Nippon India Vision Fund: More than 120X growth since inception, a proven wealth creator

In this article we will review the Nippon India Vision Fund (Gr). If you had started Rs 10,000/- monthly SIP in Nippon India Vision Fund (Gr) at its inception, it would have grown to a whopping Rs 9.33 Crores with a cumulative invested amount of Rs 34.2 Lakhs only. This fund was started in October 1995 and over the years, not only has acquired the status as one of the flagship funds of Nippon India MF, but also one of the greatest wealth creators among mutual funds in India.

What are large and midcap funds?

Large and Midcap funds are equity funds with a diversified portfolio and as per the SEBI mandate they invest a minimum of 35% each in large cap and midcap stocks. The remaining 30% of the portfolio can be invested at the discretion of the fund manager. Large Cap stocks are the top 100 stocks by market capitalization, whereas the midcap stocks belong to the 101st to 250th stock by market capitalization in India. Large cap allocation in these funds offer potential stability during volatile market conditions, and provides downside protection, whereas the Midcap stocks offer a higher growth potential leading to a potential capital appreciation in the long term.

Nippon India Vision Fund

The Nippon India Growth Fund is an open-ended equity fund that invests in Large Cap and Mid Cap stocks. The fund was started in October 1995 and has given a return of 15.22% in the last 10 years (as on 3rd April 2024). The NAV of the fund as on 2nd April 2024 was Rs 1223.2605. The fund has an AUM of Rs 4,335.22 Cr (as on 31st March 2024) managed by Amar Kalkundrikar (Since Jun 2021), and Aishwarya Deepak Agarwal (Since Jun 2021). The benchmark of the fund is Nifty Large Midcap 250 TRI. The Total Expense ratio of the fund as of 2nd April was 2.03% for the regular plan.

Performance of the fund

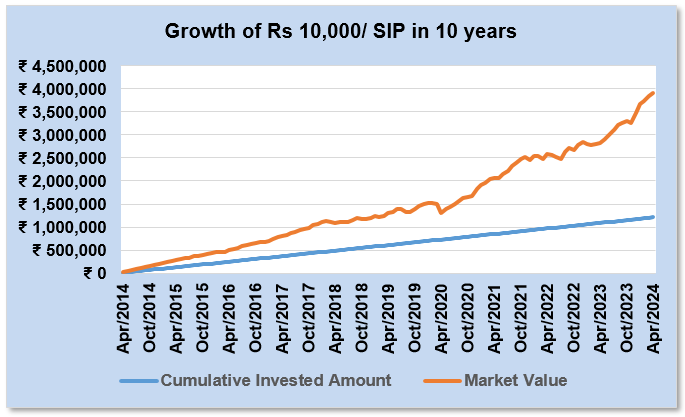

SIP Returns - In the last 10 years the Nippon India Vision fund would have grown your Rs 10,000/- monthly SIP to Rs 27,01,919/- (27 Lakhs) against a cumulative investment of Rs 12,10,000/- (12 Lakhs) giving an XIRR of 15.42% (From 1st April 2014 to 2nd April 2024). (See the chart below)

Source: Advisorkhoj (as on 2nd April 2024)

Lumpsum Returns - A lumpsum of Rs 1 lakh invested in the fund 10 years back (1st April 2014) would have grown to Rs 4.12 lakhs as on 2nd April 2024 giving an XIRR of 15.22%.

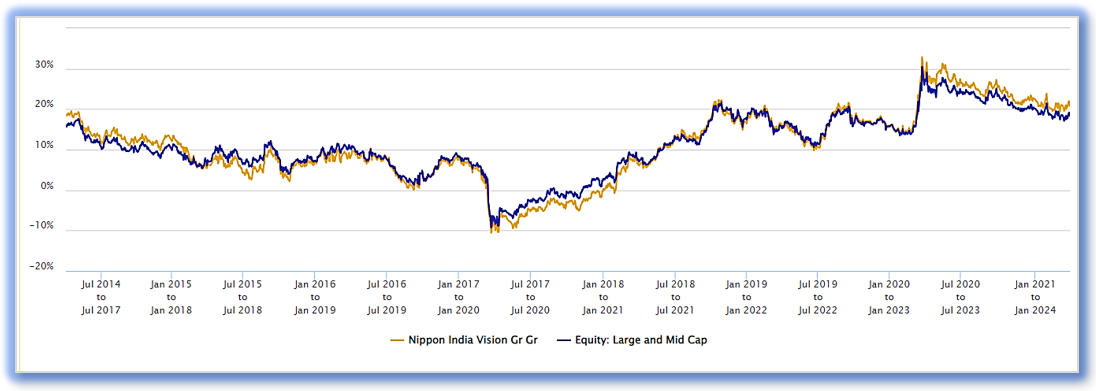

3-year Rolling Returns: Fund Vs Category

The chart below shows the 3 year rolling returns of the fund in the last 10 years since April 2014 as compared to the category. You can see that the fund was consistently able to outperform peers (category average) in bull markets.

Source: Advisorkhoj Research 2nd April, 2024

The fund performed/ gave 15%+ 3 year returns in 33.3% of instances compared to 32.5% of instances by the category average. The fund also gave 20%+ 3 years returns in 17.2% of instances compared to category average of 12.9% of instances for 20%+ 3-year returns.

Market Capture Ratio

In the last 3 years, the fund gave a down market capture ratio of 94% showing that the fund was able to limit downside risks relative to the benchmark index. The up-market capture of the fund was 97% over the same period. The up-market and down-market ratios of the fund show potential for superior risk adjusted returns over sufficiently long investment tenures. (Source: Advisorkhoj)

Investment Strategy

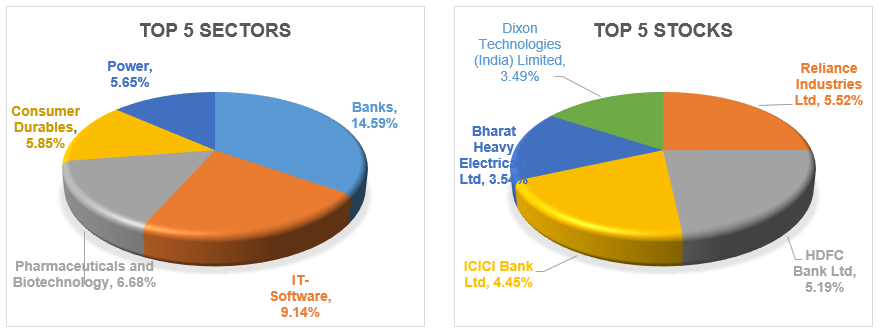

The fund attempts to invest in high-quality businesses that are market leaders in their respective sectors and have a proven track record across market conditions. Large-cap stocks endeavor to provide stability and liquidity to the portfolio, and mid-cap allocations can potentially generate relatively better returns. Backed by fund management expertise and a growth-oriented strategy, the fund endeavors to generate relatively better risk-adjusted returns over the long term. The fund has a large cap bias with 61% of its assets in stocks of large cap companies and the rest of the assets are from the Mid cap segment.

Portfolio Allocation

Source: Fund Factsheet as on 29th February 2024

Why should you invest in Large and Midcap funds?

- Historically, large & Midcap has provided above average risk-adjusted returns as compared to large caps.

- Large & Midcaps provide the combination of stability through large caps and growth through midcaps.

- Large & Midcaps category provides fair exposure to both established sectors as well as balanced exposure to promising or new age sectors.

- Fund managers can be overweight/underweight on large and midcaps based on their views while adhering to SEBI’s category mandate. There is ample scope for alpha creation through active management.

Who should invest in Nippon India Vison Fund?

- Investors who would like to benefit from the well positioned fund portfolio to gain significantly from the domestic revival can find this fund suitable.

- The fund is suited to investors who have a long-term investment horizon of 5 years or more.

- Investors can align their long-term goals like retirement planning or children’s education with this fund.

- The fund is also suited to investors who want to mitigate their risks from Midcap investments, but at the same time would like to earn higher returns which is typically offered by the midcap companies. The large cap component of the fund offers stability during volatile market conditions.

Contact your financial advisor or mutual fund distributor to understand if the Nippon India Vision Fund aligns to your financial goals and risk appetite.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team