Nippon India Small Cap Fund: 10 times return in last 13 years

If you had invested Rs 1 lakh in Nippon India Small Cap Fund at the time of its inception (September 2010), the value of your investment would have grown to nearly Rs 10.57 lakhs (as on 7th June 2023). The CAGR returns of this scheme since inception is over 20%. If you invested in the scheme with a monthly SIP of Rs 10,000 the value of your SIP would have grown to nearly Rs 79 lakhs with a cumulative investment of Rs 15.3 lakhs only (as on 7th June 2023). The annualized SIP returns (XIRR) of this scheme since inception is 23.6%. This fund is a fabulous example of wealth creation by mutual funds over long investment tenures.

Fund Overview

Nippon India Small Cap Fund was launched in September 2010 and over Rs 24,206 crores of assets under management (as on 31st May 2023). Some investors express concerns about the AUM size of small cap funds in terms of alpha creation potential. We do not think large AUM size in small caps is a constraining factor in alpha creation. Our stock market is growing bigger and deeper. Institutional investors, both FIIs and DIIs are investing in the small cap segments.

The mutual fund regulation changes made by SEBI will further deepen the small cap segment. In the past, an Rs 25,000 crore AUM small cap fund may have accounted 5-6% of the total small cap market capitalization. But as on 31st December 2022 an Rs 25,000 crore AUM small cap fund will account for just about 1% of the Nifty Small Cap 250 market capitalization.

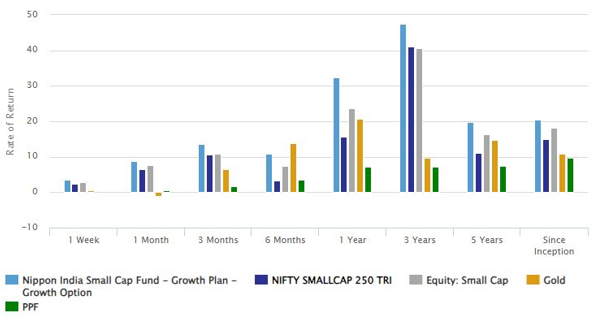

One of the advantages of a large AUM size is lower expense ratio. The expense ratio of Nippon India Small Cap Fund at 1.45% is the lowest among all small cap funds (as on 31st May 2023). The table below shows the annualized trailing returns of Nippon India Small Cap Fund over various time-scales. You can see that, the fund has outperformed its category and the benchmark Nifty Small Cap 250 TRI across different time-scales.

Source: Advisorkhoj Research, as on 7th June 2023. Returns over 1 year are in CAGR

Rolling Returns

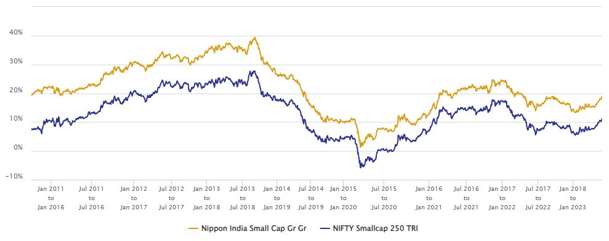

In this chart we are showing the 5 year rolling returns (rolled daily) of Nippon India Small Cap Fund (yellow line) since the scheme’s inception and comparing it with the benchmark, Nifty Small Cap 250 TRI (blue line). We have chosen a rolling return period of 5 years, because it is advisable for small cap investors to remain invested for at least 5 years to get the best returns from the investment.

Source: Advisorkhoj Rolling Returns Calculator

Over the last 5 years, the fund has beaten the benchmark index 100% times. This shows consistency of performance across different market conditions. Secondly, notice that the gap between the rolling returns of Nippon India Small Cap Fund and the benchmark index, Nifty Small Cap 250 TRI, is relatively. This implies that the fund manager follows a structured and consistent fund management approach, which is very important for long term investors.

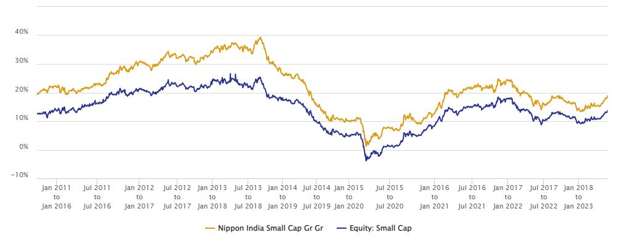

The chart below shows the 5 year rolling returns of the scheme versus the small cap funds category average since the scheme’s inception.

Source: Advisorkhoj Rolling Returns Calculator

Investment Style

Nippon India Small Cap fund focuses on small cap companies in the Nifty Small Cap 250 index. Small cap companies comprise nearly 68% of the portfolio in value terms. The fund manager identifies good growth businesses with reasonable size, quality management and rational valuation. The investment approach adopts prudent risk management measures like margin of safety and diversification across sectors & stocks with a view to generate superior risk adjusted performance over a period of time. The investment style is a mix of growth and value.

Lump Sum and SIP Returns

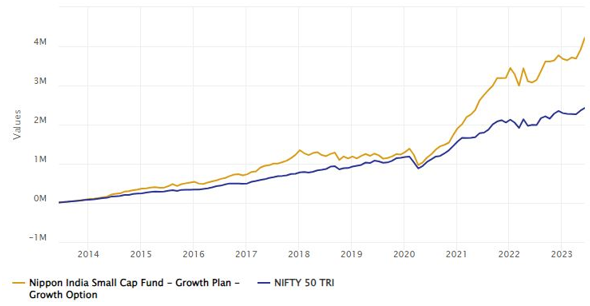

The chart below shows the growth of Rs 1 lakh lump sum investment in Nippon India Small Cap Fund (growth option) over the last 10 years. The fund has given over 27% CAGR returns. Look at the alpha the scheme has created for investors versus Nifty.

Source: Advisorkhoj Research, as on 7th June 2023

The chart below shows the returns of Rs 10,000 monthly SIP in the fund (growth option) over the last 5 years.

Source: Advisorkhoj Research, as on 7th June 2023

Outlook

Small caps underperformed in 2022 compared to large and midcaps. Nifty Small Cap 250 TRI had a 3% correction, while select small cap stocks had a far deeper correction; Nifty Small Cap 100 TRI saw a 13% correction in 2022. This fund managers the opportunity to buy small cap stocks at attractive prices. Small caps have strongly rebounded in 2023. Nifty Small Cap 250 TRI has outperformed both Nifty Midcap 150 TRI and Nifty 100 TRI on a year to date basis. With interest rates peaking and inflation cooling we expect the bullish trend to continue. Historical data shows that small caps have the potential to outperform midcaps and large caps in bull markets.

Why invest in Nippon India Small Cap Fund?

- The RBI has paused hiking interest rates. We expect RBI to hold the repo rate at 6.5% for the balance of the year and then start cutting interest rates in 2024.

- Global crude prices have come down to below $70/bbl and WPI inflation is cooling. US market data will also help equities.

- IMF has forecasted India’s GDP to grow by 5.3% in 2023. India will be fastest growing major economy in 2023.

- After underperforming till March, MSCI India Index (USD) has outperformed MSCI Emerging Market Index (USD) in both April and May. India’s outperformance in the emerging market pack is attracting FII flows to India. This is providing tailwinds to the broad market, including small caps.

- The shift from unorganized to organized sectors, digitization, rising per capita income and growing affluence will provide strong earnings growth impetus to small cap stocks.

- Nippon India Small Cap Fund has nearly 13 years of strong performance. It is one of the best performing funds in its category.

Who should invest in Nippon India Small Cap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high risk appetites

- Investors with minimum 5 year investment tenures

- We think that SIP is the best mode of investment small cap equity mutual funds over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in lump sum.

- You can also invest in this fund through 3 – 6 months STP from Nippon India Liquid Fund.

Investors should consult with their financial advisors if Nippon India Small Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team