Mirae Asset Great Consumer Fund: Capitalizing on the consumption theme

Over the past few years, rising consumption demand and private sector capex spending in India have been two most popular investment themes among both foreign institutional investors and domestic fund managers. While we may have to wait a bit longer to see clear signs of private sector capex recovery, the consumption theme has given great returns in the past two years and the future looks very bright. The reason why India is the fastest growing emerging market is that, we are a domestic consumption driven economy, unlike most major emerging economies, which are primarily export oriented (e.g. China). Therefore, we are relatively less affected by global economic weaknesses.

The demographic profile of India makes the consumption theme very attractive from a long term investment perspective. While the populations in most developed countries are ageing, India has the highest youth population in the world. More than 50% of India’s population is below the age of 25 and more than 65% below the age of 35. The lifestyle and consumption patterns of the young population in India are markedly different from the older segments of our population. The demographic advantage of India, as per some economists, can add 2% to the GDP growth rate. As more young people join the workforce and disposable incomes rise, it creates a huge opportunity for the consumption theme that equity investors can capitalize on to create long term wealth.

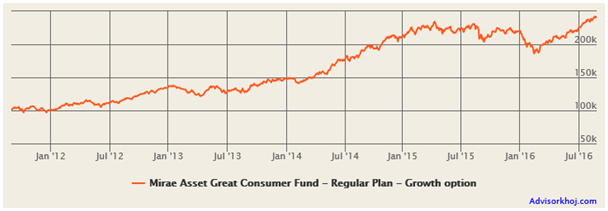

Mirae Asset India-China Consumption Fund, as the scheme was originally named, was launched in March 2011. The fund performance over the last 5 years has ticked all the boxes. The compounded annual return of this diversified equity fund since inception is a healthy 17.5%. The chart below shows the growth of र 1 lakh investment in Mirae Asset Great Consumer Fund over the last 5 years.

Source: Advisorkhoj Research

A र 1 lakh investment in Mirae Asset Great Consumer Fund, 5 years back, would have grown to र 2.4 lakhs (as on August 25, 2016).

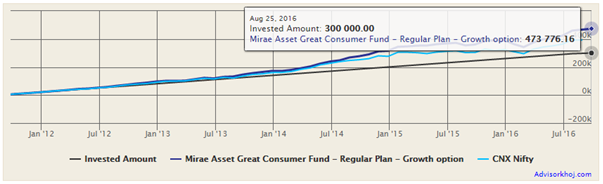

The chart below shows the returns of र 5,000 monthly SIP in Mirae Asset Great Consumer Fund (Growth Option) over the past 5 years.

Source: Advisorkhoj SIP Return Calculator AMC wise

You can see that, the value of र 5,000 monthly SIP in Mirae Asset Great Consumer Fund Regular Growth option would have grown to around र 4.73 lakhs @18.91% return, while the cumulative investment was only around र 3 lakhs.

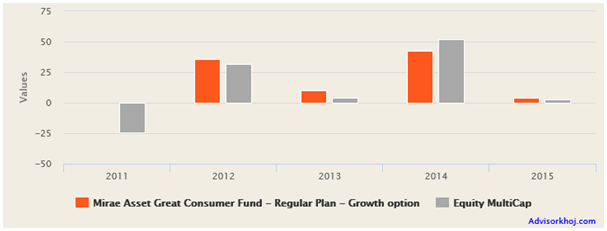

Annual Returns of Mirae Asset Great Consumer Fund

The chart below shows the annual returns of the fund versus multi-cap funds category and the benchmark index (23% for the scheme versus 28% for the category).

Source: Advisorkhoj Research

Rolling Returns of Mirae Asset Great Consumer Fund

The chart below shows the 3 year rolling returns of Mirae Asset Great Consumer Fund over the last 5 years.

Source: Advisorkhoj Research

You can see that, Mirae Asset Great Consumer Fund was able to beat diversified equity funds category in terms of 3 year rolling returns for most periods.

Investment Strategy and Portfolio Construction

At least 65% of the fund corpus is invested in Indian equities (making it an equity fund from a capital gains tax standpoint) and the balance is invested in units of Mirae Asset-China Advantage Fund. Both India and China are emerging market powerhouses, with high GDP growth rates over the last decade or so. As the name suggests, the original investment mandate of Mirae Asset Great Consumer Fund was to seek capital appreciation, by investing in companies that are directly or indirectly like to benefit from consumption led demand in India and China.

However, though China’s GDP growth rate was higher than India’s till 2014, China’s equity market has been underperforming relative to India’s equity market from 2010 onwards. In the last 3 years while the Nifty has risen around 57%, the Shanghai Composite Index has risen around 46% only. If you factor in currency devaluation then, India China equity performance gap is wider.

In the last 3 years Mirae Asset India-China Consumption Fund gave just 3.2% annualized returns. Compare this with the 3 year returns, of a purely India focused diversified equity fund from Mirae stable, Mirae Asset India Opportunities Fund, which gave around 29% annualized returns in the last three years. Though Mirae Asset Great Consumer Fund has done quite well giving 23% annualized returns in the last 3 years, the underperformance of China has weighed on the performance Mirae Asset Great Consumer Fund, relative to purely India focused diversified equity funds, including Mirae’s own Mirae Asset India Opportunities Fund.

Earlier this year, Mirae made a number of changes to the fundamental attributes of Mirae Asset Great Consumer Fund. The investment mandate of the fund was changed from “investing in companies that are directly or indirectly like to benefit from consumption led demand in India and China” to “investing in companies that are directly or indirectly like to benefit from consumption led demand in India and Asia Pacific”.

This change is important because the Chinese economy is going through a multi-year structural transformation from an export oriented economy to a domestic consumption driven economy (like India), which may cause equity returns to be subdued for years. The expansion of the mandate of the scheme to include the Asia Pacific region, which for the past couple of decades constituted the highest growth regions among emerging markets, will enable the scheme to benefit from economic growth in the region outside of mainland China, but also, over a sufficiently long period of time benefit from the growth in consumption demand in mainland China itself.

Accordingly, the Asset Allocation of the scheme was changed to 65-80% in Indian Equities of companies that are likely to benefit either directly or indirectly from consumption led demand and 20-35% in units of Mirae Asset Asia Great Consumer Fund. The benchmark index of the scheme was changed to S&P BSE 200 (65%) & S&P BSE Asia Pacific Emerging BMI (35%). Finally, the scheme name itself was changed from Mirae Asset India-China Consumption Fund to Mirae Asset Great Consumer Fund.

These changes which were put into effect from March 2016, has started to have an effect on the scheme performance. While, Mirae Asset India-China Consumption Fund trailed behind the multi-cap returns over the last 3 years (23% for the fund, versus 28% for the category), in the last one year Mirae Asset Great Consumer Fund outperformed multi-cap category returns (15.4% for the fund, versus 13.9% for the category).On a YTD basis, the fund has already given close to double digit returns.

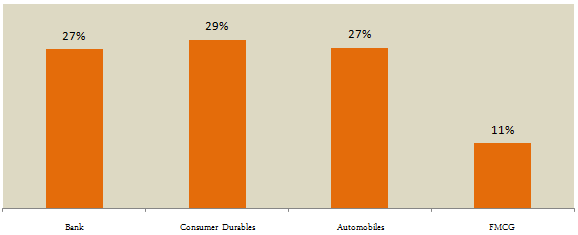

In terms of domestic sectors, the scheme has stuck to its investment mandate with allocations to banking and finance (30%), FMCG (20%), Automobiles and Auto Ancillaries (7.5%), Petroleum (5%) etc. 25% of the corpus is invested in Mirae Asset Asia Great Consumer Fund. HDFC Bank, HPCL, Maruti Suzuki, ICICI Bank and Indusind Bank are the top domestic equity holdings. As discussed earlier, as per investment mandate, Mirae Asset Great Consumer Fund, will invest at least 65% of its corpus in domestic equities and hence will be subject to equity taxation.

Benefits of having international equity exposure

Adding international equity to your equity portfolio can benefit your portfolio in terms of risk diversification. Currency movements affect different markets in different ways. Export oriented economies benefit when the dollar appreciates versus local currencies, whereas economies running trade deficits (such as India) benefit when local currency appreciates. Some markets benefit from commodity market upturns, while others benefit from downturns. Business cycles can also differ from market to market.

Risk diversification benefits of international equity exposure of Mirae Asset Great Consumer Fund will be evident when we compare the volatility of the fund with average volatilities of diversified equity fund category. The volatility, as measured by annualized standard deviation of monthly rolling returns of Mirae Asset Great Consumer Fund is significantly lower than that of diversified equity funds category. We have a developed a tool for ranking funds in quartiles based on their volatility (please see our Volatility Ranking Tool). You will see that, Mirae Asset Great Consumer Fund is a top quartile fund in the diversified equity category, as far as volatility ranking is concerned. As such, this fund can enrich your mutual fund portfolio risk diversification.

Future Outlook and Conclusion

In our view, the future outlook of the fund is very positive. Growth in consumption demand is expected be a dominant narrative in the India Growth Story. The chart below shows the 3 year CAGR of the major consumption related sectoral indices in the BSE.

Source: Bombay Stock Exchange

In 2014 and 2015 rural consumption was depressed due to consecutive years of deficit monsoon, but bountiful monsoon this year should provide a fillip to rural consumption as well. The 7th pay commission will provide an additional boost to consumption demand in our economy. Further, with the passage of the Goods and Services Tax (GST) bill in the parliament, a number of companies focused on domestic consumption stand to benefit. Automobile companies will be one of the biggest gainers because the effective tax rate will come down substantially, which will enable the companies to pass on the benefit to the end customer, which in turn will raise demand. Cement and construction companies will also benefit from lower tax rate on the implementation of GST. GST will also benefit those companies in the consumer durables and FMCG sector, which did not enjoy the tax exemptions under the current indirect tax regime will benefit. Transportation cost and time will come down with the implementation of GST, which will again be a positive for consumption demand.

Finally, from a macro perspective, continuing weakness in global commodity prices and a favourable interest rate regime in our country are positive factors as far as consumption demand is concerned. While the various factors, discussed above, will have a favourable impact on consumption in near to medium term, we think that in the longer term, the underlying strength of our economy, the demographic profile and changing consumption patterns, as discussed earlier in this post, will be more important factors.

For the past decade or so, Asia, including India, has been the engine of global economic growth and as per a recent IMF report though Asia Pacific GDP growth may moderate slightly in 2016 – 17, it will continue to be one of the fastest growing regions of the world (with 5.3% GDP growth as per IMF forecasts, higher than most other markets except India).

Regarding China, we expect that, while the structural transformation of China from an export oriented economy to a consumption driven economy will take some time, the Chinese economy will recover over the course of time as the consumption theme plays out in China. The Chinese Government and the central bank are very active in providing stimuli to their economy and we are already seeing some early signs of economic recovery. A few days back Moody’s upgraded China’s economic growth outlook. Short term volatility notwithstanding, from a long term perspective, we have reasons to expect that, the consumption theme will play out not only in India, but also in China and other parts of Asia Pacific, to the benefit of investors.

For reasons discussed above, the future outlook of Mirae Asset Great Consumer Fund appears to be good. The fund managers of this mutual fund scheme are Neelesh Surana, Sumit Agrawal and Bharti Sawant. Neelesh Surana manages Mirae Asset India Opportunities Fund (along with Sumit Agrawal) and Mirae Asset Emerging Bluechip Fund, two top performing funds in their respective categories.

Despite the decent performance of Mirae Asset Great Consumer Fund since its inception, Mirae was nimble enough to recognize the near and intermediate term challenges with respect to China and took the necessary actions. Past performance, good, satisfactory or unsatisfactory, is a data point, but in Advisorkhoj we believe that, it is the fund manager, the fund house capabilities and the investment mandate of the fund that plays the most important roles in an equity fund’s performance. On all three counts, the future prospects of Mirae Asset Great Consumer Fund look good. Investors should consult with their financial advisors, if Mirae Asset Great Consumer Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team