Nippon India Dynamic Bond Fund: Rolling down strategy for good long term returns

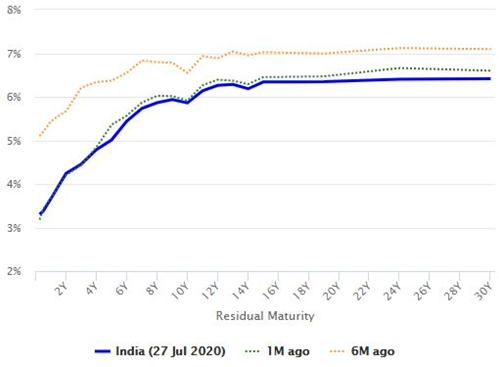

With banks reducing FD interest rates, we are seeing investor interest in debt mutual funds over the last few months. However, many investors are concerned about credit risks affecting debt funds. With the economy contracting and company revenues severely hit in the wake of COVID-19 pandemic credit risk concerns are likely to remain and credit quality will be one of the most important considerations for investors. Another concern for investors who prefer shorter duration funds to avoid interest rate risk is falling yields (please India’s yield curve below). You can see that the decline in yields is more towards the shorter maturity end of the yield curve.

Source: worldgovernmenbonds.com

Nippon India Dynamic Bond Fund offers a good fixed income solution for long term investors by addressing the concerns above through the following strategy:-

- Ensuring very high credit quality by investing primarily (more than 95% currently) in State Development Loans (SDLs). The only difference between Government Securities and SDLs is that while the former is issued by the Government of India, the latter is issued by State Governments. Like G-Secs, SDLs do not have any credit risk i.e. they have sovereign status – the interest and principal in SDLs are part of State Government Budgets.

- From a yield perspective, SDLs are attractive because they are available at a spread of 50 – 70 basis points over G-Secs. Therefore, you get higher returns with no additional risk.

- Locking higher yields by investing in longer duration bonds. Average portfolio maturity of Nippon India Dynamic Bond Fund is 10 – 10.5 years. Duration of the scheme is 6.5 – 7 years.

- Neutralizing interest rate risk by holding securities till maturity.

- Scheme will roll-down in terms of maturity, in other words, duration of the portfolio will reduce over the investment tenure reducing interest rate risk over time, while you continue to enjoy higher yields. We will discuss this in more details in the next section.

- Investors can lock-in gross yields of 6.5 – 6.6% over investment tenure of 10 years by investing now.

How does rolling down maturity works?

The normal shape of yield curve is upward sloping, i.e. longer the maturity, higher the yield. Let us assume you invest in a 3 year bond trading at 6.7% yield and after 1 year, the yield of 2 year bonds is 6.5%. So after 1 year, your 3 year bond will effectively be a 2 year bond but with additional 0.2% yield. Since the duration of the bond reduces over time, the interest rate risk also reduces. At the same time, the price of the bond appreciates because investors will be ready to pay more for an older bond with higher yield and same residual maturity as a newer bond with lower yield.

Benefits of roll-down

- Certainty/Visibility of Returns, if investments held till maturity

- Long-term locking in of prevailing interest rates

- Insulation from future reduction of interest rates

- Interest rate risk will reduce over investment tenure

- Flexibility to withdraw investments anytime, at prevailing market prices

- Tax efficiency due to Indexation Benefit, applicable after 3 years

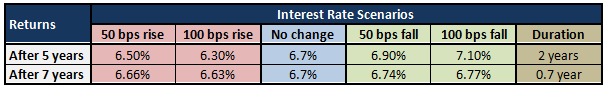

Return of Nippon India Dynamic Bond Fund in different interest rate scenarios

The table below shows the expected fund returns in different interest rate scenarios. From the analysis shown below you can see that the downside is limited, if you stick to the investment horizon of the fund.

Source: Nippon India MF

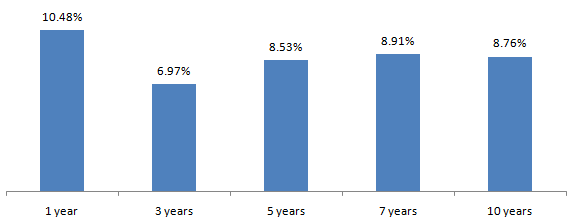

Performance of Nippon India Dynamic Bond Fund

The chart below shows the trailing returns of Nippon India Dynamic Bond Fund over different investment periods ending 24th June 2020. You can see the performance of the scheme has been consistently good.

Source: Advisorkhoj Research

Conclusion

Nippon India Dynamic Bond Fund was launched in 2004 and has around Rs 764 Crores of assets under management. The expense ratio of the scheme is 0.68%.

What distinguishes this scheme from most of the other dynamic bond funds is that this scheme used rolled down maturity strategy versus active duration management strategy used by most schemes.

As discussed in this article roll down strategy provides visibility into returns if your investment tenure matches with the scheme’s maturity profile. Roll down strategy also minimizes volatility if held till ‘intended maturity period’. Finally, you can enjoy benefits of long term capital gains taxation of debt funds if you remain invested for 3 years or longer. Investors should consult with their financial advisors if Nippon India Dynamic Bond Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team