ICICI Prudential Long Term Wealth Enhancement Fund NFO: Long term wealth with tax savings

ICICI Prudential Asset Management Company has launched a 10 year close ended ELSS new funds offer (NFO), ICICI Prudential Long Term Wealth Enhancement Fund. The NFO opened on December 22, 2017 and will close on March 21, 2018. The tenure of this fund is 10 years, but redemptions will be allowed after the statutory lock-in period of 3 years. Investments in this NFO will be eligible for Section 80C tax savings benefits up to the maximum limit of Rs 1.5 Lakhs.

Equity Linked Savings Schemes (ELSS) are one of the best investment options u/s 80C because equity as an asset class, historically has given the highest returns than other asset classes in the long term. ELSS also offers superior liquidity compared to other 80C tax saving investment options; ELSS has lock in period of 3 years versus minimum 5 years for other 80C options. ELSS is also one of the most tax friendly investment options u/s 80C (we will discuss taxation in more details later).

Salient features of the NFO

- ICICI Prudential Long Term Wealth Enhancement Fund is a 10 year close ended fund. The long tenure of the fund provides investors to benefit from the long term buy and hold investment strategy of the fund manager, if investors chose to remain invested for the entire tenure. Experience from around the world has shown that long-term buy and hold is the best strategy for wealth creation.

- The fund provides the flexibility to redeem their units partially or fully after the statutory lock-in period of three years from the date of allotment of units, should investors need liquidity for any reason. Redemption / switch-out requests will be allowed on every business day at NAV based prices, post completion of lock-in period.

- The fund benchmark will be Nifty Large Midcap 250 index. The Nifty Large Midcap 250 index comprise of the 250 largest companies by market cap in National Stock Exchange. As per SEBI guidelines, the 100 largest companies by market cap are classified as large cap companies, while the next 150 (101 to 250) largest companies by market cap are classified as midcap companies.

- The minimum application amount is Rs 500 and in multiples of Rs 500 thereafter.

- On maturity (10 years from allotment date) the outstanding units of the investors will be redeemed and paid out to the investors. Investors also have the option of switching the redemption proceeds of the fund to any open ended mutual fund scheme of ICICI Prudential AMC.

- ICICI Prudential Long Term Wealth Enhancement Fund is available both in Regular and Direct Plan.

- Growth and Dividend Payout options are available for this fund.

- ICICI Prudential AMC CIO, Sankaran Naren and Rajat Chandak will be the fund managers of this scheme.

Sound Investment Strategy of the fund

The fund managers will employ a top down and bottom up approach for stock selection. The top down approach helps identifying sectors where the portfolio should take exposure and the percentage allocation to each vis a vis the benchmark index. The relative sector weights will depend on Macroeconomic view, Policy changes, Relative valuation of each sector vis-a-vis other sector and Risk premium (Risk-reward ratio).

Bottom up approach will be used for stock selection. The percentage exposure in each stock will depend on Relative valuation of each stock vis-a-vis other stock within the sector or broader market, Management quality, Business fundamentals, Risks associated with business, Ratios (PE, PB) etc.

Robust Investment Governance Process

ICICI Prudential Asset Management Company is the one of the largest and most reputed mutual fund houses in the country. The AMC has built its formidable reputation on the basis of strong performance of its schemes over the years. The AMC has an Internal Investment Committee comprising the Chief Executive Officer and Managing Director, the Chief Investment Officer (CIO) - Fixed Income, the CIO - Equity and Fixed Income, Head – Research, Fund Managers, Portfolio Managers and Credit Analysts who meet at periodic intervals. The Investment Committee, at its meetings, reviews the performance of the Plans and general market outlook and formulates broad investment strategy.

The CIO, on an ongoing basis, reviews the portfolios of the schemes and gives directions to the respective fund managers, where considered necessary. It is the ultimate responsibility of the Chief Investment Officer to ensure that the investments are made as per the internal / Regulatory guidelines, Scheme investment objectives and in the best interest of the unit holders of the respective schemes. Periodic presentations will be made to the Board of AMC to review the performance of the schemes.

Why is long-term buy and hold the best strategy for wealth creation?

Legendary investors like Warren Buffett and Peter Lynch are advocates of long term buy and hold strategy. In the short term, stock returns are dependent on market conditions but in the long term, returns are dependent on the growth potential of the stock. The alternative strategy to buy and hold is market timing. Buy and hold is almost always a superior strategy compared to market timing because market timing is almost impossible, even for the most experience fund managers, to get market timing right always.

If fund managers were able to get market timings right, then mutual funds would not have made losses in 2008 or 2011. Buy and hold strategy precludes the need of market timing because long investment tenures are characterized by multiple market cycles – bull markets and bear markets; hence over long investment tenures, quality stocks have the opportunity to recover from temporary corrections and give excellent returns.

What is long term? Long term is defined by the investor. At the very minimum, we in Advisorkhoj, are of the view that long term implies an investment holding of at least 3 years (which is also the lock in period of ICICI Prudential Long Term Wealth Enhancement Fund).

Some investors define long term as 3 to 5 years, while others define as 5 to 10 years or even longer. The definition of long term is completely subjective, but based on our experience best results in terms of wealth creation is seen, when investments are held for 10 years or longer. One of the reasons why very long term tenures yield extra-ordinary returns especially in India is that, unlike developed economies, the full impact of Government’s structural reforms on industry usually takes a fairly long period time to realize its potential.

Let us takes the paints industry in India as an example. Some of the top paint stocks have given 7,000% to 10,000% returns in the last 18 years, beating the Sensex by a huge margin. How were these stocks able to give such extra-ordinary returns? The main cause of such fantastic returns is the growth in infrastructure, commercial real estate and housing in our country. Cyclical growth takes place on the back of the growth in consumer spending. This growth cannot happen overnight; the real estate boom in our country took place over 10 years or more. While infrastructure spending has been a theme of Governments irrespective of the political colors, infrastructure spending received a strong boost under the current central Government and the paint stocks have continued to do well, despite a slowdown in the housing market over the last few years. Over a very long investment horizon, the power of compounding in quality stocks can produce magical returns.

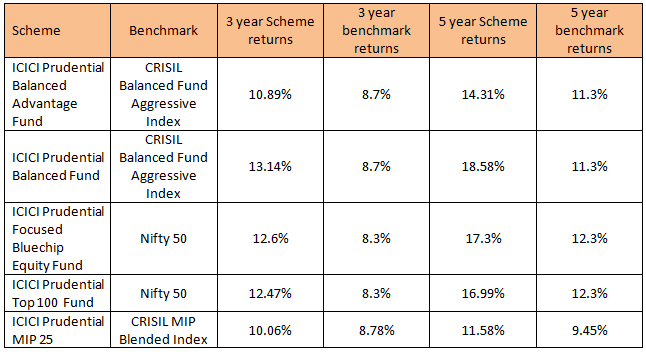

Performance of other schemes managed by the fund managers

Taxation

In the 2018 Budget, the Finance Minister proposed some important changes to taxation of equity funds. Investors should note these changes.

From April 1, 2018 long term capital gains (investments held for more than 12 months) up to Rs 1 lakh will continue to be tax free; above Rs 1 lakh capital gains will be taxed at 10%. Short term capital gains tax is irrelevant for ICICI Prudential Long Term Wealth Enhancement Fund because it has a lock in period of 3 years.

Dividends paid by this fund will be taxed at 10% from April 1, 2018 onwards. While the taxation of equity funds (including ELSS) from April 1, 2018 will not be as favorable as what we have been enjoying so far, even under the new taxation ELSS will be one of the most tax friendly investment options u/s 80C because interest from quite a few 80C investments are taxed as per the income tax rate of the investors.

Conclusion

In this article, we discussed the ICICI Prudential Long Term Wealth Enhancement Fund NFO. The strong track record of the fund managers and ICICI Prudential AMC makes this a promising NFO, but investors should understand the risk factors very carefully by reading the scheme information document (SID) and discuss with their financial advisors before making investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team

-

Shriram Mutual Fund launches Shriram Money Market Fund

Jan 19, 2026 by Advisorkhoj Team

-

PPFAS Mutual Fund launches Parag Parikh Large Cap Fund

Jan 19, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty200 Value 30 Index Fund

Jan 15, 2026 by Advisorkhoj Team

-

Bandhan Mutual Fund launches Bandhan Silver ETF FOF

Jan 12, 2026 by Advisorkhoj Team