NRIZEN curated fund baskets off to a great start: Outperformed the benchmarks

2024 has been a very interesting year for the Indian stock market. While the broad trend of the market has been bullish, we have also seen periods of volatility in certain pockets and even in the broad market. In the first half of the year Nifty 50 TRI (Total return Index) gave 11.3% return while the broader market outperformed Nifty (Nifty 500 was up 15.4%).

At the beginning of this year, mutual fund industry veteran Ritesh Jain and Eastern Financiers, one of the leading wealth management firms in India launched https://www.nrizen.com/ curated funds’ portfolios for Non-Resident Indian (NRI) investors. Ritesh selected funds in his model portfolios for NRI investors based on his broad macro views which focused on the following themes, which could create alphas in investors’ portfolios:-

- High nominal GDP

- Import substitution

- Manufacturing

- Big push to electronics and alternate energy

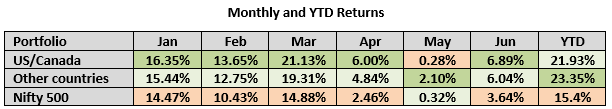

Traditional diversified equity mutual fund schemes still have a tilt towards services sector which account for more than 50% of India’s GDP. However, Ritesh has strong conviction in manufacturing led India Growth Story. Funds curated by him have a pronounced manufacturing tilt. Ritesh has developed two fund baskets (portfolios) with his curated funds, one for US / Canada residents and one for NRIs in other countries. Both the curated funds’ portfolios have given 20%+ YTD returns (as on June 30th 2024) beating the broad market index Nifty 500 in almost every month of the year and on an YTD basis. 100% of the funds in the US / Canada NRI basket and around 70% of the funds in the basket for other countries were able to beat their benchmarks in Q1 and Q2.

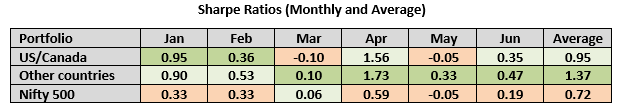

Both the curated funds portfolios outperformed the broad market index Nifty 500 TRI even on the basis of risk adjusted returns, measured in terms of Sharpe Ratios.

The performance of Ritesh Jain’s fund basket, with 80 – 90% of the curated funds beating their benchmarks, is even more impressive when compared to the performance of the universe of diversified equity mutual funds in India, where only 60% or so of the funds were able to beat their benchmarks. The performance of our model portfolios across different market conditions strengthens conviction in Ritesh Jain’s investment theme. Investors should be prepared for some volatility in the near term due to profit booking at higher levels and uncertainty regarding timing of interest rate cuts. However, we remain confident that model portfolios will continue their strong performance and create alphas for investors in the long term.

Investors (both resident Indians / Non-resident Indians / OCI’s) looking to invest in Ritesh Jain’s Model portfolio of Indian mutual funds can register at nrizen.com and invest online through the portal.

About Ritesh Jain, Founder NRIZEN and Co - Founder PineTree Macro.

Mr. Ritesh Jain is a well-known Investment Professional with over 20 years of experience in investment management. He has successfully developed asset allocation policies and risk management frameworks, using his extensive market experience to manage funds and grow investor wealth. He completed his Master of Business Economics (MBE) from India and Executive MBA degree from Haskayne School of Business (University of Calgary) and specialized courses from New Austrian school of economics, Munich Germany.

Ritesh has held many senior leadership roles including CIO - BNP Paribas Mutual Fund, where he was in charge for managing assets equivalent to US$1.2 billion and CIO - Tata Mutual Fund, where he was responsible for managing investor's assets equivalent to US$ 6 billion, in Equity and Fixed Income. He is currently co-founder of PineTree Macro, a global asset allocation theme investing fund, set up with an objective of enhancing investor portfolios with geographic diversification. The fund monitors international capital flows to pinpoint asset types that benefit from shifting macro trends. Ritesh is also a Director and Strategic Advisor of Eastern Financiers India Ltd, a wealth manager managing Indian assets worth USD $500 million. Additionally, he serves as the economic advisor to Old Bridge Capital Management, an HNI-focused portfolio management company that oversees Indian assets worth USD $1.1 billion.

He was listed as one of the top three economic and financial influencers on LinkedIn in 2019. He is also a recipient of numerous national and international awards in the field of fixed income and equity investments. Being an avid reader, he is regularly quoted in local and global print media. He regularly features in electronic and print media as guest speaker covering Global macro highlights.

Disclaimer: Advisorkhoj is one of the leading mutual fund research portals in India. The note on Ritesh Jain’s (NRIZEN) curated fund baskets reflects our in-house view and is for general information purposes only; views expressed should not be taken as specific investment recommendations. The Risk Level of any scheme must always be commensurate with the risk profile, investment objective or financial goals of the investor concerned. We have gathered all the data, information, statistics from the sources believed to be highly reliable and true. All necessary precautions have been taken to avoid any error, lapse or insufficiency; however, no representations or warranties are made (express or implied) as to the reliability, accuracy or completeness of such information. Advisorkhoj cannot be held liable for any loss arising directly or indirectly from the use of, or any action taken in on, any information appearing herein. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Past performance may or may not be sustained in the future. Investors should always invest according to their risk profile and consult with their mutual fund distributors or financial advisors before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team