ICICI Prudential Multicap Fund: Strong outperformance by this seasoned diversified equity fund

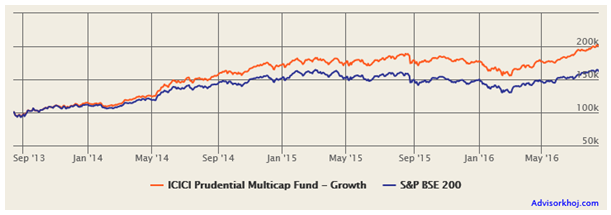

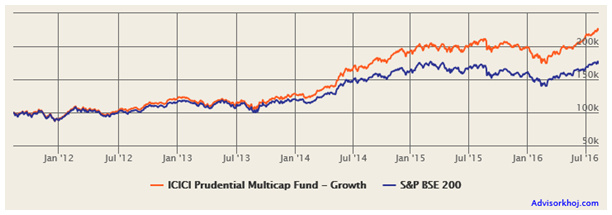

ICICI Prudential Top 200 Fund was one of the oldest (amongst the private sector pack) and well known diversified equity fund. The fund was launched more than 20 years back and over this long journey, the fund had its share of ups and downs. However, if we look at the performance of this fund over the last 3 to 5 years, the trajectory is upwards and this fund is certainly among the top quartile performers (please see our quartile ranking tool, Mutual Fund Quartile Ranking - Equity Funds Diversified). About a year back, the name of this diversified equity mutual fund scheme was changed from ICICI Prudential Top 200 to ICICI Prudential Multicap Fund. The chart below shows the growth of र 1 lakh lump sum investment in this fund over the last 3 years (period ending August 10, 2016).

Source: Advisorkhoj Research

You can see that, a र 1 lakh lumpsum investment in ICICI Prudential Multicap Fund, would have doubled in value over the last 3 years.

Fund Overview

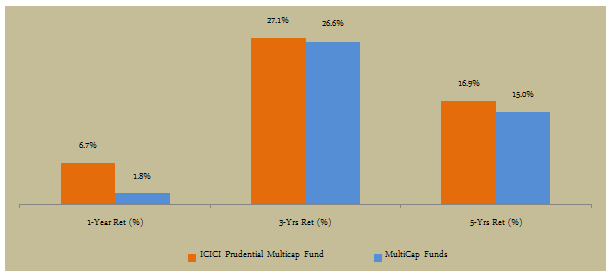

ICICI Prudential Multicap Fund (erstwhile ICICI Prudential Top 200 Fund) was launched in October 1994 and has nearly र 1,280 crores of Assets under Management (AUM). The expense ratio of the fund is 2.33%. The fund has given 15.32% compounded annual returns since its inception. As discussed earlier, the performance of the fund over the last 3 to 5 years has been quite strong. The chart below shows the annualized trailing returns of the fund versus the category, over the last 1, 3 and 5 years time periods (period ending August 10, 2016).

Source: Advisorkhoj Research

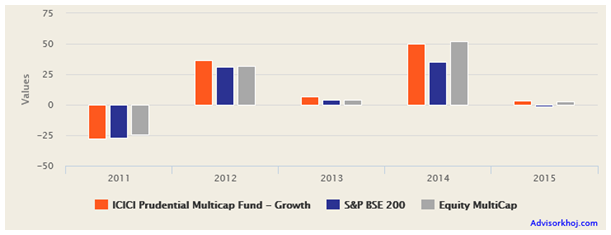

The chart below shows the annual returns of ICICI Prudential Multicap Fund versus the category average and the benchmark (BSE – 200), over the last 5 years.

Source: Advisorkhoj Research

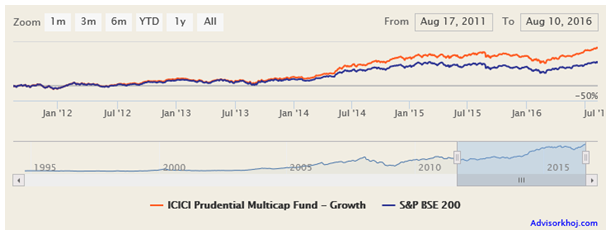

The chart below shows the NAV movement of ICICI Prudential Multicap Fund over the last 5 years.

Source: Advisorkhoj Research

Industry veteran, Yogesh Bhatt has been managing ICICI Prudential Multicap Fund and George Heber Joseph joined as a fund manager in this scheme in 2015. In March of this year, Yogesh Bhatt was replaced by Atul Patel. CRISIL ranks ICICI Prudential Multicap Fund 2 (good performer) in the diversified equity category, while Morningstar has a 4 star rating for this fund.

Rolling Returns

We have discussed a number of times in our blog that rolling returns are the best measures of fund performance. Rolling returns are the annualized returns of a mutual fund scheme taken for a specified period (rolling returns period) on every day/week/month and taken till the last day of the duration. In the chart below, we are showing the annualized returns of ICICI Prudential Multicap Fund over the rolling returns period on every day over the last 5 years and comparing it with the benchmark. We have chosen a rolling return period of 3 years, because we think an investor should have at least a 3 year investment horizon, when investing in diversified equity funds. In other words, return at any point in the chart below is the 3 year annualized return of the scheme from that point of time in the chart.

Source: Advisorkhoj Research

You can see that over the last 5 years, the 3 year rolling returns of ICICI Prudential Multicap Fund beat the average rolling returns of diversified equity category 100% of the times, an evidence of strong performance consistency. Also, the annualized 3 year rolling returns of the fund was over 20%, around 80% of the times over the last 5 years, which is remarkable, especially since we had periods of high volatility over the last 5 years.

Portfolio Construction

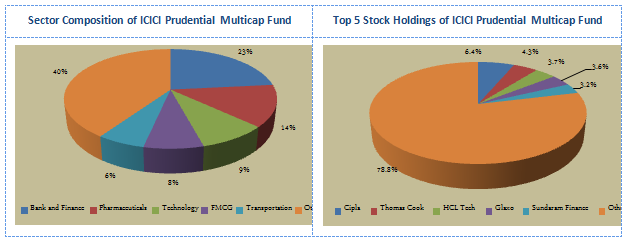

As the scheme name suggests, the fund managers invest across different market cap segments. The current market cap mix of the portfolio is about 57% mid / small cap and 43% large cap. The investment style is primarily growth focused. From a sector perspective the fund manager’s focus areas are the core sectors, e.g. telecom, energy, transportation and financial services. Most of these sectors have strong cyclical biases and will benefit from a long term secular uptrend in these sectors, if we were to believe in the India Growth Story. In the volatile market of 2015 and early 2016, financials and some other core sectors went through a fair amount of pain. The fund managers of ICICI Prudential Multicap Fund limited the downside by exiting some bank positions. In addition to the cyclical sectors, ICICI Prudential Multicap Fund has about 30% portfolio allocation to defensive sectors like Pharmaceuticals, FMCG and Technology. The midcap portion of the portfolio has given strong returns over the past few years. From a company concentration perspective the portfolio is fairly well diversified with the Top 5 holdings, Cipla, Thomas Cook, HCL Technologies, Glaxosmithkline Consumer Healthcare and Sundaram Finance, accounting for only around 21% of the portfolio holdings.

Source: Advisorkhoj Research

Risk and Return

From a volatility standpoint, the volatility of ICICI Prudential Multicap Fund is lower than the average volatilities of diversified equity funds. Despite its lower volatility, ICICI Prudential Multicap Fund has been able to outperform diversified equity funds category, thanks to its superior Sharpe Ratio, which is indicative of strong risk adjusted performance (for more performance details, please see our Scheme Details Page).

One criticism of volatility as a risk measure, as per some experts, is that, volatility (from an analytical perspective) does not distinguish between moves in bull market and bear markets. In other words funds who’s NAVs move up very rapidly in bull markets and funds whose NAVs fall very rapidly in bear markets, will both have high volatility. Critics of volatility say that, one is a good volatility (NAVs moving up rapidly in bull market), while the other (NAVs falling rapidly in bear markets) is bad volatility. Though historical evidence suggests that, volatility is usually higher in bear markets (and therefore, high volatility is in most cases not a good thing), in Advisorkhoj, in addition to looking at the overall volatility (as measured by annualized standard deviation of monthly returns) of mutual fund schemes, we also distinguish the performance of funds in different market conditions (up market / rising market and down market / falling market).

We do this through a simple, yet highly effective analytical measure, known as Market Capture Ratios. There are two market capture ratios we look at, the up market capture ratio and the down market capture ratio. Up market capture ratio is the ratio of the average returns of the fund and the benchmark, in the months that the market rose. Down market capture ratio is the ratio of the average returns of the fund and the benchmark, in the months that the market fell. High up market capture ratio (more than 100%) tells us that, the fund manager gave more returns than the market benchmark, when the market was rising. Low down market capture ratio (less than 100%) tells us that, the fund manager was able to protect investors from downside risks, when the market fell. You can check out up market and down market capture ratios of different funds by going to our tool, Market Capture Ratio.

We looked at up market and down market capture ratios of ICICI Prudential Multicap Fund over the last 3 and 5 years. Up market capture ratio of ICICI Prudential Multicap Fund over the last 3 and 5 years was more than 100%, which tells us that the fund managers were able to beat the benchmark when the market was rising. Down market capture ratio of ICICI Prudential Multicap Fund over the 5 years was more than 100%, but over the last 3 years it is only 71%. This tells us that, the fund managers were able to navigate through the 2015 – 16 downturn much better than the 2011 downturn. The improvement in market capture ratio shows the improving quality of fund management, which is great and augurs very well for the future performance of this mutual fund scheme.

As an investor, you should try to understand the drivers of good returns, instead of simply looking at how much returns a mutual fund scheme gave in the last 1 year, 3 years or 5 years. In our blog, we have stated many times that, historical returns may not be good indicators of future returns and we would like to remind investors of the famous saying by the legendary investor Warren Buffet, “Only when the tide goes out do you discover who's been swimming naked”.

Past returns are in the past; what you should care about, are future returns. How your mutual fund will perform in the future relative to the market will depend on the investment strategy of your fund manager and the quality of fund management. Performance measures like rolling returns, market capture ratios, alphas etc, can tell you a lot about the quality of fund management. We encourage our readers to use these tools by going to our MF Research Section.

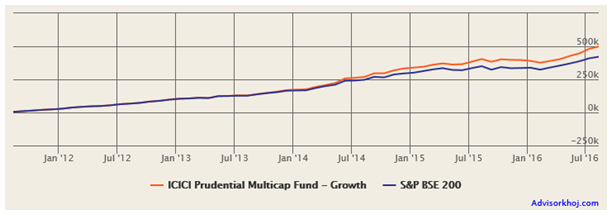

The chart below shows the growth of र 1 lac lump sum investment in this fund over the last 5 years (period ending August 10, 2016).

Source: Advisorkhoj Research

र 1 lakh lump sum investment in ICICI Prudential Multicap Fund (Growth Option) would have grown to nearly र 2.25 lakhs in the last 5 years; which means that an investor would have made a profit of nearly र 1.25 lakhs on an investment of र 1 lakh. The compounded annual growth rate of investment was around 17.6%.

The SIP returns of the ICICI Prudential Multicap Fund, over the last 5 years, were even more impressive. The chart below shows the growth of र 5,000 monthly SIP in ICICI Prudential Multicap Fund (Growth Option), over the last 5 years (period ending August 10, 2016).

Source: Advisorkhoj Research

With a monthly SIP of र 5,000 in ICICI Prudential Multicap Fund (Growth Option), you could have accumulated nearly र 5 lakhs in investment value, a profit of nearly र 2 lakhs on an investment of around र 3 lakhs. The annualized SIP return of the fund over the last 5 years was over 20%.

Conclusion

India is one of the very few bright spots in the global economy. While large parts of the globe is reeling under economic slowdown, India’s FY 2015 - 2016 GDP growth was around 7.6%, the fastest in the last 5 years. Corporate earnings, which were disappointing over the last several quarters, showed signs of improvement in Q4, FY 2016. The improvement trend has continued in Q1, FY 2017 though there are still some remaining pockets of underperformance. However, immediate term concerns (especially with respect to private sector capex spend in India) notwithstanding, the medium term future outlook is good, particularly with respect to more evidence of green shoots of recovery in corporate results, passage of the Goods and Services Tax (GST) Bill in the Parliament and other structural reforms, focus of the Government on the rural sector and the effect good monsoon this year, RBI’s stance on the interest rate regime (which is likely to continue after the new Governor takes office), low commodity prices due to a variety of global risk factors and finally, from a global perspective, growing evidence of recovery in the US economy offsetting many other global risks.

ICICI Prudential Multicap Fund is likely to benefit from the factors discussed above. However, due to a number of global risk factors that are likely to persist in the short term, investors should have a long investment horizon for ICICI Prudential Multicap Fund. The fund has established itself as a strong performer over the last few years, and hopefully, investors will benefits in the medium to long term. Investors should consult with their financial advisors, if ICICI Prudential Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team