Mutual Fund Review: Birla Sunlife MNC Fund

Morningstar recently announced the Morningstar India Fund Awards, recognising funds and fund houses that added the most value for investors within the context of their relevant peer group in the past year and over longer time periods. Morningstar named eight fund category winners and three Mutual fund house winners by applying a quantitative methodology, with a qualitative overlay, which emphasizes one-year performance but also considers the three- and five-year performance history of all eligible funds. For more details on the Morningstar India Fund Awards winner, please visit our news story on Morningstar India Fund Awards 2014.

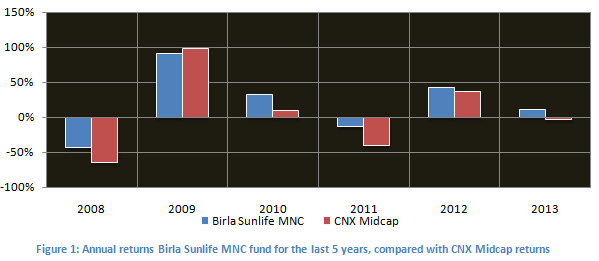

In this article, we will review the Morningstar award winner of the best small and midcap fund. The three finalists in the small and midcap categories were Birla Sunlife MNC Fund, SBI Magnum Global Fund and UTI MNC fund. The winner of the category was Birla Sunlife MNC Fund. Birla Sunlife MNC Fund has given a very strong performance over the last 5 years. It has not only done very well in capturing the upside in bull markets, but has also limited its downside in the bear markets. See the chart below for annual returns of the fund for the last 5 years, compared with benchmark (CNX Midcap returns).

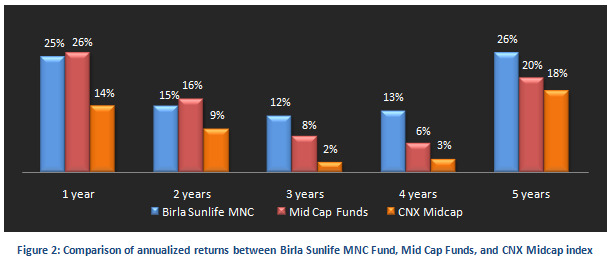

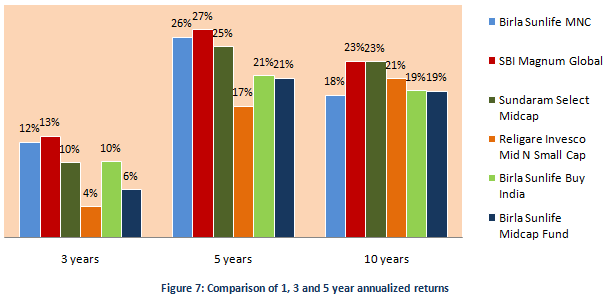

In terms of trailing annualized returns, this fund has outperformed the small and midcap funds category and the benchmark over the 3 to 5 year time periods. Please see the chart below. NAVs as on Apr 25.

Birla Sunlife MNC Fund – Fund Overview

This fund is suitable for investors with a long time horizon, looking for high capital appreciation for long term financial objectives like, retirement planning, children’s education, marriage etc. The fund was launched in December 1999. It has an AUM base of about Rs 490 crores. The expense ratio of this fund is slightly on the higher side at 2.65%. The fund manager of this scheme is Ajay Garg. The scheme is open both for growth and dividend plans. The current NAV (as on Apr 25 2014) is 303.19 for the growth plan and 89.45 for the dividend plan.

Portfolio Construction

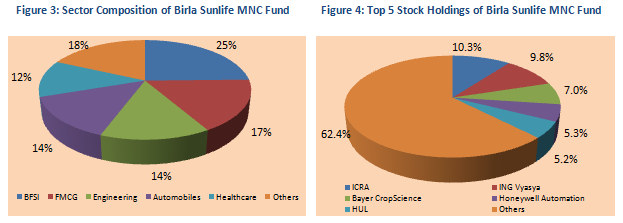

The fund invests in diversified portfolio of MNC stocks with high growth potential. While the fund manager has a high growth focus, he has constructed a balanced portfolio which limits volatility on the downside. This has enabled the fund manager to give strong returns across both bull and bear market cycles. In terms of sector allocations, the portfolio is biased towards cyclical sectors like BFSI, Engineering and Automobiles. However, the portfolio has substantial allocations to defensive sectors like FMCG and Healthcare. In terms of company concentration, the portfolio is well diversified with its top 5 holdings, ICRA, ING Vyasya Bank, Bayer CropScience, Honeywell Automation and Hindustan Unilever, accounting for about 38% of the total portfolio value.

Risk & Return

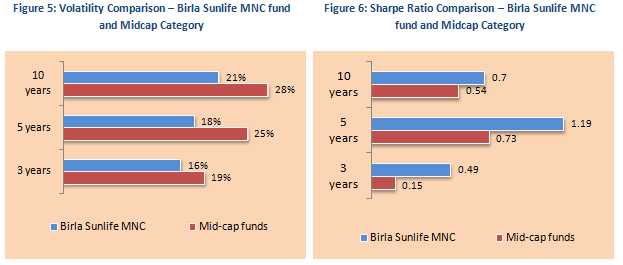

From a risk perspective, the volatility of the Birla Sunlife MNC fund is on the lower side relative to the small and mid cap funds category. The annualized standard deviations of monthly returns of the fund for three, five and ten year periods are in the range of 16% to 21%, which is much lower than the standard deviations of small and mid cap category over the same time periods. While the volatility of the fund is lower than that of the category, the returns over the three to five time periods are higher than the small and midcap funds category (see Figure 2). This makes a fund a consistent performer and an attractive pick for investors from a risk reward perspective. On a risk adjusted basis, as measured by Sharpe Ratio, the fund has outperformed the small and mid cap funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See charts below for comparison of volatilities and Sharpe ratios between Birla Sunlife MNC fund and small and midcap funds category.

Comparison with Peer Set

A comparison of annualized returns of Birla Sunlife MNC fund versus its peer set over three, five and ten year time periods shows why this fund is considered a top pick in its category. See chart below for comparison of annualized returns over one, three and five year periods. NAVs as on Apr 25 2014.

The Birla Sunlife MNC fund outperformed most of its peers, except SBI Magnum in the 3 and 5 year time periods. Its performance, even in terms of 10 years trailing returns, is quite good at 18.4%.

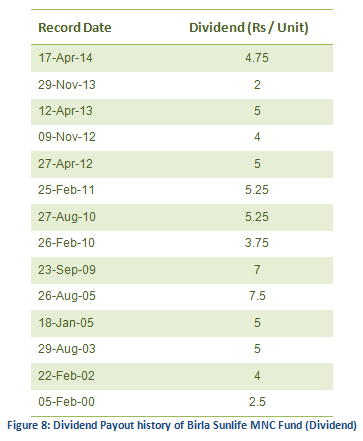

Dividend Payout Track Record

Birla Sunlife MNC fund Dividend Plan has a good dividend payout track record. It is has paid dividends every year for the last 5 years. Since its inception in Dec 1999, the fund has missed paying dividends only in 2001, 2004, 2006, 2007 and 2008. See the table below for the dividend payout track record of the Birla Sunlife MNC fund, Dividend Plan since its inception.

SIP and Lump Sum Returns

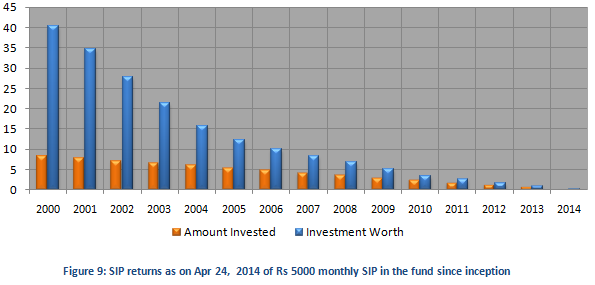

The chart below shows returns as on Apr 24 2014 (NAV of 303.19) of Rs 5000 monthly SIP in the Birla Sunlife MNC fund Growth Plan, for respective years since inception (in December 1999). The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs.

The chart above shows that a monthly SIP of Rs 5000 started on Jan 2000 in the fund would have grown to over Rs 40 lakhs, while the investor would have invested in total only Rs 8.4 lakhs. The IRR of the SIP is 17.8%. If the investor had invested a lump sum amount of Rs 1 lakh in the NFO in December 1999, his or her investment would have grown to over Rs 30 lakhs.

Conclusion

The Birla Sunlife MNC fund won this year’s Morningstar award for the best small and midcap fund. This fund has completed 14 years, and has a track record of strong performance. With the improving sentiments in the Indian equity markets, fund seems poised to deliver even stronger performance in the future. Investors with high risk tolerance can consider investing in the fund through the systematic investment plan (SIP) or lump sum route for their long term financial planning objectives. Investors, who prefer regular tax free dividends, can invest in the dividend plan of the fund. Investors should consult with their financial advisors if this fund is suitable for their investment portfolio, in line with their risk profiles.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team