Is your equity mutual fund giving the best returns

Equity mutual funds have on an average done extremely well in the last 3 years. Equity funds belonging to the large cap category have given average trailing annualized 3 years returns of 18.2%. The top performer in this category gave annualized 3 year return of 25.6%. Funds belonging to small and midcap category have given average trailing returns of 27.1%. The top performer in this category gave annualized 3 year return of 37.3%. But have funds in your mutual fund portfolio given good returns? Many investors are surprisingly tolerant of poor fund performance. Some investors simply do not track the market. While buy and hold is good policy for long term investing, if your fund has lagged behind its peers over a period of 3 years or longer, you should consider switching to a better performing fund. Many investors do not know the benchmark to compare the fund’s performance with. If you compare the performance of your small and midcap fund with Nifty or Sensex, it is not the correct benchmark to use. Performance of small and midcap funds should be compared benchmarked against CNX Midcap or S&P BSE Midcap index. Similarly, there are benchmark indices for other categories of funds. You can read about various mutual benchmark indices in our article, What are the market benchmark indices of various mutual funds. In addition to market benchmark indices, you should also compare the performance of your fund with other funds in the same category.

Your mutual fund return may beat the market benchmark index but may still be lower than category average, which means that you have better investment options. On the other hand your mutual return may beat category average, but still be lower than the market benchmark. There may be funds in the same category, which have beaten the market benchmark and therefore present better investment opportunity for you. While there may be funds in the category that would have performed better than your fund, you should ensure that your fund is also a good performer in its category. What is good performance relative to the category performance? At the very minimum, your fund should beat the category average return. As an example, in terms of trailing annualized 3 year returns, your large cap fund should have given more than 18.2% annualized returns in the last 3 years. Similarly your small and midcap fund should have given more than 27.1% annualized returns in the last 3 years. However, even if your fund beats the category average, there is still a big difference in returns between the top performer and the category average. For example, in the large cap funds category, while the category average is 18.2%, the top performing fund gave 7.4% higher returns than the category average. One र 1 lac lump sum investment the top performing fund would have given र 33,000 higher returns over three years than an average performer. In the small cap funds category, while the category average is 27.1%, the top performing fund gave 10.2% higher returns than the category average. One र 1 lac lump sum investment the top performing fund in the small and midcap would have given almost र 54,000 higher returns over three years than an average performer.

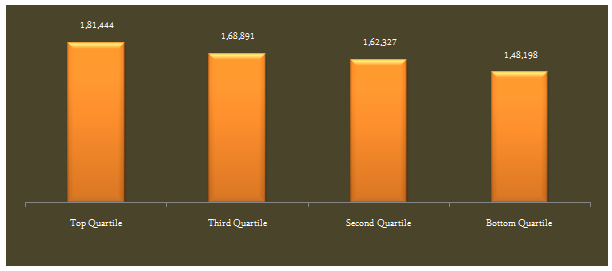

Even if your fund is not the top performer in the category, you should strive to have a top quartile fund in your portfolio to maximise your returns. Quartile is a statistical measure that divides funds in the category into 4 almost equal divisions based on the range of returns given funds in the category. The bottom quartile has the bottom 25% of funds in terms of returns. The next 25% of the funds in terms of returns fall in the second quartile and so on. The top quartile has the top 25% of funds. There is a big performance differential between funds in the bottom quartile and the top quartile. The performance advantage of the top quartile funds is significant even compared to funds in the second or third quartile. The chart below shows the average 3 year annualized return of large cap funds in each performance quartile.

A र 1 lac lump sum investment in a top quartile fund would have give on an average र 33,000 higher returns in three years compared to a bottom quartile fund. The chart below shows the average current values of र 1 lac lump sum investment in a bottom quartile, second quartile, third quartile and a top quartile fund.

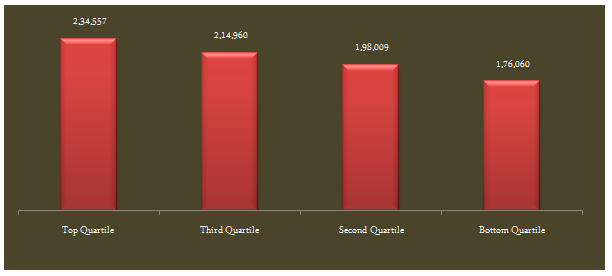

The performance differential between funds in different quartiles is even greater in the small and midcap funds category. The chart below shows the average 3 year annualized return of small and midcap funds in each performance quartile.

A र 1 lac lump sum investment in a top quartile small and midcap fund would have give on an average र 58,500 higher returns in three years compared to a bottom quartile small and midcap fund. The chart below shows the average current values of र 1 lac lump sum investment in a bottom quartile, second quartile, third quartile and a top quartile midcap fund.

Conclusion

You should evaluate the performance of your mutual funds in the context of how the market is doing. While 18% and 27% average 3 year annualized returns of large cap and midcap funds respectively look attractive by themselves, you could get much higher returns by selecting the best funds in the category. However, you should not switch from your fund based on short term, e.g. 6 months or 1 year performance. While we have focused on returns in this blog, you should also factor in other considerations by taking a portfolio perspective. For example, if there is a high concentration of a specific sector, e.g. banks in your fund portfolio, then you should try to diversify the sector risk by selecting a fund that has a low concentration of that specific sector. You should review your mutual fund portfolio with your financial advisor at regular intervals to ensure that you have the best funds in your portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team