Mutual Fund Pension Plans

What is a pension plan?

A pension plan is an annuity product which generates income during retirement. At a very high level there are two types of pension plans:

Immediate annuity plans:

These plans start paying fixed annuities from day one. These plans are preferred by investors who receive a large sum as superannuation benefit post retirement. The investors choose to invest the proceeds in a pension plan so as to generate safe and regular income for the rest of his or her life. There are only a few immediate annuity plans in India, such as LIC Jeevan Akshay, ICICI Prudential Immediate Annuity, HDFC Immediate Annuity etc.Deferred annuity plans:

These plans defer annuity payments till the time, a retirement corpus been accumulated. These plans have an accumulation phase during which investors invest regularly while they are working, and then a distribution phase when they start withdrawing money to meet their income needs during their retirement. Most pension plans products available in India are of the deferred annuity type. These products include the National Pension scheme funds, deferred annuity plans offered by insurance companies (e.g. LIC Jeevan Tarang, LIC Jeevan Nidhi etc.) and pension plans offered by Mutual Funds.

In this article we will focus on pension plans offered by mutual funds.

What is Mutual Fund Pension Plan?

Pension plans offered by Mutual Funds do not get as much of mention, compared to the other retirement planning solutions. These funds are similar in nature to balanced funds, in that the portfolio has both a debt and an equity component. However, unlike balanced funds the equity exposure and portfolio risk is much lower. While most balance funds have 60 – 70% of their portfolio invested in equities, pension plans have only 40% or so invested in equities. The balance is invested in fixed income securities. Investors can invest either in lump sum amounts or through systematic investment plans. Post retirement the investors can withdraw their corpus on a lump sum basis or through systematic withdrawal plan chosen intervals (e.g. monthly, quarterly etc.) for regular income during retirement. The balance units post withdrawals in either case remain invested and continue to grow.

Benefits of Mutual Fund Pension Plans as retirement planning solution:

- With higher allocation to equities (around other products), mutual funds pension plans can generate superior returns in the long run compared to other products like PPF, NPS, insurance plans etc

- Due to higher returns, Mutual fund pension plans offer a hedge against inflation

- Charges of mutual fund pension plans are much lower compared to insurance products

- Investments in Mutual Fund pension plans qualify for Section 80C benefits, under Income Tax Act

Disadvantages of Mutual Fund Pension Plans

- There is limited flexibility, with heavy exit load of up to 3%, in case of withdrawal before 58 years of age

- The returns on investments are not tax free, unlike some other products like PPF

- NPS offers slightly higher allocation to equities (50%) compared to 40% in the mutual fund pension plans. However, the Tata Retirement Savings Fund offers an aggressive equity allocation option (up to 85%)

- There is not a wide array of choices available in the market

Mutual Fund Pension Plans in India

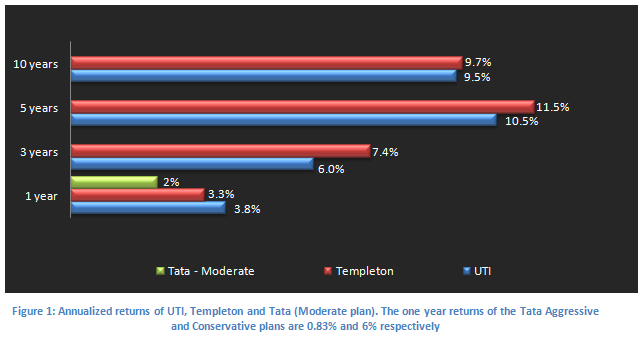

Pension plans offered by Mutual Funds do not get as much of mention, compared to the other retirement planning solutions like PPF, Insurance Plans etc. This is surprising, since the 5 to 10 year investment returns from mutual fund pension plans are quite good. UTI Retirement Benefit Pension Fund was the first fund to be launched in this space in 1994, followed by Templeton India Pension Plan in 1997. After a gap of 15 years, Tata Mutual Fund came out with a retirement savings fund in November 2011. On a 5 year annualized basis, these plans have delivered returns of around 10%.

The funds from UTI and Templeton have around 40% of their assets allocated to equity, while the balance is invested in fixed income securities. The equity portion of both these schemes investment in both the schemes is concentrated in large-cap stocks in the equity portion, whereas the fixed income has more of corporate bonds and government securities.

The Tata scheme offers three options:

- Progressive plan in which the minimum equity investment of 85%

- Moderate plan in which the equity investment is around 75%

- Conservative plans offer equity exposure ranging from 0-65%

The scheme automatically switches from one plan to another depending on the investor's age. At age of 45, investments under the progressive plan automatically switch to the moderate plan, while at the age of 60 investments in the moderate plan are switched to the conservative plan.

The chart below shows the 1, 3, 5 and 10 year annualized returns of the three comparable plans, UTI, Templeton and Tata (Moderate plan)

UTI Retirement Benefit Pension Fund:

This is one of the earliest schemes, launched in 1994 and has nearly Rs 990 crores assets under management. The expense ratio is only 2.12%. There is no entry load. An exit load of 5% is levied if the investor exits within one year, 3% if the exit is between one to three years and 1% thereafter, until retirement. Manish Joshi and V. Srivatsa are fund managers. The portfolio mix comprises 38% equity, 44% debt and 18% money market instruments.Templeton India Pension Plan:

This scheme launched in 1999 has Rs 244 crores assets under management. It has an expense ratio of 2.45%. There is no entry load. An exit load of 3% is levied if the investor exits before retirement. Anand Radhakrishnan, Anil Prabhudas, Sachin Desai and Umesh Sharma are the fund managers. The portfolio mix is 36% equity, 50% debt and 14% money market instrumentsTata Retirement Savings Plan:

This is the newest scheme. It has Rs 38 crores, Rs 10 crores and Rs 1.9 crores assets under management for the progressive, moderate and conservative plan respectively. For entry and exit loads please refer to the offer documents. While the portfolio mix is heavily weighted towards equity at 89% in the aggressive plan, equity allocation is 77% in the moderate plan and only 19% in the conservative plan.

Tax Implications for Mutual Fund Pension Plans

UTI Retirement Benefit Pension Fund and Templeton India Pension Plan provide tax savings of up to Rs 1 lakh under Section 80C. However, Tata Retirement Savings Fund is not a tax-saving instrument as its features are different from the above two. Returns from all the above three schemes are taxable.

Summary

In summary, while on an absolute basis the returns of these pension plans is not as attractive as equity funds, on a risk adjusted return basis their performance is quite good, especially compared to other pension products available in the market. Higher equity market returns over the long term make these products an effective inflation hedge for retirement. The UTI Retirement Benefit Pension Fund and Templeton India Pension Plan are suitable for investors with moderate risk profiles, while Tata offers variety of options for investors with different risk profiles. You should consult with your financial advisor if these products are suitable for your retirement objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team