Indiabulls Bluechip Fund: One of the top performing Large Cap Funds

2017 was a great year for stock markets in India with the Nifty rising by nearly 2,470 points (a rise of nearly 29%). Mutual fund investors enjoyed fantastic returns, especially in the small and midcap funds category in 2017 – fund category return of over 36%. This terrific rally has also brought concerns with regards to valuations. Sumit Bhatnagar, fund manager in Indiabulls Asset Management Company, feels that investors need to “tone down their return expectations” in the short term going forward (please see our interview with Sumit Bhatnagar).

In our blog posts, Are midcap valuations a cause of concern for mid cap mutual funds – Part 1 and Part 2, we discussed that valuations of many midcap stocks are very high and many midcap stocks are trading at a huge premium to large cap stocks. If there is a sharp correction in the market in the near term then, small and midcap stocks are likely to be affected the most due to stretched valuations. From a risk reward trade-off perspective, large cap stocks and funds are the best place to be in such a scenario. Many mutual fund advisors are also recommending large cap funds to investors. In this blog post, we will discuss the performance and outlook of Indiabulls Bluechip Fund, a large cap oriented equity mutual fund scheme.

What is a Bluechip Fund?

Let us first discuss, what we mean by a bluechip stock. Companies which have a market capitalization exceeding Rs 10,000 Crores are usually known as large cap companies. As per the market regulator SEBI, the 100 largest companies by market capitalization in India will come under the large cap segment. These are well known companies with a fairly long history. These companies command a high percentage of the market share in their respective industry sectors. The largest of large cap companies are known as bluechip companies (stocks). They are called bluechip companies because they enjoy the public’s confidence due to their strong long term track record. In India the companies which form part of the BSE - Sensex of CNX – Nifty index are usually considered bluechip companies. Given their large size, investors believe that these companies are better placed to survive downturns in the economy compared to smaller companies; as a result these companies are perceived to be less risky and investors are ready to pay a premium for their shares. A mutual fund scheme which invests primarily in bluechip stocks is named a bluechip fund.

Indiabulls Blue Chip Fund – Overview

Indiabulls Blue Chip Fund was launched in February 2012. The scheme has Rs 413 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.62%. The fund has given 13.3% compounded annual returns since inception. The fund is managed by Sumit Bhatnagar. Mr. Bhatnagar is an MBA (Investment Management) from University of Toronto, Canada and CFA Charter (USA). Prior to joining Indiabulls Mutual Fund he has worked with SEBI. The scheme benchmark is CNX – Nifty.

Outperformance by Indiabulls Blue Chip Fund

Indiabulls Blue Chip Fund has consistently outperformed both the benchmark Nifty and the large cap funds category over the last 3 years (please see our chart below).

Source: Advisorkhoj Research

The chart below shows the Net Asset Value (NAV) growth of Indiabulls Blue Chip Fund versus Nifty over the last 3 years.

Source: Advisorkhoj Research

Rolling Returns

Regular Advisorkhoj readers know that, Rolling Return is the best measure of a mutual fund’s performance because it is not biased point in time market conditions. The chart below shows the 3 year rolling returns of Indiabulls Bluechip Fund versus the benchmark Nifty since.

Source: Advisorkhoj Rolling Returns calculator

You can see that Indiabulls Blue Chip Fund has consistently outperformed Nifty almost since inception and generated alphas for investors over a 3 years investment horizon.

Market Capture Ratio

A less used tool on Advisorkhoj website is our Market Capture Ratio tool. We encourage investors to use this tool because Market rallies and crashes are both realities of equity investing. A mutual fund scheme which outperforms both in up markets and down markets is likely to give superior risk adjusted returns and outperform other funds in the long term. Performance in different market conditions is measured by a set of metrics called market capture ratios.

In this tool we see the performance of a fund both in up-market (months in which the benchmark index was up) and down market (months in which benchmark index was down). The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was up is known as Up-market Capture Ratio. The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was down is known as Down-market Capture Ratio. Capture Ratio is the ratio of Up Market Capture Ratio and Down Market Capture Ratio.

The table below shows how Up-market Capture Ratio and Down-market Capture Ratio of Indiabulls Bluechip Fund over the last 3 years.

Source: Advisorkhoj Market Capture Ratios

High Up Market Capture Ratio (more than 100%) is good, because it means the fund manager is able to generate higher than market benchmark returns when market is rising. Low Down Market Capture Ratio (less than 100%) is good, because it means the fund manager is able to provide some downside risk protection when market is falling. HighCapture Ratio (more than 1) is good because it implies good risk adjusted returns. You can see that the market capture ratios of Indiabulls Bluechip Fund over the last 3 years were quite good.

Investment Strategy

Indiabulls Blue Chip Fund follows a combination of top down and bottom up stock picking strategies. Fund manager, Sumit Bhatnagar told Advisorkhoj that the “idea is to be conservative in the portfolio construction process. First we look to identify key themes to play by analyzing global macro environment, Indian macros, government policies and other economic factors. Once the key themes are identified, we look at companies that are near monopolies or oligopolies, having pricing power, strong brands, leaders/challengers in their respective sectors, strong distribution franchise, low leverage, decent growth prospects, decent RoE (Return on Equity) & RoCE (Return on Capital Employed) and high quality management teams and low leverage. Currently, the portfolio is built predominantly around domestic consumption and government spending themes”.

From a market capitalization perspective, Indiabulls Blue Chip fund has a mandate to deploy 80% in large caps (basically top 100 companies by markets cap) and upto 20% mid & small cap space. Fund manager, Sumit Bhatnagar believes that there are still “enough opportunities both large cap and mid cap space in the market to enable us to generate alpha”. In terms of industry sectors, the fund manager continues to be “positive on Oil & Gas, Autos and FMCG & construction and allied sectors as earnings momentum is expected to be fairly strong in this space over next few quarters”.

Lump Sum and SIP returns

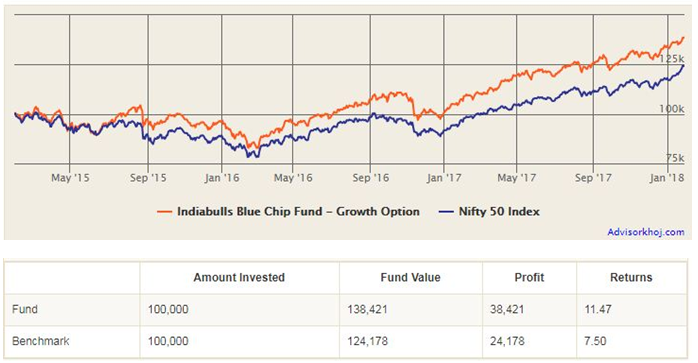

The chart below shows the growth of Rs 1 lakh invested in the Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

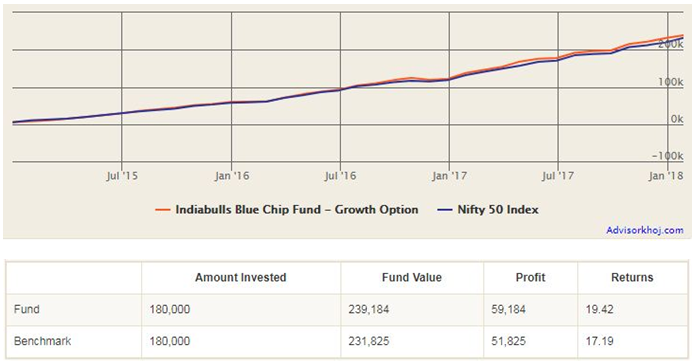

The chart below shows the returns of Rs 5,000 monthly SIP in Indiabulls Blue Chip Fund (Growth Option) over the last 3 years.

Source: Advisorkhoj Research

Dividend Sweep Feature

Equity markets have the potential to generate wealth over a long term but are volatile in the near to medium term. One of the prudent ways to invest in the equity markets in is to invest regularly to ride out the volatility. The dividend sweep plan offers investors to participate in the potential upside of the equity market while remaining invested in a mutual fund which has low to moderate risk.

- The investor can invest in a Source scheme for e.g. Indiabulls Arbitrage Fund and give a standing instruction to sweep the dividends, as and when declared by the source scheme, to a target scheme, which has the potential to give higher returns, e.g. Indiabulls Bluechip Fund.

- The investment in the Source scheme could give steady capital appreciation.

- The dividends invested regularly in an equity fund, e.g. Indiabulls Blue Chip Fund can have the potential to give additional returns in one’s overall portfolio.

Indiabulls Dividend Sweep plan has several advantages like dual investment benefit (benefit of investing in multiple asset classes), portfolio diversification (risk reduction), disciplined investing and convenience (one time mandate).

Outlook and Conclusion

Indiabulls Bluechip Fund manager, Sumit Bhatnagar, expects “the growth to bounce back from GST led disruptions to 7%+ trajectory over next 12-18 months. Earnings are also expected to bounce back sharply to mid-teens over same period. Key risks would be Oil, Geo politics, Monsoons, Union-Budget & State elections which may trigger bouts of volatility in the market for short term”.

For FY19, the fund manager expects “earnings growth of 12-15% against Bloomberg consensus of 25% growth, which is still pretty healthy considering that we are coming out of a period of virtually no earnings growth for last five years”.

From a longer term perspective, Mr. Bhatnagar believes that, “India is one of the best placed among large economies in the world in terms of demographics, demand, growth potential etc. Outlook for Indian economy and equities looks very promising over medium to long term. With India expected to be a $5 trillion economy by 2025, equity markets would be a big beneficiary. Favourable demographics, huge as aspirational consumption demand, Government policies like Housing for All, 24 X 7 Power for All, focus on infrastructure and rural economy, resets like Demonetization & GST, measures to improve ease of doing business, liberalized FDI policies can catalyze strong and stable economic growth for a long period of time”.

Indiabulls Bluechip Fund delivered strong performance both in relative and absolute terms over the last 3 years. The outlook for equity in India continues to be very positive since India is “on cusp of a structural economic upturn and equities are likely to remain the best asset class from a 3 to 5 years perspective”. Investors should discuss with their financial advisors if Indiabulls Bluechip Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team