Nippon India Passive Flexicap FOF: Making collective market wisdom work for you

This year has been unlike any year that most people have ever experienced. A deadly pandemic raging around the world, lockdowns and restrictions on many activities for a few months leading to one of the worst recessions many have seen in their lifetimes and an environment of fear and uncertainty. At the same time, the stock market has recovered from its March crash and is now trading at all time high. Those of you, who invested April and May, will be sitting on pretty gains now. However, those who want to invest now are confronted with the three basic questions:-

- Is this the right time to invest in equities?

- Which categories of fund to invest?

- Which funds to select?

Is this the right time to invest?

- The lockdowns around the world and in India were harsh but necessary in the interest of public health. Governments around the world recognized that lockdowns would cause economic hardships and responded with massive fiscal stimulus, more than what we saw in Global Financial Crisis (2008). Stimuli, especially in the developed economies, have resulted in ample liquidity in the financial markets.

- Central banks around the world, including the RBI have provided massive monetary policy stimulus to ensure adequate liquidity in the banking system and proper functioning of the bond markets. Favourable monetary policies have resulted in lower cost of capital due to lower borrowing rates. This has provided a massive boost to capital markets.

- The history of past economic recessions tells us that fiscal and monetary stimulus results in recovery of the broader market which are hurt worst during bear markets.

- Nearly 9 months after the March crash, the stock market is at record high. Over the past several months the broader market (midcaps and small caps) have outperformed the Nifty.

Which category to invest?

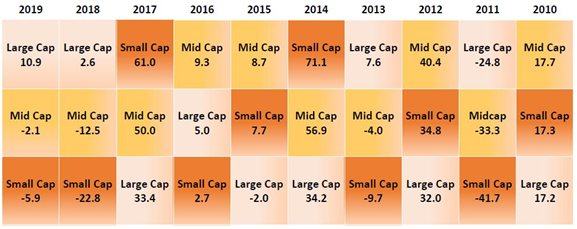

Past data shows market cap segment winners tend to rotate regularly between large, mid and small caps (please see the table below). With market at all time high and recent under performance of small / midcap versus large cap, it seems that small and midcaps are likely to outperform large cap in the near term future. However, it is difficult to predict how long the trend will last. Therefore, staying invested across market caps may help generate potentially better returns over the long run. Multicap funds have traditionally been very popular with mutual fund investors. As on October 2020, funds in the multicap category had the second highest aggregate AUM among all equity fund categories with 18.8% share of equity fund AUM.

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

Which fund to invest?

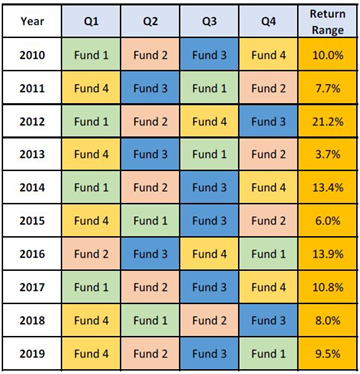

This is the most difficult question, since relative performance of funds can fluctuate over the years. For example, four funds from four different quartiles (first to fourth) had different quartile ranks in different years (see the table below). The return range is the difference between the best performing fund and the worst performing fund. You can see the difference in the annual returns between different funds can be quite significant. The table shows that it is very hard predict which fund will outperform in the long term.

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

Nippon India Passive Flexicap Fund of Funds

As discussed earlier, it is difficult to capture market cap trend and stocks that may outperform the market in specific periods. Nippon India mutual fund has come up with an innovative, one of its kind investment product which aims to capture the industry and market wisdom, thereby eliminating fund manager biases towards market cap segment and stocks. The upcoming NFO, Nippon India Passive Flexicap Fund of Funds will follow a flexicap strategy by investing across all the three market cap segments (large cap, midcap and small cap) and will invest in the entire universe of stocks in Nifty 500.

Investment strategy

Nippon India Passive Flexicap Fund of Funds in the following ETFs:-

- Nippon India ETF Nifty 100 (Large Cap)

- Nippon India ETF Nifty Midcap 150 (Midcap)

- Nippon India ETF Nifty Small Cap 250 (Small Cap)

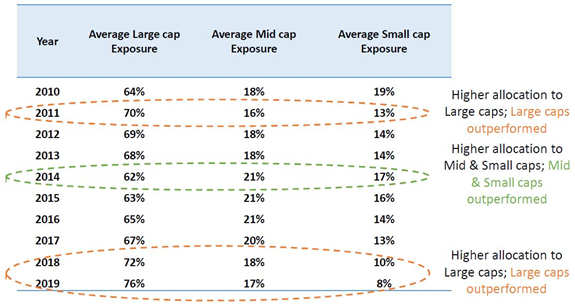

The market cap allocation will be based on the mutual fund industry’s previous month multicap market segment allocation as provided by CRISIL. The rationale behind the market cap strategy is that the mutual fund industry tends to anticipate and capture market trend (see the table below) – capture the industry wisdom.

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

There will be unsystematic risk since the scheme will invest in the market indices i.e. Nifty 100, Nifty Midcap 150 and Nifty Small Cap 250 – capture the market wisdom

How has the model performed?

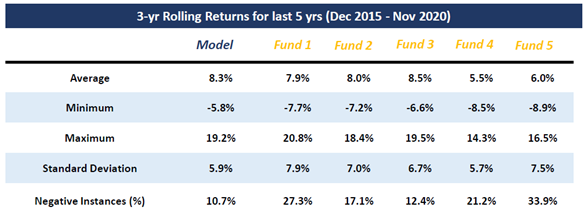

The model has been back-tested for rolling returns over past 10 years. Results show that the model is able to generate alphas consistently. The rolling returns performance of the model has also been compared versus that of 5 popular funds in the multicap category, which account for 40% of industry AUM (see the table below). You can see that the average 3 year rolling returns of the model is at par with the best performing fund and at the same time volatility (standard deviation) is considerably lower than most funds. The percentage of negative instances is also the lowest. Back-testing shows that the model has been to produce superior risk adjusted returns with low volatility against the Top 5 multicap funds (no one gets it right consistently).

Source: Nippon India Mutual Fund. Disclaimer: Past performance may or may not be sustained in the future.

Why invest in Nippon India Passive Flexicap Fund of Funds?

- The stock market is at all time high. Multicap strategy makes most sense now.

- Divergence is seen in performance of multicap funds. Hence concentrated bets need to be avoided in favour of Top 500 companies. The FOF invests Nifty 100, Nifty Midcap 150 and Nifty Small Cap 250, i.e. in all the Top 500 companies.

- Allocation between large, mid and small cap to be decided by collective wisdom (since the no fund has done it right consistently). The market cap allocation will be based on average market cap allocations of all multicap funds and rebalanced monthly.

- Low cost as FOF will invest in ETFs

- Consistent returns with lower downside risks (based on back-testing results as shown above)

- The proposition is powerful to be part of your core equity portfolio.

- The fund is great product for SIP investing due to low volatility and better risk-adjusted returns.

About the NFO

- Fund of Funds investing in ETFs

- Benchmark will be Nifty 500 TRI

- Minimum application amount is Rs 5,000

- No exit load

- NFO opens on December 10 and closes on December 24

- Riskometer is Moderately High

Investors should consult with their financial advisors to see if this fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team