Nippon India Growth Fund: More than 110 X returns since inception

If you had invested Rs 1 lakh in Nippon India Growth Fund in its NFO in October 1995, your money would have multiplied to more than Rs 1.1 Crore. Nippon India Growth Fund is undoubtedly one of the biggest wealth creators for mutual fund investors in India over the last 25 years or so. The phenomenal wealth creation story of Nippon India Growth Fund boosted confidence of retail investors in equity mutual funds in general and midcap mutual funds in particular. Reliance Growth Fund was launched in October 1995 and has an AUM of over Rs 6,800 crores.

Strong performance in difficult conditions

The last 2 years have been very difficult for midcap segment of the equity market with BSE Midcap Index falling nearly 19%, but Nippon India Growth Fund was able to limit the downside risk for investors to a large extent falling only 4%. Despite recovery in the last quarter of the calendar year, BSE Midcap index ended lower by around 2% but Nippon India Growth Fund was able to generate positive returns for investors (6.4%). The outperformance of the fund in difficult market conditions highlights superior fund management abilities. Over the last 3 years, Nippon India Growth Fund gave double digit returns (10 %+).

The strong performance of this scheme over time can be attributed to bottom up stock picking approach of the different fund managers of this scheme, focusing on individual midcap stocks which later turned out to be multi-baggers. The bottom up approach worked wonders for Reliance Growth Fund and the scheme has given nearly 22% CAGR returns since inception. The chart below shows the returns of Nippon India Growth Fund versus its benchmark, scheme category and other asset classes over different trailing time-scales (ending 3rd January, 2019). Please note that returns over time periods exceeding 12 months have been annualized. You can see that the scheme was able to outperform the benchmark and category over different time-scales. You can also see that the scheme was able to beat the returns of different asset classes over long investment horizons.

Source: Advisorkhoj Research

Rolling Returns of Nippon India Growth Fund

The chart below shows the 3 year rolling returns of Nippon India Growth Fund versus the benchmark BSE Midcap Index over the last 5 years. You can see that, though the scheme underperformed versus the benchmark in the initial part of the period, it has consistently outperformed the midcap index since the middle of 2016. The reason for underperformance of Nippon India Growth Fund in the initial part of the above mentioned period was the market cap mix of the scheme portfolio. Though Nippon India Growth Fund was historically a midcap fund, the fund managers adopted a large cap tilt in the portfolio in the aftermath of the stock market crash of 2008, which affected midcap stocks severely. This was consciously done to improve liquidity and provide stability to investors. At one point of time, Nippon India Growth Fund had more than 50% allocation to large cap. Over the last 2 to 3 years, the scheme is being again managed as a midcap fund. As per SEBI rules which came into effect in 2007, midcap funds are required to have minimum 65% allocation to midcap stocks.

Source: Advisorkhoj Research

Let us now see the 3 year rolling returns of Nippon India Growth Fund versus midcap funds category over the last 5 years. You can see that the scheme has consistently beaten the midcap fund category rolling returns average. The fund gave average 10.6% CAGR rolling returns over 3 year investment periods. The maximum 3 year CAGR rolling return was 16%.

Source: Advisorkhoj Research

SIP Returns of Nippon India Growth Fund

The chart below shows the returns Rs 10,000 monthly SIP in Nippon India Growth Fund over the last 20 years. We have compared returns of the SIP in the scheme with returns of similar SIP in Gold. The chart below shows the wealth creation potential of the scheme through the SIP route. The current market value of the SIP is Rs 2.8 crores with a cumulative investment of just Rs 24 lakhs. On the other hand, the SIP in gold would have grown to around Rs 80 lakhs only. This chart also shows why equity is the best asset class for long term investors.

Source: Advisorkhoj Research

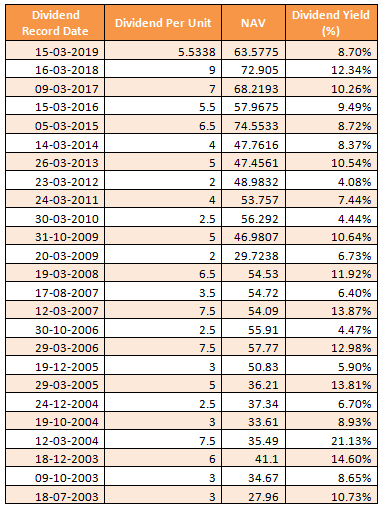

Dividend Payout Track Record

The scheme has been paying regular dividends for many years now. It did not skip dividends even in the bear market years. However, the dividend yield will depend on the scheme performance, since mutual fund dividends can be paid only from the accumulated profits. Although your mutual fund scheme may have been paying regular dividends in the past, you should always factor in the possibility of the scheme changing the dividend payout rate or not paying dividends during a certain period in your financial planning. Investors should also know that, while dividends are tax free in your hands, AMCs have to pay 10% Dividend Distribution Tax (DDT) before paying dividends to you.

Source: Advisorkhoj Research

Outlook

The last 2 years have been rough for midcap funds, but price movement over the last 3 months indicates that midcaps have bottomed out. Historically, midcaps have given very strong returns from sharp corrections. The concerns regarding the Indian economy is known to many readers. Therefore, one should be patient and have a sufficiently long investment horizon particularly when investing in mid cap mutual funds. The market represents the collective wisdom of all investors and one should respect it. The market’s resilience despite weak economic data shows bullishness about the long term prospects of the Indian economy and the Government’s willingness to push through structural reforms. We believe midcaps will be biggest beneficiaries of economic reforms in the long term. As such, we in Advisorkhoj believe that this is a good time for investors to increase their allocations to midcap funds with a sufficiently long (minimum 5 years) investment horizon. You must read – Should you invest in midcap mutual funds now

Summary

If you look at the historical long term returns of equity mutual fund schemes, you will see that midcap funds have been one of the biggest wealth creators over very long investment tenures. The wealth creation story of Nippon India Growth Fund (erstwhile Reliance Growth Fund) over the past 24 years is one of the best examples. The scheme will celebrate its 25th anniversary later this year. The current fund management team of Dhrumil Shah, Manish Gunwani and Tejas Sheth is very experienced and have a fantastic long term track record of managing a number of top performing funds. Nippon India Growth Fund is suitable for your long term financial goals like retirement planning, children’s education, children’s marriage etc. SIP is the ideal investment mode for this scheme but investors can take advantage of deep corrections to tactically increase their midcap allocations by investing in lump sum. Alternatively, one may also look at the STP route to invest in this scheme.

Suggested reading – How mutual fund Systematic Transfer Plans help invest in volatile markets

Investors should consult with their financial advisors if Nippon India Growth Fund is suitable for their long term investment needs

You must also read – What are mid and small cap mutual fund investing myths

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team