ICICI Prudential Focused Bluechip Equity Fund: A strong performer

In the Advisorkhoj blog, we have often stressed the importance of selecting consistent performers for your long term mutual fund portfolios. Many investors select mutual funds based on last 1 or 2 years performance, but investors should know that a mutual fund’s recent performance is driven by the fund manager’s strategy in relation the market conditions prevailing during the period under consideration. A particular investment strategy may work very well in certain condition but may not work well when conditions change; as a result you will see that, top 5 or top 10 mutual funds change every year.

Mutual Fund schemes which, on the other hand, do well across different market conditions, even though they may not be in the top 5 or 10 funds in some years, outperform their peers over a long investment period. In this post, we will review a large cap equity fund, ICICI Prudential Focused Bluechip Equity Fund, which has performed well in different market conditions.

Fund Overview

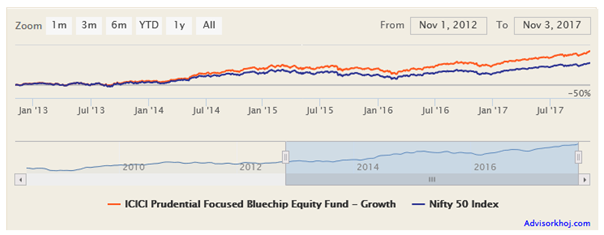

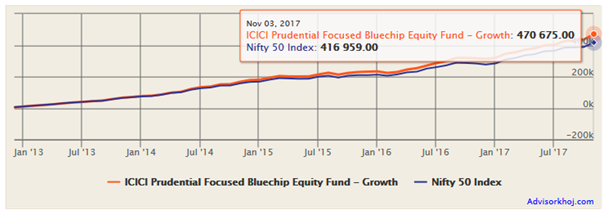

ICICI Prudential Focused Bluechip Equity Fund, one of the most well know large cap equity funds in India, was launched in May 2008. The AUM of the scheme as on September 30, 2017 was around Rs 14,400 Crores. The expense ratio of the scheme is 2.1%. Industry veteran, SankaranNaren and RajatChandak are the fund managers of the scheme. The scheme has given nearly 16% annualized return since inception. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Performance

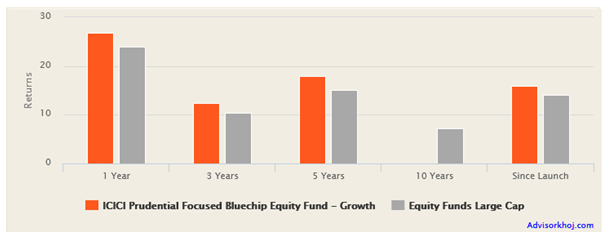

The chart below shows the trailing returns of ICICI Focused Bluechip Equity Fund versus the large cap funds category over different time-scales.

Source: Advisorkhoj Research

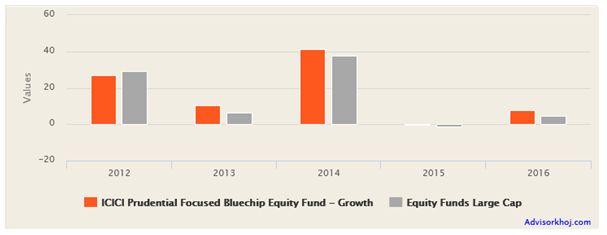

You can see that, ICICI Prudential Focused Bluechip Equity Fund has been an above average performer across different time-scales. The chart below shows the annual returns of the scheme versus category over the last 5 years.

Source: Advisorkhoj Research

Again ICICI Prudential Focused Bluechip Equity Fund has outperformed the category in most years.

Performance in different market conditions

Market rallies and crashes are both realities of equity investing. As discussed earlier, a mutual fund scheme which outperforms both in up markets and down markets is likely to give superior risk adjusted returns and outperform other funds in the long term. Performance in different market conditions is measured by a set of metrics called market capture ratios.

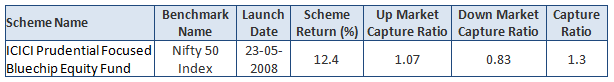

In Advisorkhoj, we have developed a tool called Market Capture Ratio. Using this tool we see the performance of a fund both in up-market (months in which the benchmark index was up) and down market (months in which benchmark index was down). The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was up is known as up-market capture ratio. The ratio of the average monthly returns of a scheme versus average monthly returns of the benchmark when the market was down is known as down-market capture ratio. The table below shows the up-market and down-market capture ratios of ICICI Prudential Focused Bluechip Equity Fund over the last 5 years.

Source: Advisorkhoj Market Capture Ratio Calculator

High Up-Market Capture Ratio (up market capture ratio more than 1) is good, because it means the fund manager is able to generate higher than market returns when market is rising. Low Down - Market Capture Ratio (down market capture ratio less than 1) is good, because it means the fund manager is able to provide some downside risk protection when market is falling.

You can see that Up Market capture ratio of ICICI Prudential Focused Bluechip Equity Fund is more than 1, which means that the scheme outperformed Nifty in up markets. The Down Market capture ratio of ICICI Prudential Focused Bluechip Equity Fund is more than 1, which means that the scheme outperformed Nifty in up markets.

Let us now discuss another market capture ratio, the Capture Ratio. Capture Ratio is the ratio of Up Market Capture Ratio and Down Market Capture Ratio. High Capture Ratio is good because it implies good risk adjusted returns. The capture ratio of ICICI Prudential Focused Bluechip Equity Fund is 1.32 which indicates strong performance.

Rolling Returns

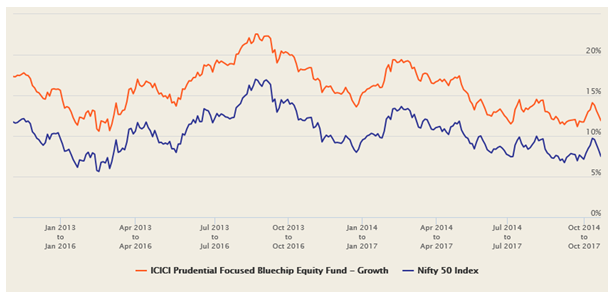

The chart below shows the 3 years rolling returns of ICICI Prudential Focused Bluechip Equity Fund versus Nifty over the last 5 years. We chose a 3 year rolling returns period because investors should have a long investment horizon for investing in equity funds. You can see in the chart below that 3 year rolling returns of ICICI Prudential Focused Bluechip Equity Fund has consistently beaten Nifty over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

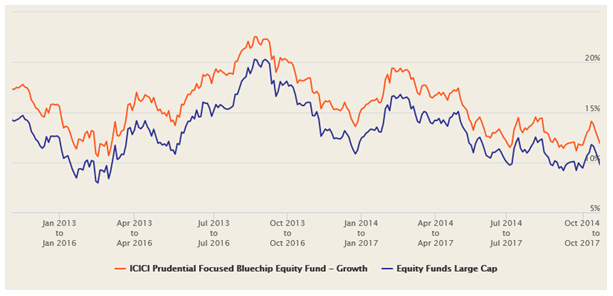

The chart below shows the 3 years rolling returns of ICICI Focused Bluechip Equity Fund versus the large cap equity funds category over the last 5 years. Again you can see in the chart below that 3 year rolling returns of ICICI Prudential Focused Bluechip Equity Fund has consistently beaten Nifty over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

Portfolio

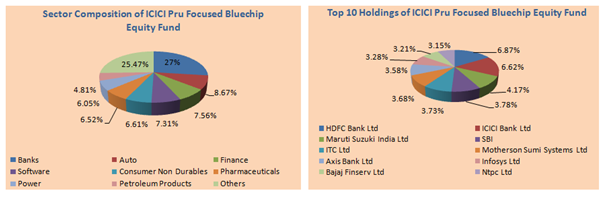

ICICI Prudential Focused Bluechip Equity Fund was launched with 20 stocks in their portfolio. Over time as the AUM went up, the scheme now has around 60 stocks in the portfolio. The portfolio is heavily biased towards cyclical sectors like banks and finance, automobiles, power, petroleum etc. The scheme portfolio is well diversified from a company concentration perspective with the Top 5 stocks, HDFC Bank, ICICI Bank, Maruti Suzuki, State Bank of India and ITC accounting for 23% of the portfolio value. The chart below shows the sector and company concentration of the scheme portfolio.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

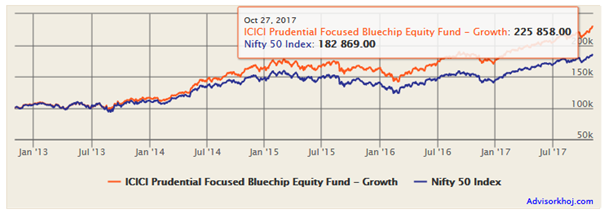

The chart below shows the growth of Rs 100,000 lump sum investment in ICICI Prudential Focused Bluechip Equity Fund (Growth Option) over the last 5 years. The current value of Rs 100,000 invested 5 years back is around Rs 225,858. The annualized return over the last 5 years is 18%.

Source: Advisorkhoj Research

The chart below shows the growth of Rs 5,000 monthly SIP ICICI Prudential Focused Bluechip Equity Fund (Growth Option) over the last 5 years. Rs 5,000 monthly SIP in the fund would have grown to around Rs 4.70 lakhs with a cumulative investment of just Rs 3 lakhs (profit of nearly Rs 1.70 lakhs). The annualized SIP return over the last 5 years is over 18%.

You may also check what would have been the Step Up SIP return had you increased your SIPs in this funds by 10% annual – Please check this SIP STEP UP TOOL

Conclusion

ICICI Prudential Focused Bluechip Equity Fund has completed very successful nine years of strong and sustainable performance. This has been one of the most popular large cap mutual funds with investors over the years. The fund has sustained its strong performance in different market conditions. Investors should consult with their financial advisors if ICICI Focused Bluechip Equity Fund is suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team