ICICI Prudential Value Fund Rollover: Potential of realizing further value upside

ICICI Prudential Value Series 1 and 2 were launched towards the end of 2013 as three year close ended schemes. With the benefit of hindsight, we can say that the timing of subscription to these Value Series schemes were just great. The equity market was beginning to recover after a fairly deep correction caused by the US Federal Reserve’s decision to taper off Quantitative Easing (bond buying programme). Stocks in the midcap market segment were trading at a considerable discount (more than 30%) to large cap stocks.

Overall valuations (Price Earnings, Price to book etc) were at attractive levels compared to long term averages. Market was anticipating an NDA victory in Lok Sabha election of 2014. The performances of these schemes in the last 3 years have been very strong. ICICI Prudential Value Series 1 gave 81% absolute return in the last 3 years, while ICICI Prudential Value Series 2 gave 82% absolute return.

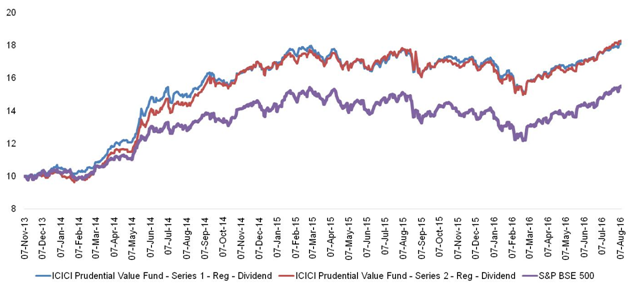

The chart below shows the NAV growth of the two schemes assuming dividend re-investment at ex dividend NAVs (BSE – 200 has been rebased to Rs 10 at the inception of the scheme).

Source: ICICI Prudential Mutual Fund

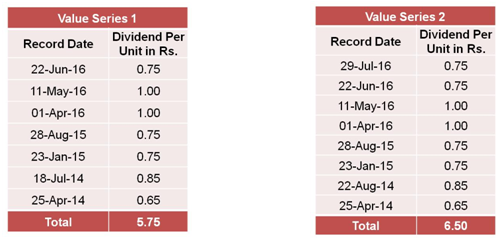

The two schemes have paid regular dividends to investors (these schemes only had dividend payout option), ensuring regular profit booking for investors. Since inception, ICICI Prudential Value Series 1 paid Rs 5.75 as dividends per unit on a subscription price of Rs 10 per unit (face value). ICICI Prudential Value Series 2 paid Rs 6.5 as dividends per unit since inception on the subscription price of Rs 10 per unit (face value).

Source: ICICI Prudential Mutual Fund

If you had invested in these schemes you have good reasons to feel satisfied, but the fund managers believe that there is more potential to unlock incremental value over the next two years. That is why ICICI Prudential Mutual Fund has offered investors to rollover the investment for two more years.

Why Rollover?

The market has seen a lot of volatility over the past 20 months or so. Donald Trump has surprised the market by winning the US Presidential elections and volatility is expected to continue for some more time. Volatility presents both challenges and opportunities; but in equity markets the challenges are usually short term in nature, while the opportunities are longer term in their nature.

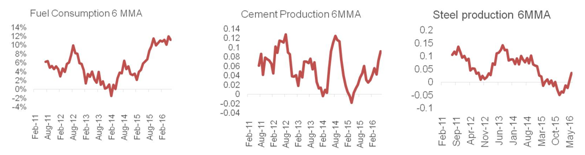

In the last three years the BSE – 200 grew at a CAGR of 14.7%. The growth was fuelled largely by improving macros of the Indian economy, but we must remember that corporate earnings growth remained subdued during most of this period. Corporate earnings growth has been showing signs of recovery over the past 2 quarters. The fund managers believe that, what we are seeing are strong signs of demand recovery in India. The three charts below support their conviction in demand recovery in our country.

Source: ICICI Prudential Mutual Fund

Good monsoon after two consecutive deficient monsoons is likely to help demand recovery in the rural sector, which has been suffering for the past few years. The 7th pay commission will significantly increase wages of government employees and increase discretionary spending in coming quarters will provide a further boost to demand recovery, particularly in the automobile and consumer durables sectors. Demand recovery will not only grow the top-line of Indian companies at a much faster pace, it will grow the bottom-line (EPS) at an even faster pace, through the effect of Operating Leverage.

The capacity utilization of our factories is at multi-year lows. The capacity utilization of our factories was between 73 – 76% from 2009 to 2013 (it was at 92% in 2007). The capacity utilization is now at 69.7%. This means our factories can meet additional demand without adding much fixed costs. So, when demand picks up, Indian companies will not only see revenues increase, but also expansion in operating margins. Therefore, we can expect profits (EPS) to grow at a faster rate than revenues in the coming years. Higher EPS growth will result in higher share prices.

The banking sector, particularly public sector banks, has been a major concern for the market for the past 2 years or so. If we look at the aggregate earnings (EPS) of the Nifty over the past few quarters, we have seen that, as one fund manager lamented, good earnings / profits of some of the best companies of India were offset by the losses made by just a few large public sector banks. The market has been absorbing the NPA related pain in the banking sector for some time now.

In Advisorkhoj, we have asked fund managers and CIOs of different fund houses when can we expect the NPA related banking woes (particularly related to the public sector banks) to peak. To some of our readers, the NPA stress may seem never ending, but ICICI Prudential house view is that, NPA cycle may peak in the next one year. We believe that, a lot of the pain is already discounted in prices and in the view of a benign interest rate environment the banking sector may lead the market to much greater heights.

Interest rates in most developed economies around the world are close to zero or even negative. From a purely rational perspective, it makes much more sense for Foreign Institutional Investors (FIIs) in the developed world, to invest in a strong emerging market like India instead of their domestic Government bonds, unless of course, there is extreme risk aversion; even if there is risk aversion, we have seen in the past that, it is mostly temporary in nature. If the US Fed increases interest rates in the coming months, it will be a sign of (as we had discussed a number of times in our blog) strengthening US economy. The United States is the largest economy of the world and a stronger US economy is always good for emerging markets like India. You will be wiser off, not paying attention to some of the extreme views in the media about free trade in Donald Trump’s regime as the President of United States.

More important than the global geo-political scenario, local factors will continue to play an important role in India. The policy measures taken by the Government is likely to drive growth in our economy. GST, Land Reforms, Labour laws, Infrastructure improvements, administrative policies regarding ease of doing business and most recently, a bold monetary measure concerning Black Money is aimed at structurally reforming our economy and strengthening it fundamentally.

ICICI Prudential Value Fund Series 1 & 2 Rollover

ICICI Prudential Value Series 1 and 2 funds were managed on the basis of the principles of value investment. These two schemes had a bias towards midcap (54% and 56% of portfolio values of Series 1 and 2 respectively), when they were launched. The strategy reaped rich dividends, but in the rollover, the fund managers will be biased towards large caps, which makes sense, because the valuation gap between market cap segments has been closed or even reversed. Consistent dividend payouts will allow timely profit booking; however, please note that, dividend pay-out will be subject to profits made by the schemes and approval of the Trustees. The rolled over close ended scheme will mature in December 2018. Readers of our blog know that, we do not like event risk (please read our post, The US Presidential Election and Indian stock market). The rolled over ICICI Value Series schemes mature much before the Lok Sabha elections of 2019 and therefore, you will be able to avoid the event risk.

Conclusion

The revised maturity dates of ICICI Prudential Value Series 1 and 2 funds are December 31, 2018. The roll-over dates of these two schemes are November 8 and December 6 respectively. The fund managers of ICICI Prudential Value Series 1 are Sankaran Naren and Mittul Kalawadia. The fund managers of ICICI Prudential Value Series 2 are Sankaran Naren and Atul Patel. Applications of roll-overs will be accepted till November 7 for ICICI Prudential Value Series 1 and December 6 for ICICI Prudential Value Series 2. Investors should consult with their financial advisors if they should roll-over their investments in these two schemes.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team