ICICI Prudential Equity Income Fund: A tax efficient solution for moderate risk investors

Equity Savings Funds are a relatively new mutual fund product category. These are equity oriented hybrid funds similar to balanced funds, but the risk profile of these funds are more moderate (lower risk) compared to balanced funds. Balanced Funds allocate at least 65% of their assets in equity and the balance in fixed income. The asset allocation of balanced funds ensures equity taxation (tax free long term capital gains) for this category of mutual funds. For investors who want a more moderate risk profile (lower equity allocation), debt oriented hybrid funds offer investment solutions, but they are not able to enjoy the benefits of equity taxation. In his first budget, Finance Minister, Arun Jaitley, made changes to taxation of debt fund schemes, which widened the tax advantage that equity funds enjoyed over debt funds. Equity Savings Funds are seen as a tax efficient investment solution in response to the debt fund tax changes announced by the Government two years back.

What is an Equity Savings Fund?

As discussed earlier, Equity Savings Funds are hybrid equity oriented funds. The risk profiles of these funds are more moderate than balanced funds, but like Balanced Funds, Equity Savings Funds enjoy equity taxation. How is fund manager able to lower the risk, yet enjoy equity taxation? They lower the risk, not by allocating more to debt, but through hedging, while keeping the overall equity allocation at 65%+. The underlying portfolio of an equity savings fund has three components:-

- Un-hedged Equity

- Hedged Equity

- Debt

The combined un-hedged and hedged equity portions total to minimum 65%, which allow these funds to enjoy equity taxation. The un-hedged equity component is exposed to equity market risk. The debt component is exposed to interest rate risk and credit risk. But the fund manager can greatly reduce these two risks, by employing suitable fixed income strategies. The hedged equity component is virtually risk free.

The un-hedged equity portion will give equity returns, the debt portion will give fixed income returns, but some readers may wonder, can the hedged equity portion give any return? If hedged equity portion does not give any return, is the investor losing out on returns, despite the tax advantage? The answer is no. In a perfect market a completely hedged equity portfolio will not give any return, but there are inefficiencies in the market which gives rise to arbitrage opportunities (the opportunity to generate risk free profit by exploiting market inefficiencies). In an Equity Savings Fund, the hedged equity portion generates arbitrage profits for the investors. As such, Equity Savings Funds are good tax efficient investment option for investors with moderate risk appetites and can provide solutions to a number of medium to long term investment objectives.

ICICI Prudential Equity Income Fund

ICICI Prudential Equity Income Fund is an equity savings fund from ICICI Prudential Mutual Fund stable. The fund was launched in December 2014 and has र 665 Crores of Assets Under Management. The expense ratio of the fund is 1.38% only. For redemption of units in excess of 10% of the investment within 365 days, ICICI Prudential will charge an exit load of 1%.

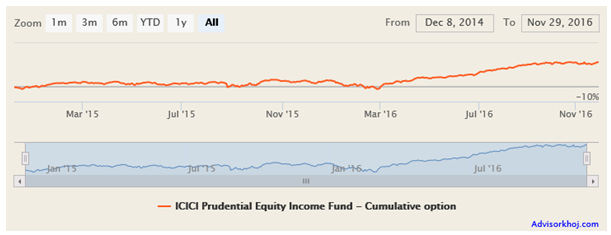

Shalya Shah, Chintan Haria, Manish Banthia and Sankaran Naren are the fund managers of this scheme. In addition to growth option, the fund also has monthly, quarterly and half-yearly dividend option. The chart below shows the NAV movement of the scheme since inception.

Source: Advisorkhoj Research

Rolling Returns

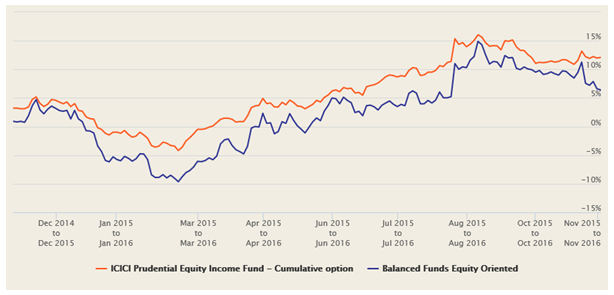

The chart below shows the 1 year rolling returns of ICICI Prudential Equity Income Fund versus the Balanced Fund category since the inception of the fund nearly two years back.

Source: Advisorkhoj Rolling Returns Calculator

You can see that, ICICI Prudential Equity Income Fund was able to consistently outperform balanced fund category in terms of one year rolling returns over the past 2 years. In the past two years, market conditions were very difficult with the Nifty falling more than 20%, between March 2015 and March 2016. The outperformance of ICICI Prudential Equity Income Fund in these difficult conditions shows why this fund is suitable for investors with low volatility for appetite.

Investors should, however, note that, once the bull market regains momentum, ICICI Prudential Equity Income Fund cannot be expected to outperform the more aggressive balanced funds, since the risk / return characteristics of this mutual fund scheme, as explained earlier, is fundamentally different from the typical balanced funds.

Investment Strategy and Outlook

- ICICI Prudential Equity Income Fund seeks to maintain gross equity exposure in the range of 65% to 75%. This will ensure equity taxation

- The gross equity to debt allocation ratios will depend on ICICI Prudential’s proprietary Price to Book model. If the price to book ratio is attractive, the fund will increase the gross equity exposure to the higher end of the 65% to 75%, and reduce it to the lower end of the range, if price to book is high

- Though the equity portfolio of ICICI Prudential Equity Income Fund is currently large cap oriented, the stated fund investment strategy does not have any market cap bias. ICICI Prudential as a fund house, has been advocating a large cap based approach for the last few quarters and, therefore, the market cap mix of ICICI Prudential Equity Income Fund is consistent with the fund house view

- ICICI Prudential, as a fund house, and especially, their CIO, Sankaran Naren, are advocates of the value investment approach. Historical data from developed markets, like the US, have shown that value investment style gave superior returns in the long term

- The un-hedged (net) equity exposure of the fund will range from 20 to 40%. The balance equity exposure will be hedged.

- The fund managers will exploit arbitrage opportunities in the market. You can get a sense of arbitrage returns by looking up the returns of our Top performing Arbitrage Funds.

- Based on our experience, the arbitrage returns have a positive correlation with volatility. The market has been quite volatile over the past 2 years and we expect volatility to persist due to variety of geopolitical and global macro-economic factors.

- As far as the debt portion of the ICICI Prudential Equity Income Fund is concerned, the fund manager’s will try to actively manage duration. This means that, the debt portion of the fund will be exposed to some interest rate risk. In the current economic environment, we believe that, interest rate risk, if carefully managed, can give good returns to the investor. The recent step announced by the Prime Minister regarding the demonetization of some high value currency notes, will in the medium term, may result in lower interest rates, which in turn will benefit duration fund investors.

- The credit quality of the debt portfolio is high and therefore, credit risk very limited.

SIP Returns

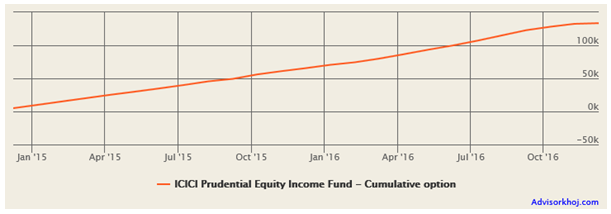

The chart below shows the returns of monthly र 5,000 SIP in ICICI Prudential Equity Income Fund.

Source: Advisorkhoj Research

Observe the steady growth in the investment value (almost a straight line), despite the vicissitudes of the market during this period. A cumulative investment of र 1.2 Lakhs in ICICI Prudential Equity Income Fund would have grown to र 1.33 Lakhs in two years, an XIRR of almost 11%.

Conclusion

In a few days ICICI Prudential Equity Income Fund will complete two years. Though two years is a very short time to judge the performance of a fund, from what we have seen so far, the fund has a lot of promise. ICICI Prudential Mutual Fund has in its product portfolio some of the top performing schemes across a variety of categories. Investors who have moderate risk appetites can invest in this fund for a variety of medium to long term objectives. Investors should consult with their financial advisors, if ICICI Prudential Equity Income Fund is suitable for their financial planning requirements.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty 500 Low Volatility 50 ETF

May 28, 2025 by Advisorkhoj Team

-

Falling Interest Rates Prompt Union Mutual Fund to Launch Tax-Efficient** Income Oriented Fund: Union Income Plus Arbitrage Active FOF

May 26, 2025 by Union Mutual Fund

-

Can surplus banking liquidity lead to a steeper yield curve?

May 26, 2025 by Axis Mutual Fund

-

Union Mutual Fund launches Union Income Plus Arbitrage Active FOF

May 22, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 ETF

May 21, 2025 by Advisorkhoj Team