Nippon India Nifty Alpha Low Volatility 30 Index Fund NFO

Nippon India Mutual Fund is launching Nippon India Nifty Alpha Low Volatility 30 Index Fund NFO. This is a passive fund which will track the Nifty Alpha Low Volatility 30 Index. The Nifty Alpha Low Volatility 30 Index is multi-factor index, which will comprise of the top 30 stocks based on alpha and low volatility. The NFO will open for subscription on 1st August 2022 and close on 12th August 2022. If you invest during the NFO period, you will be able to buy units of the fund at par value, i.e. Rs 10. After the NFO period, you can invest in the fund at prevailing Net Asset Values (NAVs).

What is Index Fund?

Index funds are passive mutual fund schemes which track an index. ETFs invest in a basket of stocks which replicate the index the fund is tracking; the percentage weight of stocks in an index funds is the same as the percentage of the stocks in the market benchmark index. Unlike Exchange Traded Funds (ETFs), you do not need demat accounts to invest in index funds. You can buy / sell units of index funds like any other open ended mutual funds.

Benefits of index funds

- The biggest advantage of index funds is low cost. The expense ratios of index funds are much lower than actively managed mutual funds. For the same level of performance of the underlying portfolio, lower costs means high returns for investors.

- There is no unsystematic risk in index funds because they invest in the entire basket of stocks in the index they are tracking, in the same proportion as the market index. Index funds are only exposed to market risks.

- Index funds are highly transparent because they replicate the index. So their portfolio holdings will always be the index constituents. The weight of the holdings will also always be the same as the weights of the index constituents.

- Unlike ETFs, you can invest in Index Funds through Systematic Investment Plans (SIPs). With SIPs, you can start investing with relatively small amounts from your regular savings and invest over long horizons.

What is Nifty Alpha Low Volatility 30 Index?

- Nifty Alpha Low Volatility 30 Index is a strategy index. A strategy index is an index which is based on quantitative investment strategies (using algorithms / models) for specific investment objectives.

- The Nifty Alpha Low Volatility 30 Index invests in top 30 stocks which generate alpha (outperforms the market) and also have low volatility.

- The stocks in the index are selected from the top 150 stocks by free float market capitalization in the National Stock Exchange (NSE). The top 150 stocks by market cap include 100 large cap stocks and top 50 (by market cap) midcap stocks. For the benefit of new investors, top 100 stocks by market cap are classified as large cap stocks by SEBI. 101st to 250th stocks by market cap are classified as midcap stocks.

- Stocks selected in the index should be available for trading in the Futures and Options (F&O) market. They should also have minimum listing history of 1 year.

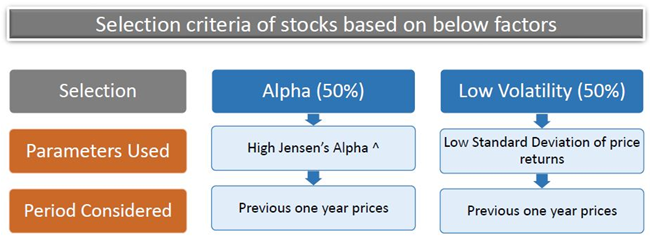

- Top 30 stocks are selected and weighted based on two factors - Alpha (factor weight 50%) + Low Volatility (factor weight 50%). In other words, the stocks in the index have outperformed the market and at the same time have relatively lower volatility (downside risks).

- The index is rebalanced semi-annually in June and December

Nifty Alpha Low Volatility 30 Index stock selection strategy

The index uses a multi-factor model using two factors – Alpha and Volatility. The schematic below shows how the index is constructed using these two factors.

Source: Nippon India Mutual Fund

Benefits of multi-factor model

As mentioned earlier, Nifty Alpha Low Volatility 30 Index is a strategy index. A strategy index uses quantitative models based different investment strategies. The quantitative investment strategies can be based on a single factor or multiple factors – single factor strategy index or multi-factor strategy index. Most strategy indices in both BSE and NSE are single factor indices. However, there are benefits of using a multi-factor model:-

- Single factor-based strategies exhibit cyclicality and may under perform during certain market phases.

- The cyclical component of single factor indices can be mitigated by selecting stocks based on a combination of multiple factors.

- A strategy index based on alpha (higher returns / growth) and low volatility (lower downside risks) has the potential to generate growth and also provide stability.

Why Nippon India Nifty Alpha Low Volatility 30 Index Fund – current market context

The equal market has shown strong signals of consolidation at lower levels and gaining strength. Over the past month or so, the Nifty has rebounded from low of 15,200 levels to 17,150 levels. Indicators in the several market segments signal bullishness in investors. The earnings outlook is positive and economic indicators are also showing strength. We expect Indian equities to perform strongly from the current levels in the medium to long term. While the economic indicators in India are encouraging, there are concerns for the global economy – the US GDP contracted in the last quarter, raising concerns of a recession. While most analysts are bullish about Indian equities, there may be headwinds (volatility) due to global macros. In this market context, Nippon India Nifty Alpha Low Volatility 30 Index Fund, which can provide both long term growth and stability in the short term, can be suitable investment option.

Who should invest in Nippon India Nifty Alpha Low Volatility 30 Index Fund?

- Investors looking for capital appreciation over long investment horizon.

- Investors who want to gain from market growth but want to reduce volatility

- Investors with high to very high risk appetites.

- Investors who have minimum five year investment horizon.

Investors should consult with their financial advisors, if Nippon India Nifty Alpha Low Volatility 30 Index Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team