Mirae Asset Tax Saver Fund: Best performing ELSS Fund in last 3 years

Mirae Asset Tax Saver Fund has emerged as the best performing tax saving mutual fund (ELSS) in the last 3 years (please see, Top Performing Mutual Funds (Trailing returns) - Equity: ELSS). If you had invested Rs 1 Lakh in the scheme three years back, then your investment value today (as on February 17) would have been Rs 1.72 Lakhs, a profit of Rs 72,000 (based on NAV of 15/02/2019).

If you add tax savings benefit to the profit, for investors in the higher tax brackets, the gain would be Rs 1 Lakh or higher. For ELSS fund investments, taxpayers can claim deductions of up to Rs 1.5 Lakhs from the gross taxable income under Section 80C of Income Tax Act 1961.

Mirae Asset Tax Saver Fund, though a relatively new scheme, has established a strong performance track record. The chart below shows the trailing returns of the scheme versus benchmark (BSE 200 TRI) and the ELSS category over different time-scales and since inception.

Source: Advisorkhoj Research

The scheme was launched in December 2015 and has Rs 1,315 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.3%. Neelesh Surana is the fund manager of this scheme. The chart below shows the NAV growth of the scheme since inception.

Source: Advisorkhoj Research

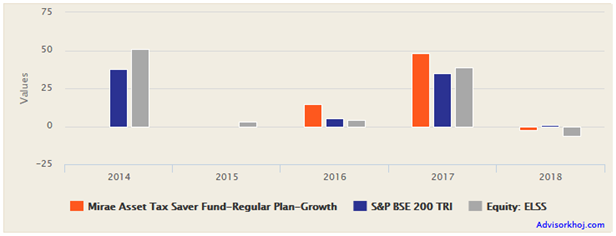

Mirae Asset Tax Saver Fund has outperformed the ELSS category every year since inception. The chart below shows the annual returns of the scheme versus the benchmark and category since inception.

Source: Advisorkhoj Research

Performance consistency

Regular Advisorkhoj readers know that, we give a lot of importance to performance consistency in fund selections. We have developed a tool, which determines quartile rankings of a fund each year, over several years and rank them according to quartile ranking consistency over several years. Please see our tool, Top 10 mutual funds in India - Equity: ELSS. You can see in this tool that Mirae Asset Tax Saver Fund is one of most consistent ELSS funds. The fund has always ranked in the top quartile since inception including current year to date.

We also look at performance consistency using rolling returns. Rolling returns is one of the best measures of performance consistency in mutual funds. Unlike point to point returns which are biased by prevailing market conditions, rolling returns measure scheme performance versus benchmark and category across different market conditions. The chart below shows the 1 year rolling returns of Mirae Asset Tax Saver Fund versus the benchmark S&P BSE 200 TRI since inception of the scheme.

Source: Advisorkhoj Research

You can see in the chart above that Mirae Asset Tax Saver Fund outperformed the benchmark most of the times since inception. This demonstrates the ability of the fund manager to create alphas consistently over sufficiently long investment tenors. The chart below shows the 1 year rolling returns of the scheme versus the ELSS category average since the inception of the scheme.

Source: Advisorkhoj Research

You can see that the scheme outperformed the category 100% of the times since its inception, a hallmark of very strong performance. The average one year rolling returns of the scheme since inception is 23%, while the median one year rolling return of the scheme is 26%. The scheme gave annualized returns in excess of 15%, more than 65% of the times since inception.

Portfolio Strategy

The portfolio of Mirae Asset Tax Saver Fund has a large cap bias; currently 75% of the portfolio is large cap. Though the scheme portfolio has a prominent tilt towards cyclical sectors like banking, finance, construction, petroleum and automobiles, it also has significant allocations to defensive sectors like technology, pharmaceuticals and FMCG. The portfolio is fairly well diversified in terms of company concentration. The chart below shows the major sector and stock allocations of the scheme.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 Lakh lump sum investment Mirae Asset Tax Saver Fund since inception. As discussed earlier, you could have accumulated a profit of over Rs 61,000 since inception. The fund gave 61.28% absolute returns (based on NAV of 15/02/2019)

Source: Advisorkhoj Research

The chart below shows the growth Rs 5,000 monthly SIP in the scheme since inception. You can see that with a cumulative investment of Rs 190,000 you could have accumulated a corpus of Rs around Rs 2.29 Lakhs (Based on NAV of 15/02/2019). The fund gave over 12% annualized SIP returns since inception.

Source: Advisorkhoj Research

Conclusion

Mirae Asset Tax Saver Fund completed 3 years little over a month back. It has emerged as a strong performer in its product category. The dividend option of this scheme has been paying regular dividends over the last 2 years. You can invest in this ELSS fund either in lump sum or SIP depending on your tax planning needs. Though the lock in period of ELSS funds is 3 years, investors should be ready to remain invested for longer period to get the best results. Investors should consult with their financial advisor, if Mirae Asset Tax Savings Fund is suitable for their tax planning investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team