Nippon India Nifty Bank and Nifty IT Index Funds NFO: Invest in Banking and IT Sectors

Nippon India Mutual Fund has launched two index funds NFOs – Nippon India Nifty Bank Index Fund and Nippon India Nifty IT Index Fund. Nippon India Nifty Bank Index Fund is a passive fund which will track the Nifty Bank Index, while the IT fund is also a passive fund which will track the Nifty IT index. Both the NFOs opened for subscription on 5th February 2024 and will close on 16th February 2024. In this article, we will review these two Index fund funds NFOs.

What are index funds?

Index funds are passive mutual fund schemes which track a market index. Unlike actively managed mutual funds, Index funds do not aim to beat the market benchmark; they invest in a basket of stocks that replicate the composition of the benchmark index. The cost (Total Expense Ratio) of an index fund is much lower than the TER of active funds. Let us now discuss the two benchmark indices that two Nippon India MF Index funds will be tracking.

Nifty Bank Index

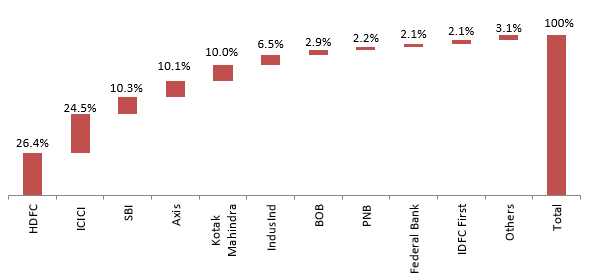

Banking sector is the lifeblood of any economy. Banks provide payments ecosystem for carrying out financial transactions. Companies borrow from banks to fund their working capital and capex. A robust and well functioning banking system is critical for economic growth. Over the past decade, the Government has implemented several policy measures to strengthen our banking system. Nifty Bank Index comprises of 12 large and liquid banking stocks. Nifty Bank Index is a market cap weighted index, which means that the stocks with higher free floating market capitalization has higher weights in the index. The chart below shows the top constituents of the Nifty Bank Index.

Source: National Stock Exchange, as on 31st January 2024

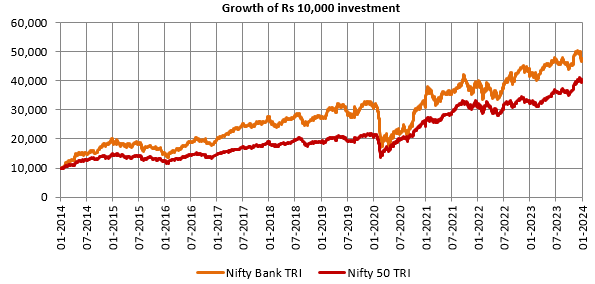

Nifty Bank Index has outperformed over long investment horizons

The chart below shows the growth of Rs 10,000 investment in Nifty Bank TRI and Nifty 50 TRI over the past 10 years. You can see that Nifty Bank Index has outperformed the NIFTY 50 TRI.

Source: National Stock Exchange, as on 31st January 2024

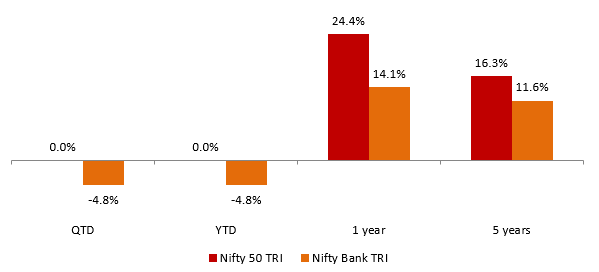

Performance of Nifty Bank TRI

Source: National Stock Exchange, as on 31st January 2024, returns over periods exceeding 1 year are annualized (CAGR).

Nifty IT Index

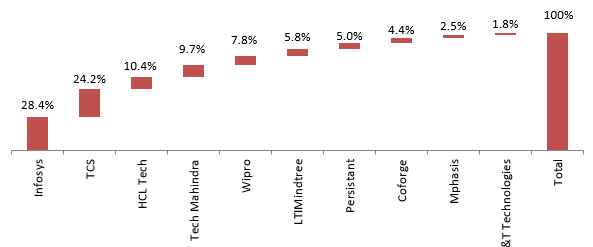

Investing in the Nifty IT Index Fund offers a unique opportunity for investors to gain exposure to India’s thriving information technology (IT) sector. The global spend on IT services, BPM and Software products was $1.9 trillion in CY 2022 out of which 40% is outsourced. India’s share of global outsourced spending is ~57-58%, while there is growth potential and market share gains for Indian IT from - higher spending and outsourcing by Enterprises on IT. Indian IT companies are changing the business mix in favor of digital technologies which now accounts for 30-40% of revenues (FY 2023). The Nifty IT Index comprises 10 companies listed on the National Stock Exchange (NSE). The Nifty IT index is computed using the free float market capitalization method. Companies in this Index have over 50% of their turnover from IT-related activities like IT Infrastructure, IT Education and Software Training, Telecommunication Services and Networking Infrastructure, Software Development, Hardware Manufacturing, Support and Maintenance. The chart below shows the constituents of the Nifty IT Index.

Source: National Stock Exchange, as on 31st January 2024

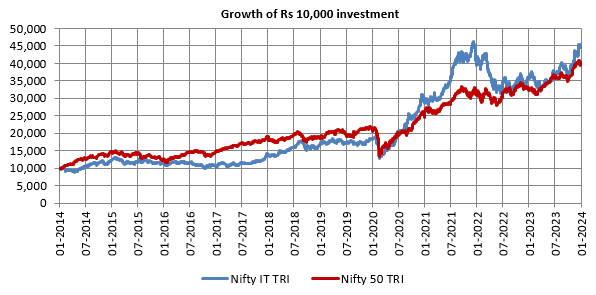

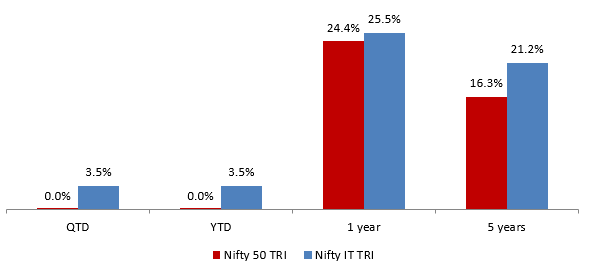

Nifty IT Index has outperformed over long investment horizons

The chart below shows the growth of Rs 10,000 investment in Nifty IT TRI and Nifty 50 TRI over the past 10 years. You can see that Nifty IT Index has outperformed over the last 10 year period.

Source: National Stock Exchange, as on 31st January 2024

Performance of Nifty IT TRI

Source: National Stock Exchange, as on 31st January 2024, returns over periods exceeding 1 year are annualized (CAGR).

Why invest in Nippon India Nifty Bank and Nifty IT Index Funds?

- The Index funds investment strategy & stock selection is clearly defined, holding stocks as per the underlying index in the same weights (subject to expense ratio & tracking error).

- Buying a single unit offers diversification benefit in the entire index companies.

- Generally less expensive than investing in multiple individual securities/actively managed equity fund. (Low cost with respect to Total Expense Ratio).

- Nippon India Nifty Bank Index Fund provides exposure to top 12 large & liquid Banking stocks listed on the National Stock Exchange of India Ltd. (NSE).

- Nippon India Nifty IT Index Fund provides exposure to top 10 Information Technology stocks listed on NSE.

- Elimination of non-systematic risks like stock picking and portfolio manager selection.

- Will also allow non-demat account holders to seek exposure to Banking and IT sectors via investing through Nippon India Nifty Bank Index Fund and / or Nippon India Nifty IT Index Fund.

- You can invest in these funds from your regular savings through SIP.

Who should invest in Nippon India Nifty Bank and Nifty IT Index Funds?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors with very high risk appetites.

- Nippon India Nifty Bank Index Fund – Investors who seek exposure to top stocks in the banking sector.

- Nippon India Nifty IT Index Fund – Investors who seek exposure to top stocks in the IT sector.

- You can invest in either Nippon India Nifty Bank or Nifty IT Index Funds. You can also spread your investment across both the schemes to diversify your exposure.

- You should have minimum investment tenure of 5 years.

- You can invest either in lumpsum or SIP, depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributor if Nippon India Nifty Bank and / or Nippon India IT Index Funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team