Nippon India Nifty Auto and Nifty Realty Index Funds NFOs: Invest in the top performing sectors

Nippon India MF is launching two index funds, Nippon India Nifty Auto Index Fund and Nippon India Nifty Realty Index Fund. As the names suggest, the funds will be tracking the Nifty Auto and Nifty Realty Index respectively. Realty and auto have been among the best performing sector in the last 1 year. Nifty Realty TRI gave 66.2% and Nifty Auto TRI gave 48.8% returns (as on 31st October 2024, source: NSE, Advisorkhoj Research). Both these sectors have outperformed the broad market indices Nifty 50 TRI and Nifty 500 TRI. Automobiles and Realty are also long-term plays since these sectors will be among the key consumption drivers in the India Growth Story.

The NFOs will open for subscription on 14th November 2024 and will close on 28th November 2024. In this article will review these two NFOs.

Nippon India Nifty Auto Index Fund

Nifty Auto Index comprises of 15 stocks from the automobile and automobile related sectors. These include 4-wheeler automobiles, 2 and 3-wheeler automobiles, auto ancillaries, tyres etc. The stocks should be part of the Nifty 500 universe (500 largest companies by market capitalization listed on National Stock Exchange). The index constituents should have a minimum listing history of 1 month as on cutoff date.

The top 15 stocks based on the free-float market capitalization will be selected. Preference will be given to F&O stocks. F&O stocks are those whose derivatives (futures or options) are traded in the F&O market. Single stock weightage capped at 33% and weightage of top 3 stocks shall not be more than 62% at the time of rebalancing. The index is rebalanced semi-annually in March and September.

Nifty Auto Index outperformed Nifty 50

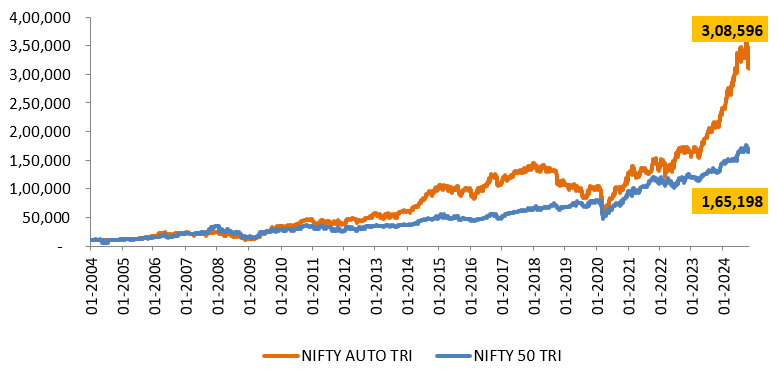

The chart below shows the growth of Rs 10,000 investment Nifty Auto TRI versus Nifty 50 TRI from 1st January 2004 (inception of the Nifty Auto Index) to 31st October 2024. You can see that Nifty Auto Index outperformed the broad market Nifty 50 Index.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.01.2004 to 31.10.2024

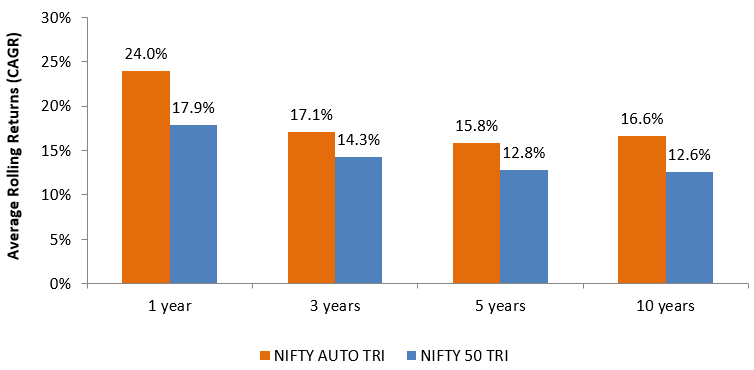

The chart below shows the 1 year, 3 years, 5 years and 10 years average rolling returns of Nifty Auto TRI versus Nifty 50 TRI. You can see that the auto index outperformed Nifty over long investment tenures.

Source: MFI. Period: 01.01.2004 to 31.10.2024

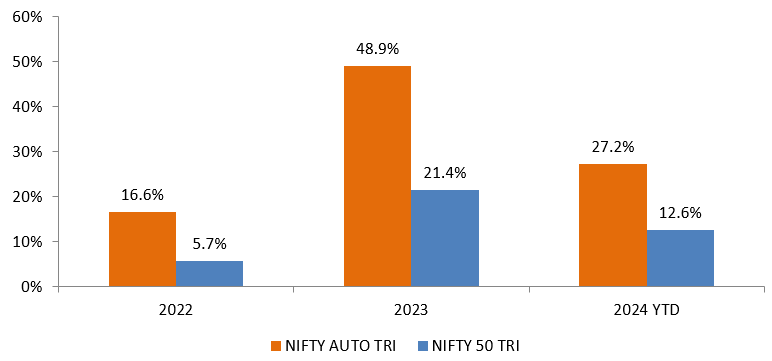

Stronger outperformance post COVID

Source: National Stock Exchange, Advisorkhoj Research, as on 31.10.2024.

Nippon India Nifty Realty Index Fund

Nifty Realty Index comprises of 15 stocks from the real estate sector. The stocks should be part of the Nifty 500 universe (500 largest companies by market capitalization listed on National Stock Exchange). The index constituents should have a minimum listing history of 1 month as on cutoff date. The top 15 stocks based on the free-float market capitalization will be selected. Single stock weightage capped at 33% and weightage of top 3 stocks shall not be more than 62% at the time of rebalancing. The index is rebalanced semi-annually in March and September.

Nifty Realty Index outperformed Nifty 50

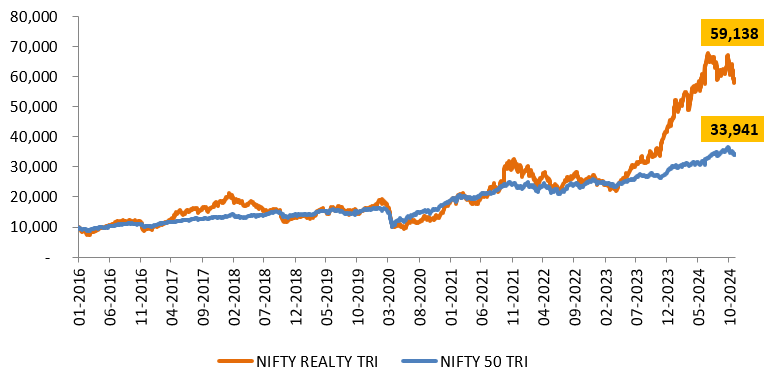

The chart below shows the growth of Rs 10,000 investment Nifty Realty TRI versus Nifty 50 TRI from 1st January 2016 (the year RERA was implemented) to 31st October 2024. You can see that Nifty Realty Index outperformed the broad market Nifty 50 Index.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.01.2016 to 31.10.2024

The chart below shows the 1 year, 3 years, 5 years and 10 years average rolling returns of Nifty Realty TRI versus Nifty 50 TRI. You can see that the Realty index outperformed Nifty over long investment tenures.

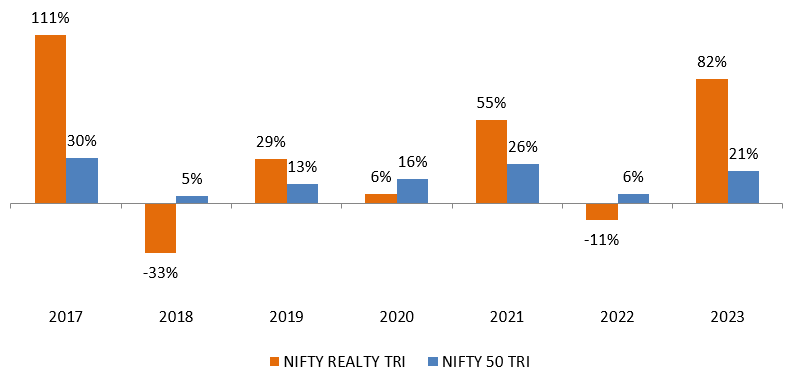

More consistent outperformance post RERA implementation

Nifty Realty Index outperformed Nifty 50 in 4 out 7 years since the implementation of Real Estate Regulation and Development Act (RERA).

Source: National Stock Exchange, Advisorkhoj Research, as on 31.12.2023.

Why invest in Nippon India Nifty Auto and Realty Index Funds?

- Low-cost exposures to the top performing sectors viz. Auto and Real Estate.

- Both Nifty Realty and Auto indices outperformed the broad market index (Nifty 50) over long investment horizon.

- Elimination of non-systematic risks like stock picking and portfolio manager selection.

- Will also allow non-demat account holders to seek passive exposure to Auto and Real Estate sectors.

- Investors can avail themselves of the benefit of investing through Systematic Investment Plan (SIP).

- Nippon India Mutual Fund is one of the leading AMCs with passive products, having a track record of more than 22 years. Nippon India Mutual Fund has comprehensive suite of 46 passive products.

Who should invest in Nippon India Nifty Auto and Realty Index Funds?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors who want to invest in Automobile and Real Estate sectors.

- Investors with high-risk appetites.

- You should have minimum investment tenure of 3 to 5 years.

- You can invest either in Nippon India Nifty Auto Index Fund or Nippon India Nifty Realty Index Fund or both the funds.

- You can invest either in lumpsum or through SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Nippon India Nifty Auto Index Fund and Nippon India Nifty Realty Index Fund are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team