing Large and Midcap Funds). The chart below shows the NAV growth of the scheme in the last 5 years.

Source: Advisorkhoj Research

One of the most consistent performers

We have stated a number of times in our blog that one of the most important attributes of a mutual fund scheme is its performance consistency. We have developed a research tool which identifies the most consistent mutual schemes based on their performance ranking every year (relative to peer funds) over the last 5 years (please see our tool, Top 10 mutual funds in India - Equity: Large and Mid Cap). For ranking purposes, we use quartile ranks.

What are mutual fund quartile ranks

For the benefit of new investors among our readers, quartile ranking is basically bucketing mutual funds into four approximately equal sized groups based on their performance / returns in a particular period. The top 25% of the schemes (based on performance) are grouped in Top Quartile, the next 25% are grouped into the Upper Middle Quartile, the next 25% are grouped in the Lower Middle Quartile and worst 25% performers are grouped in the Bottom Quartile. A scheme which figures maximum number of times in the top or the top 2 quartiles in a year, over a sufficiently long period of time (e.g. 5 years) are the most consistent performers. Using our proprietary scoring algorithm we identify most consistently performing mutual fund schemes. We urge investors to use our Top Most Consistent Funds tool to select mutual fund schemes according to their investment needs or validate their selection made through their own / their financial advisor’s research.

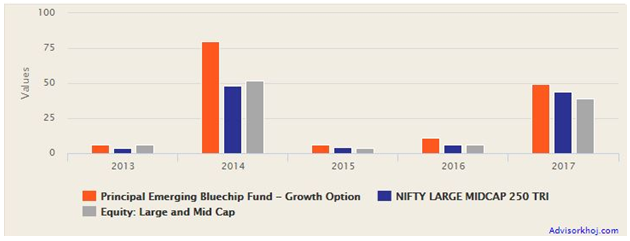

Principal Emerging Bluechip Fund is among the top most consistent mutual fund schemes in the Large and Midcap category (please see, Top 10 mutual funds in India - Equity: Large and Mid Cap). The scheme was in top quartilein three out of the last five years and was in the top 2 quartiles in four out of the last 5 years. The chart below shows the annual returns of the scheme versus its benchmark and the category over the last 5 years.

Source: Advisorkhoj Research

Regular Advisorkhoj readers know that rolling returns is one of the best measures of a mutual fund scheme’s performance consistency. For benefit of all our readers, rolling returns are returns over a certain investment tenor (1 year, 3 years, 5 years etc) across a sufficiently long time period covering different types of market conditions (e.g. bull market, bear market, range-bound market, flat market, volatile market etc).

Rolling returns are basically a series of point to point (defined by the investment tenor) returns over a sufficiently long time period (across different market conditions). Rolling return is a better measure of performance than trailing returns or point to point returns because they are biased by market conditions prevailing during a certain period of time.

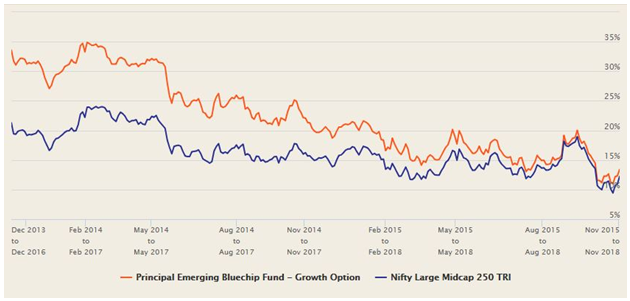

The chart below shows the 3 year rolling returns of Principal Emerging Bluechip Fund versus its benchmark, Nifty Large Midcap 250 TRI over the last 5 years. The last 5 years included periods which saw different market conditions like bull market (2014 and 2017), bear market (2015 / early 2016) and volatile market (2018). If a mutual fund scheme is able to beat its benchmark consistently across different market conditions then it should be considered as a consistent performer. We have chosen to show 3 year rolling returns because we think investors should have a sufficiently long investment tenor (at least 3 years) for equity funds.

You may read – Why you should think long term when investing in mutual funds

Source: Advisorkhoj Rolling Returns Calculator

You can see in the chart above that Principal Emerging Bluechip Fund was consistently able to beat its benchmark and generate alpha for investors across different market conditions. This is the hallmark of the strong fund management and the fund manager of the scheme should be lauded for this achievement.

Let us now see how Principal Emerging Bluechip Fund fared against the Large and Midcap Funds category in terms of 3 year rolling returns over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that Principal Emerging Bluechip Fund consistently outperformed the Large and Midcap Funds category, across different market conditions. That is why this scheme is highly rated for a number of years now.

Average 3 year rolling returns of the scheme over the last 5 years is 22.3%, while the median rolling returns of the scheme over the last 5 years is 21.2%. The maximum 3 year rolling return of the scheme over the last 5 years was 34.9%, while the minimum 3 year rolling return of the scheme over the last 5 years was 11%.

The chart below shows the 3 years rolling returns consistency of Principal Emerging Bluechip Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

Investment Strategy

The primary objective of the Scheme is to achieve long-term capital appreciation by investing in equity and equity related instruments of large cap and mid cap companies.The fund pursues to invest in large cap and mid cap companies with attractive growth prospects, and that are available at reasonable valuations (GARP).It also seeks to invest in stocks that have the potential to become bluechip in the future. The current market capitalization mix of the scheme portfolio is 39% large cap (top 100 companies in terms of market cap), 35.4% mid cap (101st to 250th companies in terms of market cap) and 21.8% small cap (251st and lower companies in terms of market cap). The top 5 sector allocations in the scheme portfolio are in banks (10.8%), information technology (9.2%), finance (7.7%), fast moving consumer goods (7.7%) and industrial products (6.9%). The scheme is fairly well diversified in terms of company concentration.

Lump Sum and SIP returns

The chart below shows the growth of Rs 1 Lakh lump sum investment in Principal Emerging Bluechip Fund over the last 5 years. You can see that a lump sum investment in the growth option of the scheme would have multiplied 3 times in the last 5 years.

Source: Advisorkhoj Research

The chart below shows the returns of Rs 5,000 monthly SIP in Principal Emerging Bluechip Fund over the last 5 years. You can see in the chart below that, with a cumulative investment of just Rs 3 Lakhs over the last 5 years, you could have accumulated a corpus of over Rs 4.4 Lakhs – profit of Rs 1.4 Lakhs. The annualized SIP returns (XIRR) of the scheme over the last 5 years was 15.4%.

Source: Advisorkhoj Research

You can read – Systematic Investment Plans: A checklist of myths and facts

Dividend Track Record

Principal Emerging Bluechip Fund has been paying regular dividends since 2014. Prior to 2014, the scheme paid dividends in 2009 and 2010. In 2016 and 2017, the scheme paid dividends twice a year. The dividend yields were quite high.

However, investors should understand that mutual fund dividends are paid from the accumulated profits of a scheme. Even if a scheme has accumulated profits in its reserves, the decision to pay dividends to investors is entirely at the discretion of the fund manager. Further, even though dividends are tax free in the hands of the investor, the asset management company (AMC) has to pay 10% dividend distribution tax (DDT) from this financial year onwards, before paying dividends to its investors.

In Advisorkhoj’s view, capital appreciation should be the primary objective of investors when investing in equity mutual funds. The table below shows the dividend history of Principal Emerging Bluechip Fund.

Source: Advisorkhoj Historical Dividends

Conclusion

Principal Emerging Bluechip Fund has completed 10 years of terrific track record. Advisorkhoj wishes the scheme a very happy anniversary. The scheme’s performance over the last 5 years, even in difficult market conditions, has been quite outstanding.

Investors should have a long investment horizon, at least 5 years, in our view, for this scheme. The scheme is suitable for investors with moderately high risk appetites, seeking long term capital appreciation for a variety of financial goals like retirement planning, children’s education, wedding etc.

You can invest in the scheme in both lump sum or SIP modes. If you are worried about volatility in current market conditions, you can invest in this scheme through Systematic Transfer Plan (STP) from either Principal Cash Management Fund or Principal Ultra Short Term Fund over the next 3 to 6 months. Investors should discuss with their financial advisors if Principal Emerging Bluechip Fund is suitable for their investment objectives.

(Play this Video)

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team