Nippon India Large Cap Fund: The best performing large cap fund in CY 2023

Market context

Stock market capped of the year 2023 with Nifty and Sensex making record highs in December. The markets cheered Fed’s indication in its December FOMC meeting that there will be multiple rate cuts in 2024. India was the standout outperformer in the emerging markets pack; in CY 2023, MSCI India USD Index (8.6%) outperformed MSCI Emerging Markets USD Index (4.2%) by a large margin (source: MSCI, as on 29th December 2023). The weight of India in MSCI Emerging Market Index is at an all time high of 16.7%, higher than Taiwan, South Korea and Brazil (source: MSCI EM Index factsheet, as on 29th December 2023) and ever more closer to China than in the past. India is expected to receive a large share of FII’s EM allocations.

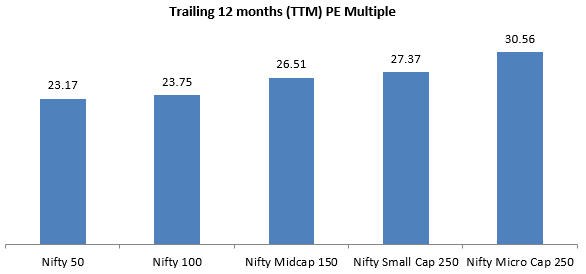

Valuations

2023 was a very strong year for the broader market, especially midcaps and small caps. The Nifty midcap and small indices rallied by 44 – 48% in CY 2023. With the great rally in midcaps and small caps, there may be concerns about valuations in certain pockets of the market. The chart below shows the TTM PE multiples of different market segments compared to broad market index (Nifty 50). You can see that Midcaps and Small caps are trading at significant premiums to large caps.

Source: National Stock Exchange, as on 29th December 2023

What are large cap funds?

According to SEBI, the 100 largest stocks by market capitalization are classified as large cap stocks. The market capitalization of large cap stocks range from Rs 690 billion to Rs 18 trillion (source: AMFI, as on 31st December 2023). They are amongst the biggest companies in India and are household names. Large cap funds invest 80% of their assets in large cap stocks. In this article, we will review Nippon India Large Cap Fund, one of the best performing large cap funds in the last 1 to 5 years. It was the best performing large cap fund in CY 2023.

About Nippon India Large Cap Fund

Nippon India Large Cap Fund was launched in August 2007 and has Rs 20,218 crores of assets under management (AUM) as on 31st December 2023. The expense ratio of the scheme is 1.68%. The scheme is helmed by veteran fund manager Shailesh Raj Bhan and Ashutosh Bhargava. Mr Bhan has been managing the scheme since inception.

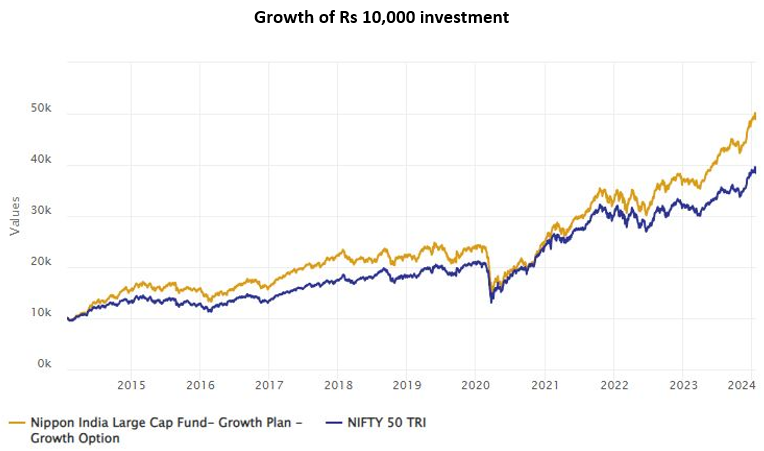

Wealth Creation by Nippon India Large Cap Fund

Rs 10,000 invested in Nippon India Large Cap Fund 10 years back would have multiplied nearly 5 times (as on 21st January 2024). The CAGR return of the scheme over the last 10 years was 17.3%, while that of the Nifty was 14.5%.

Source: Advisorkhoj Research (as on 21st January 2024)

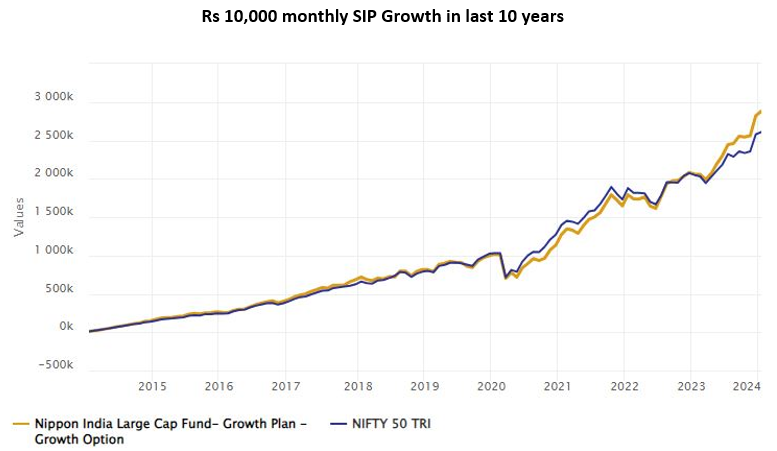

Wealth creation through SIP

The systematic investment plan (SIP) performance of the scheme over the last 10 years is equally impressive. A monthly SIP of Rs 10,000 in Nippon India Large Cap Fund would have grown to nearly Rs 29 lakhs in market value (as on 21st January 2024) with a cumulative investment of just Rs 12 lakhs. The annualized SIP return (XIRR) of the scheme was 16.62%.

Source: Advisorkhoj Research (as on 21st January 2024)

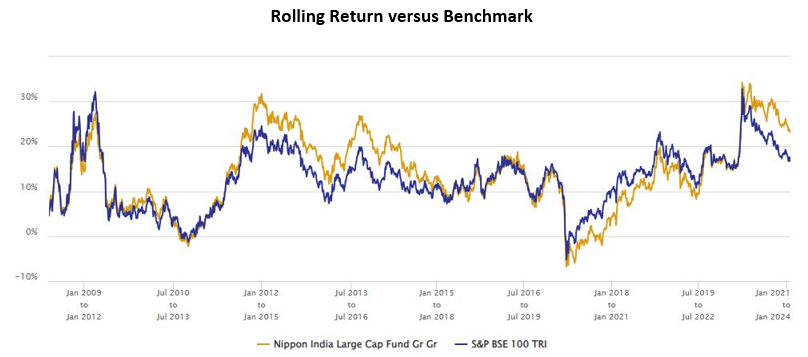

Rolling Returns

As mentioned earlier in our blog, rolling returns is the most unbiased measure of mutual fund performance. The chart below shows the 3 year rolling returns of Nippon India Large Cap Fund versus the scheme benchmark since the inception of the scheme. We have chosen to show 3 year rolling returns of the scheme because we think investors should have at least 3 year investment horizons when investing in equity funds. You can see that the scheme outperformed its benchmark most times.

Source: Advisorkhoj Research (as on 21st January 2024)

Consistent top quartile performer

The chart below shows the quartile ranking of Nippon India Large Cap Fund for the last 10 years. You can see that the scheme was in the top 2 quartiles, 7 times in the last 10 years. The scheme has been ranked in the top quartile for 3 consecutive years.

Source: Advisorkhoj Research (as on 29th December 2023)

Why invest in Nippon India Large Cap Fund now?

- FII have been sellers for the past 3 years i.e. CY 2021, 2022 and 2023. With India firmly establishing itself as a standout performer in the EM pack we may see large FII flows in 2024.

- India’s inclusion in global EM debt indices may have a positive impact on FII equity flows also. A very large portion of FII flows will go into large caps, since foreign investors prefer to invest in large cap stocks, either through active or passive route.

- Retail assets under management (AUM) from large cap to mid / small cap MFs in CY 2023. We may see trend reversal and portfolio rebalancing in CY 2024. This will boost large cap returns.

- Large caps are trading at more reasonable valuations compared to midcaps and small caps.

- Nippon India Large Cap Fund has consistently created alphas over long investment tenures.

Who should invest in Nippon India Large Cap Fund

- Investors who are looking for long term capital appreciation.

- This scheme is suitable for your long term financial goals like retirement planning, children’s higher education, children’s marriage, wealth creation etc.

- This scheme is also suitable for young or new investors since large funds are less volatile than flexicap, midcap or small cap funds.

- You need to have moderately high to high risk appetite for this scheme.

- You need to have minimum 5 years or longer investment horizon for this scheme

- Investors should consult with their financial advisors if Nippon India Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team